Einstein Bros 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Einstein Bros annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]

10-K 1 a2153240z10-k.htm FORM 10-K

Use these links to rapidly review the document

NEW WORLD RESTAURANT GROUP, INC. FORM 10-K TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One):

ýANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 28, 2004

OR

oTRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission File Number 0-27148

NEW WORLD RESTAURANT GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation or Organization)

13-3690261

(I.R.S. Employer

Identification No.)

1687 Cole Blvd., Golden, Colorado 80401

(Address of Principal Executive Offices) (Zip Code)

(303) 568-8000

(Registrant's telephone number, including area code)

Securities registered pursuant to

Section 12(b) of the Act:

None

Securities registered pursuant to

Section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendments of this Form 10-K. o

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Securities Exchange Act of

1934). Yes o No ý

Table of contents

-

Page 1

...Use these links to rapidly review the document NEW WORLD RESTAURANT GROUP, INC. FORM 10-K TABLE OF CONTENTS ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One): ý ANNUAL REPORT PURSUANT TO SECTION 13 OR... -

Page 2

The aggregate market value of the common stock held by non-affiliates of the registrant computed by reference to the closing sale price as reported on the "pink sheets" as of June 29, 2004 was $877,366. As of March 7, 2005, 9,848,713 shares of common stock of the registrant were outstanding. ... -

Page 3

... and in the District of Columbia as of December 28, 2004, we operate and license locations primarily under the Einstein Bros. and Noah's brand names, and franchise locations primarily under the Manhattan and Chesapeake brand names. We also operate a dough production facility. We view our business as... -

Page 4

..., was promoted to Chief Operating Officer. On October 14, 2004, we announced the introduction of our new test concept, Einstein Bros. Café (EB Café). In addition to our core bagel offerings and expanded breakfast menu, the new concept offers an extensive lunch menu with a culinary focus on... -

Page 5

ingredients. The first unit of this new concept, located within Denver's Stapleton neighborhood, opened on October 18, 2004. By the end of fiscal year 2004, we retrofitted four additional Einstein Bros. Bagels restaurants in the Denver and Colorado Springs, Colorado markets to EB Cafés. We ... -

Page 6

... coffee roasting plant, three retail locations and office space. Einstein Bros. Bagels (Einstein Bros.) Einstein Bros. is a national, quick casual restaurant chain. Einstein Bros. offers a menu that specializes in high-quality foods for breakfast and lunch, including hot breakfast bagels/sandwiches... -

Page 7

... locations offer a menu that specializes in bagels and an extensive array of cream cheese flavors. The locations also offer breakfast and lunch sandwiches, soups, salads, coffees and café beverages, soft drinks and desserts. 7 New World Coffee Our New World Coffee brand is principally operated... -

Page 8

... prices of flour, butter, cheese, coffee, dairy and/or fresh produce, energy costs, existing and additional competition, marketing programs, weather and variations in the number of company-owned or licensed location openings and closings. Although few, if any, employees are paid at the minimum wage... -

Page 9

... services personnel, and 207 were corporate personnel. Most store personnel work part-time and are paid on an hourly basis. We have never experienced a work stoppage and our employees are not represented by a labor organization. We believe that our employee relations are good. Executive Officers... -

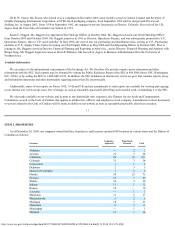

Page 10

... As of December 28, 2004, our company-owned facilities, franchisees and licensees operated 690 locations in various states and the District of Columbia as follows: Location CompanyOperated Franchised/ Licensed Total Alabama Arizona California Colorado Connecticut Delaware District of Columbia... -

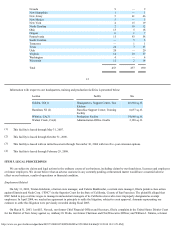

Page 11

... Einstein and Noah Corp. ("ENC") in the Superior Court for the State of California, County of San Francisco. The plaintiffs alleged that ENC failed to pay overtime wages to managers and assistant managers of its California stores who were improperly designated as exempt employees. In April 2004... -

Page 12

... On February 23, 2000, New World Coffee of Forest Hills, Inc., a franchisee, filed a demand for arbitration with the American Arbitration Association against us alleging fraudulent inducement and violations of New York General Business Law Article 33. In August 2004, this matter was resolved... -

Page 13

...This number does not include individual stockholders who own common stock registered in the name of a nominee under nominee security listings. We have not declared or paid any cash dividends on our common stock since our inception. We do not intend to pay any cash dividends in the foreseeable future... -

