Dominion Power 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

60

40

20

0

-20

-40

21.4

8.2

73.8

26.2

(38.5)

(12.2)

24.0

(12.3)

12.7

28.7

(11.7)

(2.8)

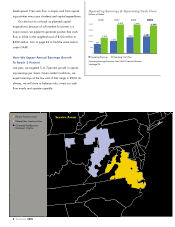

1 Year Total Return 3 Year Total Return 5 Year Total Return

Total Return Comparison

Percent

As of December 31, 2003

Dominion S&P Utilities S&P Electric S&P 500

We’re committed to

aligning management

interests with yours.

7.Dominion 2003

long-term decisions. Four years ago, we instituted a

unique long-term share-ownership program. It requires

officers to own from three to eight times their annual base

salaries in stock. Together, our 62-person officer group

owned more than 2.2 million shares of common stock at

year-end. We’re committed to aligning management

interests with yours.

Looking Beyond A Given Year’s

Earnings Per Share

Investors continue to focus on the basics. Does the com-

pany pay out a steady dividend?Does it have growing

cash flow and increasing earnings?Does its business

plan ring true?Does it have a strong balance sheet and

financial flexibility?

Let’s look at how Dominion did in 2003 compared

with the pack.

Our 21-percent year-end total return trailed the S&P

Utilities Index, which returned 26 percent, and the S&P

At year-end, our

equity market capital-

ization was bigger

than Federal Express

or General Mills.

Electric Utilities Index, which produced a total return of

24 percent. Looking across all sectors, the S&P 500

returned 29 percent.

For the last 3- and 5-year periods, we beat these

indexes. So it was no surprise the broader indexes

moved slightly ahead of us in 2003 to recover ground

we never lost.

At year-end, our equity market capitalization — our

share price times the number of outstanding common

shares — was bigger than Federal Express or General

Mills. At $20.8 billion, ranked by market capitalization,

we were the nation’s third-largest natural gas and electric

company.

Operating Cash Flow:

Significant Growth Expected in 2004

In past years, I’ve told you that cash is king.

In 2004, we expect to generate positive free cash

flow, barring any major new acquisition or unforeseen