Einstein Bros 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]

member of our board of directors. On January 13, 2005, the parties resolved the litigation. The resolution of this issue did not have a material

adverse effect on our consolidated financial condition or results of operations.

On June 4, 2003, R. Ramin Kamfar, our former Chairman of the Board and Chief Executive Officer, filed an action in the United States

District Court for the Southern District of New York against us and Anthony D. Wedo, our former Chairman and Chief Executive Officer, alleging

breach of contract, defamation, declaratory relief and punitive damages. On February 10, 2005, the case was dismissed with prejudice and the

parties have resolved this litigation. The resolution of this issue did not have a material adverse effect on our consolidated financial condition or

results of operations.

On September 14, 2004, Atlantic Mutual Insurance Company brought an action in the Superior Court of New Jersey Law Division: Morris

County, Docket No. MRS-L-2463-04 against the Company, Wedo, Nimmo, Novack, Kamfar, Lexington Insurance Company, and XL Specialty

Insurance Company seeking declaratory judgment on insurance coverage issues in the Novack litigation and the Kamfar litigation described above.

The parties have filed answers and cross-claims, and Mr. Kamfar has filed a

13

motion for partial summary judgment claiming advancement for expenses for which he claims the Company is required to indemnify him. At this

time, we can not predict the outcome of this matter and there can be no assurance that we will prevail in this matter, that a determination will be

made that we have insurance coverage for expenses that we have already incurred, or that damages or other relief will not be awarded against us.

Investigations

On April 3, 2002, the Securities and Exchange Commission notified us that the Commission was conducting an investigation into the

resignation of our former Chairman, R. Ramin Kamfar, and the termination for cause of our former Chief Financial Officer, Jerold Novack, and the

delay in filing our Form 10-K for 2001. We have cooperated fully with the investigation as well as with a Department of Justice inquiry relating to

these issues. Further, several of the former and present officers and directors have requested that, under applicable law and our by-laws, we

advance reasonable legal expenses on their respective behalves to the extent any of them is or has been requested to provide information to the

Commission in connection with its investigation. We have advanced certain expenses in connection with these claims. At this time, it is not

possible to reasonably estimate the loss or range of loss, if any.

Other Litigation

On February 23, 2000, New World Coffee of Forest Hills, Inc., a franchisee, filed a demand for arbitration with the American Arbitration

Association against us alleging fraudulent inducement and violations of New York General Business Law Article 33. In August 2004, this matter

was resolved. The resolution of this issue did not have a material adverse effect on our consolidated financial condition or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No items were submitted to a vote of security holders in the fourth quarter of the fiscal year ended December 28, 2004.

14

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

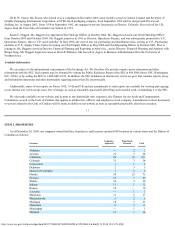

Our common stock is quoted on the Pink Sheets OTC market under the symbol "NWRG.PK". The following table sets forth the high and low

bid information for our common stock for each fiscal quarter during the periods indicated. Bid information quoted reflects inter-dealer prices

without retail mark-up, markdown or commission and may not necessarily represent actual transactions. All share prices have been adjusted for the

stock split which occurred in the third quarter of 2003.

Year ended December 28, 2004:

High

Low

First Quarter (From December 31, 2003 to March 30, 2004) $ 8.00 $ 3.00