Page 14

... of the Series F. (3) (4) ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Restatement of Prior Financial Information Over the past few months, several restaurant companies and other multi-location retailers have been reviewing their treatment of lease... -

Page 15

..., revenues, same store sales, loss from operations plus depreciation and amortization, or our compliance with the covenants under our $160 Million Notes or AmSouth Revolver. The adjustments were not attributable to any intentional non-compliance with any financial reporting requirements under... -

Page 16

.... We specialize in high-quality foods for breakfast and lunch in a café atmosphere with a neighborhood emphasis. Our product offerings include fresh baked goods, made-to-order sandwiches, bagels, soups, salads, desserts, premium coffees and other café beverages. With 690 locations in 34 states and... -

Page 17

... the classification of several of our positions. Changes in the reclassification of employees from management to hourly employees could also affect our labor costs. Certain states and local governments have increased both the rate and nature of taxes on businesses in their regions in an effort to... -

Page 18

... and other related costs Income (loss) from operations Other expense (income): Interest expense, net Cumulative change in the fair value of derivatives Loss (gain) on sale, disposal or abandonment of assets, net Gain on investment in debt securities Loss on exchange of Series F Preferred Stock Other... -

Page 19

... 2.6% We believe the trend in comparable store sales throughout fiscal 2004 was the result of improvements in the operation of our restaurants, the introduction of new menu items, improved catering programs in certain markets, and the marketing and advertising campaigns that were initiated in the... -

Page 20

...related to closed restaurants and our administrative facilities located in New Jersey. Additional information regarding the loss (gain) on sale, disposal or abandonment of assets is included in footnote 19 of Item 8 of this report...the Einstein/Noah Bagel Corp. 7.25% Convertible Debentures due 2004. ... -

Page 21

... and remodeling costs associated with the openings of EB Café, (3) capital spent on our manufacturing operations and upgrades to our bagel manufacturing equipment located at our contract manufacturer's site and (4) additional capital for our support center in Golden, Colorado, primarily related to... -

Page 22

... which included $1.2 million for new stores, $5.8 million for replacement and new equipment at our existing company-operated stores, $0.8 million for our manufacturing operations and $1.6 million for general corporate purposes. 25 Financing Activities During fiscal 2004, we used $1.0 million of... -

Page 23

... calculations provides meaningful non-GAAP financial measures to help investors understand and compare business trends among different reporting periods on a consistent basis. These measures are not in accordance with, or an alternative to, generally accepted accounting principles (GAAP). Rather... -

Page 24

... using APB Opinion No. 25, "Accounting for Stock Issued to Employees," and generally 27 would require instead that such transactions be accounted for using a fair-value-based method. This Statement is effective as of the first interim or annual reporting period that begins after June 15, 2005. We... -

Page 25

... of existing store management, the necessity of tiered pricing structures and ...report and from time to time in news releases, reports...openings or closings, operating margins, the availability of acceptable real estate locations, the sufficiency of our cash balances and cash generated from operating... -

Page 26

... Einstein Bros. brand, its success is dependent upon various factors, including customer acceptance of new menu offerings and pricings, the look and feel of the restaurant, and the new service system. In addition, the availability of capital and opportunities to make modifications to existing stores... -

Page 27

... licensees. A shortage in the labor pool or other general inflationary pressures or changes could also increase labor costs. In addition, changes in labor laws or reclassifications of employees from management to hourly employees could affect our labor cost. For example, federal overtime regulations... -

Page 28

... of our board of directors is a current employee of Greenlight. Our common stock is not currently listed on any stock exchange or Nasdaq. As a result, we are not subject to corporate governance rules adopted by the New York Stock Exchange, American Stock Exchange and Nasdaq requiring a majority of... -

Page 29

... that are not listed on a stock exchange, the Nasdaq National Market or the Nasdaq SmallCap Market are subject to an SEC rule that imposes special requirements on broker-dealers who sell those securities to persons other than their established customers and accredited investors. The broker-dealer... -

Page 30

... improvements in conformity with accounting principles generally accepted in the United States of America. /s/ GRANT THORNTON LLP Denver, Colorado February 21, 2005 36 NEW WORLD RESTAURANT GROUP, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 28, 2004 AND DECEMBER 30, 2003 (in... -

Page 31

...Trademarks and other intangibles, net Goodwill Debt issuance costs and other assets Total assets $ 1,269 7,... 276,891 Stockholders' deficit: Common stock, $.001 par value; 15,000,000 shares authorized...an integral part of these consolidated financial statements. 37 NEW WORLD RESTAURANT GROUP, INC. ... -

