Einstein Bros 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]

Darden Restaurants, Jack in the Box, Starbucks and Wild Oats have either restated their historic financial statements or have announced their

intention to restate. In late January 2005, we commenced a review of our accounting policies and practices with respect to leasehold amortization

and deferred rent. On February 7, 2005, the Office of the Chief Accountant of the Securities and Exchange Commission expressed its views

regarding lease accounting issues and their application under Generally Accepted Accounting Principles (GAAP). Based upon the results of our

internal review and after discussions with our independent auditors, Grant Thornton LLP, we determined on March 1, 2005 that it was appropriate

to adjust certain prior financial statements for leasehold amortization. The resulting adjustments were all non-cash and had no impact on our cash

flows, cash position, revenues, same store sales, loss from operations plus depreciation and amortization, or our compliance with the covenants

under our $160 Million Notes or AmSouth Revolver. The adjustments were not attributable to any intentional non-compliance with any financial

reporting requirements under securities laws, and we believe there will not be any further adjustments as a result of our internal review of this

matter.

The issue requiring restatement related to our historical accounting practice of amortizing our leasehold improvements over a period that

included both the noncancelable term of the lease and its option periods (or the useful life of the asset, if shorter). Concurrently, we used the

noncancelable lease term in determining whether each of our leases was an operating lease or a capital lease and in calculating our straight-line

rent expense. We believed that these longstanding accounting treatments were appropriate under generally accepted accounting principles.

Furthermore, we believed that these accounting treatments were comparable to the practices of other public companies. However, after noting

recent Form 8-K filings of various restaurant companies and other multi-location entities and following discussions with Grant Thornton LLP, we

have now interpreted the authoritative accounting literature to require that we use the same lease term in amortizing leasehold improvements as we

use in determining capital versus operating leases and in calculating straight-line rent expense. Accordingly, we have adopted the following

policy: We will generally limit the depreciable lives for our leasehold improvements, which are subject to a lease, to the lesser of the useful life or

the noncancelable lease term. However, in circumstances where we would incur an economic penalty by not exercising one or more option periods,

as contemplated by Statement of Financial Accounting Standard (SFAS) No. 13, "Accounting for Leases," we may include one or more option

periods when determining the amortization period. In either circumstance, our policy requires consistency when calculating the amortization

period, in classifying the lease, and in computing straight-line rent expense.

17

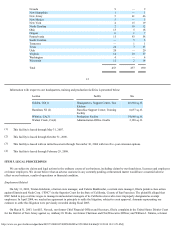

As a result of the adjustments to leasehold amortization, our financial results have been restated as follows (dollars in thousands, except per

share data):

2001

2000

Accumulated

Deficit

Net

Loss

Dividends/

Accretion

on Preferred

Stock

Net Loss

Available to

Common

Stockholders

Net Loss

per

Common

Share

2001

Accumulated

Deficit

As reported $ (30,043) $ (18,700) $ (58,520) (77,220) $ (128.36) $ (107,263)

Adjustments — (3,053) — (3,053) (5.07) (3,053)

As restated $ (30,043) $ (21,753) $ (58,520) (80,273) $ (133.43) $ (110,316)

2002

2001

Accumulated

Deficit

Net

Loss

Dividends/

Accretion

on Preferred

Stock

Net Loss

Available to

Common

Stockholders

Net Loss

per

Common

Share

2002

Accumulated

Deficit

As reported $ (107,263) $ (40,473) $ (27,594) (68,067) $ (51.81) $ (175,330)

Adjustments (3,053) (4,421) — (4,421) (3.37) (7,474)

As restated $ (110,316) $ (44,894) $ (27,594) (72,488) $ (55.18) $ (182,804)

2003

2002

Accumulated

Deficit

Net

Loss

Dividends/

Accretion

on Preferred

Stock

Net Loss

Available to

Common

Stockholders

Net Loss

per

Common

Share

2003

Accumulated

Deficit