Einstein Bros 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]

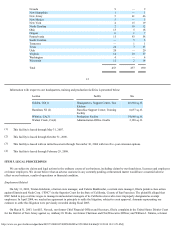

Second Quarter (From March 31, 2004 to June 29, 2004) $ 4.99 $ 2.50

Third Quarter (From June 30, 2004 to September 28, 2004) $ 2.98 $ 1.75

Fourth Quarter (From September 29, 2004 to December 28, 2004) $ 3.10 $ 1.60

Year ended December 30, 2003:

High

Low

First Quarter (From January 1, 2003 to April 1, 2003) $ 7.16 $ 4.21

Second Quarter (From April 2, 2003 to July 1, 2003) $ 18.66 $ 3.19

Third Quarter (From July 2, 2003 to September 30, 2003) $ 14.39 $ 8.37

Fourth Quarter (From October 1, 2003 to December 30, 2003) $ 10.00 $ 3.25

As of March 7, 2005, there were 397 holders of record of our common stock. This number does not include individual stockholders who own

common stock registered in the name of a nominee under nominee security listings.

We have not declared or paid any cash dividends on our common stock since our inception. We do not intend to pay any cash dividends in the

foreseeable future, and we are precluded from paying cash dividends on our common stock under our financing agreements.

Sales of Unregistered Securities

During the fourth quarter of 2004, we received consideration of $6,464 and issued 6,328 shares of our common stock upon the exercise of

certain warrants granted by us subject to registration rights agreements. We issued these warrants to the warrant holder in a private financing

transaction related to our issuance of increasing rate notes that were repaid in July 2003. Securities issued were offered and sold in reliance upon

the exemption from registration under Section 4(2) of the Securities Act, relating to sales by an issuer not involving a public offering. The sales of

securities were made without the use of an underwriter. The recipients of the securities represented their intention to acquire the securities for

investment only and not with a view to or for sale in connection with any distribution thereof and restrictive legends were affixed to the share

certificates issued.

15

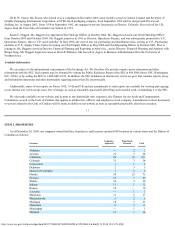

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data for each fiscal year was extracted or derived from financial statements which have been audited by Grant

Thornton LLP, our independent registered public accounting firm.

Fiscal years ended (1)(3):

2004

2003

2002

2001

2000

(restated)

(restated)

(restated)

(in thousands of dollars, except per share amounts)

Income Statement Data:

Revenues $ 373,860 $ 383,306 $ 398,650 $ 234,175 $ 43,078

Cost of sales 306,661 317,690 321,506 189,403 30,138

Gross margin 67,199 65,616 77,144 44,772 12,940

Gross margin as percent of sales 18.0% 17.1% 19.4% 19.1% 30.0%

General and administrative expenses 32,755 41,794 42,640 28,647 12,733

Depreciation and amortization 27,848 34,013 35,047 18,260 2,254

Charges for integration and reorganization costs (869) 2,132 4,194 4,432 —

Impairment charge 450 5,292 — 3,259 1,076

Income (loss) from operations 7,015 (17,615) (4,737) (9,826) (3,123)

Interest expense, net(2) 23,196 34,184 42,883 47,104 2,076

Cumulative change in the fair value of derivatives — (993) (233) (57,680) —

Loss (gain) on sale, disposal or abandonment of assets,

net 1,557 (558) — — —

Gain on sale of debt securities — (374) (2,537) (241) —