Page 32

... 28, 2004 December 30, 2003 (Restated) December 31, 2002 (Restated) Revenues: Retail sales Manufacturing revenues Franchise and license related revenues Total revenues Cost of sales: Retail costs Manufacturing costs Total cost of sales Gross profit Operating expenses: General and administrative... -

Page 33

... stock issued upon warrant exercise Balance, December 28, 2004 - - - 6,885 9,848,713 $ - - - - 10 $ - 205 - 7 175,797 $ - (205) 68 - (137) $ (17,405) - - - (288,153) $ (17,405) - 68 7 (112,483) The accompanying notes are an integral part of these consolidated financial statements. 39 NEW... -

Page 34

... FINANCING ACTIVITIES: Proceeds (repayments) of line of credit, net Repayment of notes payable Proceeds from issuance of $160 Million Indenture Repayment of $140 Million Facility Advance funding of NJEDA (restricted cash) Debt issuance costs Common stock issued upon warrant exercise Net cash... -

Page 35

... names of Einstein Bros. Bagels and Einstein Bros. Café (collectively known as Einstein Bros.), Noah's New York Bagels (Noah's), Manhattan Bagel Company (Manhattan), Chesapeake Bagel Bakery (Chesapeake) and New World Coffee (New World). We have a 52/53-week fiscal year ending on the Tuesday closest... -

Page 36

...principles generally accepted in the United States of America requires us to make estimates and assumptions that affect reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues, costs and... -

Page 37

... licensee in opening a new location, which is generally at the time the franchisee or licensee commences operations. Continuing royalties, which are a percentage of the net sales of franchised and licensed locations, are accrued as income each month. Proceeds from the sale of gift cards are recorded... -

Page 38

...borrowings with similar credit ratings. The fair value of the $160 Million Notes approximates its carrying value at December 28, 2004 as the notes are traded at par in the market. The Mandatorily Redeemable Series Z Preferred Stock (Series Z) is recorded in the accompanying balance sheet at its full... -

Page 39

... a loyal consumer base. Advertising Costs We expense advertising costs as incurred. Advertising costs were $4,500, $12,900 and $14,000 for the fiscal years ended 2004, 2003 and 2002, respectively, and are included in retail costs of sales in the consolidated statements of operations. Income Taxes We... -

Page 40

...No. 25, Accounting for Stock Issued to Employees , and related interpretations, in accounting for our fixed award stock options to our employees. As such, compensation expense is recorded only if the current market price of the underlying common stock exceeded the exercise price 47 of the option on... -

Page 41

... using APB Opinion No. 25, "Accounting for Stock Issued to Employees," and generally would require instead that such transactions be accounted for using a fair-value-based method. This Statement is effective as of the first interim or annual reporting period that begins after June 15, 2005. We... -

Page 42

..., which consist of food, beverage, paper supplies and bagel ingredients, are stated at the lower of cost or market, with cost being determined by the first-in, first-out method. Inventories consist of the following: December 28, 2004 December 30, 2003 Finished goods Raw materials Total inventories... -

Page 43

...located at a major supplier's plant. 7. TRADEMARKS AND OTHER INTANGIBLES Trademarks and other intangibles consist of the following as of: December 28, 2004...340 4,428 516 129 - - 13,413 $ 8. DEBT ISSUANCE COSTS AND OTHER ASSETS http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.... -

Page 44

...following: December 28, 2004 December 30, 2003 Payroll and related bonuses Interest Integration and reorganization Gift cards Other Total accrued ... December 28, 2004 December 30, 2003 $160 Million Notes AmSouth Revolver Chesapeake Bagel Bakery Note Payable New Jersey Economic Development Authority... -

Page 45

... 28, 2004, we are in compliance with all of our financial and operating covenants. Interest payments under the AmSouth Revolver are payable in arrears on the first of each month. The net borrowings under the AmSouth Revolver bear an interest rate equal to the base rate plus an applicable margin with... -

Page 46

... and equipment are the asset values of $51 and the related accumulated amortization of $5 at December 28, 2004. Amortization of assets under capital leases is included in depreciation and amortization expense. Operating Leases We lease office space, restaurant space and certain equipment under... -

Page 47

... operated 2 brands: Einstein Bros. Bagels and Noah's New York Bagels. The Einstein Acquisition in 2001 was accomplished by issuing a substantial amount of short-term debt and mandatorily redeemable preferred equity. The maturity date on the debt and the redemption date of certain preferred stock... -

Page 48

... the Bridge Loan, which bore interest at an initial rate of 14% per annum and increased by 0.35% on the fifteenth day of each month beginning July 15, 2002. The Bridge Loan was secured by the Einstein Bonds. We issued Series F to pay the remaining balance of the Bridge Loan. Additionally, we issued... -

