Dominion Power 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

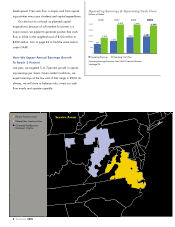

Dominion Exploration & Production (Major Operating Areas)

Proved Reserves (Bcfe)

As of December 31, 2003:

6,388

Daily Production (Mmcfe/day)

Year-to-date December 31, 2003:

1,228

= 100 Bcfe

Includes Dominion Transmission, Inc.

1Canada

Proved Reserves (Bcfe): 772

Daily Production (Mmcfe/day): 153

2 Gulf Coast

Proved Reserves (Bcfe): 715

Daily Production (Mmcfe/day): 193

3 Gulf of Mexico

Proved Reserves (Bcfe): 1,130

Daily Production (Mmcfe/day): 318

4 Appalachian/

Michigan Basin

Proved Reserves (Bcfe): 1,195

Daily Production (Mmcfe/day): 152

5 Mid-Continent

Proved Reserves (Bcfe): 644

Daily Production (Mmcfe/day): 119

6 Permian

Proved Reserves (Bcfe): 1,417

Daily Production (Mmcfe/day): 178

7 Rocky Mountain / Other

Proved Reserves (Bcfe): 515

Daily Production (Mmcfe/day): 115

1

7

6

5

3

4

2

2

4

2

11.Dominion 2003

gas factories is more than 95 percent. We don’t have a

lot of risk, but we have to get these low-risk, long-lived

reserves out of the ground efficiently. They are the back-

bone of our E&P assets. Overall, more than 80 percent of

Dominion E&P’s 6.4 trillion cubic feet of proved natural

gas and oil reserve base resides onshore, principally in

the Appalachian Basin, west Texas and western Canada.

Offshore properties in the Gulf of Mexico have

been yielding about 25 percent of E&P’s production.

There, we typically share costs with partners to minimize

the higher risks of finding these potentially rewarding off-

shore reserves and producing gas and oil from them. This

opens up an upside component to our overall program.

In short, this blend —weighted towards low-risk,

onshore reserves— provides stable and relatively pre-

dictable earnings and cash flow. Dominion was one of

the most active onshore operators in both 2002 and

2003. On a net basis, we drilled 922 wells in 2003 and

expect even more in 2004.

Retail Rate Certainty Also

an Investor Advantage

In the past, the electric utility business was a lot simpler.

We built power plants approved by regulators and

sold all the output into our franchise service territories at

rates, including profit levels, which regulators deter-

mined. Much of this has changed in efforts to deregulate

the power industry. Dominion Virginia Power now oper-

ates under capped rates. From an investor perspective,

it’s a competitive advantage because savings from produc-

tivity gains go to the bottom line. Rate stability also benefits

Dominion Virginia Power’s retail customers.

In our electric-utility service area we have rate

certainty in Virginia until 2007. As we went to press,

Virginia legislators were studying the possibility of a

rate-cap extension. At our natural gas-utility service areas

in Ohio, West Virginia and Pennsylvania, which serve

about 1.7 million retail customers, we still operate under

stable forms of traditional regulation.