Dow Chemical 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Dow Chemical annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Annual Report 13

Optimizing Our Portfolio

Across our integrated portfolio, we are executing a number of strategic

actions to deliver maximum value from each business. We are enhancing

our cost position and the value of our integration, while at the same time

prioritizing investments in innovation and commercializing multi-tiered

and multi-generation solutions that bring value to our customers and to

Dow. With a careful eye toward value, we are exiting non-strategic and

capital-intensive businesses.

Our actions in 2014 resulted in $2 billion in proceeds expected from

divestitures of non-strategic assets and businesses signed or completed

in 2014. Since 2013, the Company has signed or completed transactions

that are expected to generate $2.9 billion in proceeds.

Our divestiture projects are on track, such as the carve-out of our chlorine

and epoxy assets, which is expected to close by year-end 2015.

At the same time, we also are optimizing our joint venture portfolio.

For example, by mid-2016, we plan to reduce our equity ownership in

our Kuwait joint ventures, allowing us to redeploy capital for more

strategic purposes.

Taken together with our divestiture actions in 2013, we are on track to

meet our divestiture targets and expect to generate $7 billion to

$8.5 billion in proceeds by mid-2016.

Infrastructure Solutions

Performance Materials

& Chemicals Performance Plastics

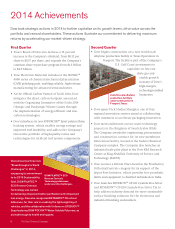

Ongoing, Proactive Portfolio Management

Pretax Proceeds (dollars in millions)

Expanded Target

Mid-2016 Implementation

Additional

Portfolio Actions

$7B–$8.5B

Chlorine Carve-Out

~$500MM (est.) Additional

Corporate Actions

AgroFresh

ANGUS Chemical Company

Sodium Borohydride

~$450MM Asset Sales

(Railcars, Land, etc.)

~$850MM in 2014

(Polypropylene Licensing

and Catalysts, others)

Completed In Progress

Total Sales $22,386

Dow Elastomers

56%

Dow Electrical and Telecommunications

7%

Dow Packaging and Specialty Plastics

4%

(dollars in millions)

Energy

31%Hydrocarbons

2%

Total Sales $15,114

Chlor-Alkali and Vinyl

41%

Chlorinated Organics

32%

Epoxy

13%

(dollars in millions)

Industrial Solutions

12%

Polyurethanes

2%

Total Sales $8,429

Dow Building & Construction 21%

Dow Coating Materials

28%

Energy & Water Solutions 24%

(dollars in millions)

Performance Monomers 27%