Page 49

...-current exercise price, a number of the acquiring company's common shares having a market value at that time of twice the right's exercise price. 16. STOCK OPTION AND WARRANT PLANS 1994 and 1995 Plans Our 1994 Stock Plan (1994 Plan) provided for the granting to employees of incentive stock options... -

Page 50

... The following table summarizes information about stock options outstanding at December 28, 2004: Options Outstanding Wt.Avg. Remaining Life (Years) Wt.Avg. Exercise Price Options Exercisable Wt.Avg. Exercise Price Range of Exercise Prices Number of Options Number of Options $2.25 - $4.00 $4.01... -

Page 51

...covering eligible employees of New World Restaurant Group. Employees, excluding officers, are ...balances related to the 2001 restructuring accrual: Facility Consolidation Costs Contract Termination and Other Costs Store Lease Termination Severance Costs Total Initial accrual Application of costs... -

Page 52

...'s to the original founders. The Willoughby's business consisted of a coffee roasting plant, three retail locations and an office space. Components of the asset sale included, but were not limited to The "Willoughby's Coffee & Tea" trade name, trademark and logo, The "Serious Coffee" trademark, The... -

Page 53

... that the revenues, cost of sales, other operating expenses and the net book value of the assets related to the sale of the coffee roasting plant and three retail locations included in the Willoughby's business were immaterial in relation to our Einstein Bros., Noah and Manhattan restaurants... -

Page 54

... operating loss carryforwards is subject to an annual ...related party transactions involving these investors during 2004, 2003 and 2002 fiscal years. E. Nelson Heumann is the chairman of our board of directors and is a current employee of Greenlight. Leonard Tannenbaum, a director, was the Managing... -

Page 55

... to the purchase price of certain commodities that are related to the ingredients used for the production of our bagels. On a periodic basis, we review the relationship of these purchase commitments to our business plan, general market trends and our assumptions in our operating plans. If these... -

Page 56

... Einstein and Noah Corp. ("ENC") in the Superior Court for the State of California, County of San Francisco. The plaintiffs alleged that ENC failed to pay overtime wages to managers and assistant managers of its California stores who were improperly designated as exempt employees. In April 2004... -

Page 57

...43) The loss from operations includes charges for integration...sale, disposal or abandonment of assets for the 2004...Stock...related...annual earnings per share due to the required method of computing the weighted average number of shares in interim periods. 70 (4) NEW WORLD RESTAURANT GROUP, INC. Schedule... -

Page 58

..., our chief executive officer and our chief financial officer have concluded that the design and operation of our disclosure controls and procedures were effective in timely making known to them material information relating to the Company required to be disclosed in reports that we file or... -

Page 59

... OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT This information will be included in our 2005 Proxy Statement, which will be filed within 120 days after the close of the 2004 fiscal year, and is hereby incorporated by reference. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS This information... -

Page 60

... Registrant and American Stock Transfer & Trust Company, as Rights Agent dated as of June 7, 1999(3) Asset Purchase Agreement dated as of February 10, 2001, by and between Einstein Acquisition Corp., GNW, ENBC and ENBP(4) Order of the United States Bankruptcy Court for the District of Arizona dated... -

Page 61

...Einstein/Noah Bagel Partners, Inc. and The Bank of New York, as Collateral Agent(17) Trademark Security Agreement dated as of July 8, 2003, between Einstein and Noah Corp. and The Bank of New York... and the financial institutions named therein, as Lenders, and AmSouth Capital Corp., as Administrative... -

Page 62

...and Brookwood(4) Form of Common Stock Purchase Warrant issued to Halpern Denny, Greenlight Capital and Special Situations(4) Warrant Agreement dated ...2004, dated February 23, 2005, by and among New World Restaurant Group, Inc., Einstein and Noah Corp., Manhattan Bagel Company, Inc., and Harlan Bagel... -

Page 63

respect to the Registrant's Annual Report on Form 10-K for the year ended December 28, 2004* 32.1 Certification of Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act* Certification of Principal Financial Officer pursuant to 18... -

Page 64

... 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. NEW WORLD RESTAURANT GROUP, INC. Date: March 11, 2005 By: /s/ PAUL J.B. MURPHY, III Paul J.B. Murphy, III Chief Executive Officer Pursuant to the requirements of the Securities... -

Page 65

http://www.sec.gov/Archives/edgar/data/949373/000104746905006202/a2153240z10-k.htm[9/11/2014 10:13:29 AM]