Einstein Bros 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]

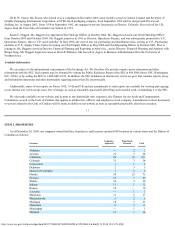

Loss on exchange of Series F due to Equity Recap — 23,007 — — —

Loss on extinguishment of Greenlight obligation — — 16,641 —

Permanent impairment in the value of investment in

debt securities — — — 5,805 —

Other expense (income) (284) (172) (322) 131 339

Loss before income taxes (17,454) (72,709) (44,528) (21,586) (5,538)

Provision (benefit) for state income taxes (49) 812 366 167 —

Net loss (17,405) (73,521) (44,894) (21,753) (5,538)

Dividends and accretion on Preferred Stock — (14,423) (27,594) (58,520) (2,373)

Net loss available to common stockholders $ (17,405) $ (87,944) $ (72,488) $ (80,273) $ (7,911)

Net loss per share—basic and diluted $ (1.77) $ (22.71) $ (55.18) $ (133.43) $ (37.66)

Other Financial Data:

Depreciation and amortization $ 27,848 $ 34,013 $ 35,047 $ 18,260 $ 2,254

Capital expenditures 9,393 6,921 5,172 3,757 335

Balance Sheet Data (at end of period):

Cash and cash equivalents $ 9,752 $ 9,575 $ 9,935 $ 15,478 $ 2,271

Property, plant and equipment, net 41,855 54,513 73,780 98,064 6,502

Total assets 158,456 181,738 203,174 280,203 49,220

Short-term debt and current portion of long-term debt 295 2,105 150,872 168,394 16,240

Mandatorily redeemable Series Z preferred stock, $.001

par value, $1,000 per share liquidation value 57,000 57,000 — — —

Long-term debt 160,840 161,120 11,011 12,119 1,873

Mandatorily redeemable Series F preferred stock, $.001

par value, $1,000 per share liquidation value (temporary

equity)(4) — — 84,932 57,338 —

Total stockholders' equity (deficit) (112,483) (95,153) (96,146) (30,096) 10,967

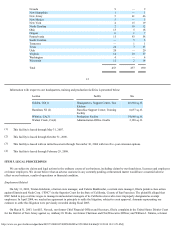

(1) Fiscal years 2001 through 2003 have been restated from amounts previously reported to reflect certain adjustments as discussed in Item 7,

Restatement of Prior Financial Information and Note 2 to our consolidated financial statements.

16

(2) Interest expense is comprised of interest paid or payable in cash and non-cash interest expense resulting from the amortization of debt

discount, notes paid-in-kind, debt issuance costs and the amortization of warrants issued in connection with debt financings.

(3) Effective for the quarter ended July 3, 2001 and as a result of the Einstein Acquisition, we elected to change our fiscal year end to the

Tuesday closest to December 31. Our annual accounting period had previously ended on the Sunday closest to December 31. The fiscal

year-end dates for 2004, 2003, 2002 and 2001 are December 28, 2004, December 30, 2003, December 31, 2002 and January 1, 2002,

respectively, resulting in all years containing 52 weeks.

(4) As more fully described in the notes to the consolidated financial statements, the adoption of SFAS 150 resulted in the Series Z being

presented as a liability rather than the historical mezzanine presentation of the Series F.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Restatement of Prior Financial Information

Over the past few months, several restaurant companies and other multi-location retailers have been reviewing their treatment of lease

accounting and leasehold amortization. During this time, many companies including but not limited to Brinker International, CKE Restaurants,