Dish Network 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-14

sales and marketing relationship with StarBand and ceased subsidizing StarBand equipment. StarBand subsequently

filed for bankruptcy during June 2002.

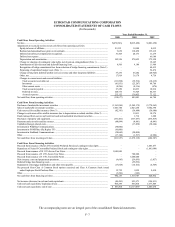

Restricted cash and marketable investment securities, as reflected in the accompanying consolidated balance

sheets, include restricted cash placed in trust for the purpose of repaying a note payable as of December 31, 2001

and restricted cash related to insurance premium requirements as of December 31, 2002.

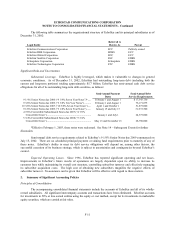

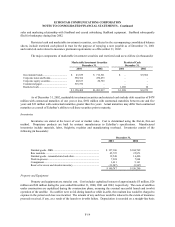

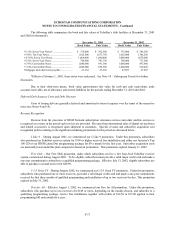

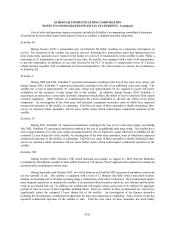

The major components of marketable investment securities and restricted cash are as follow (in thousands):

Marketable Investment Securities Restricted Cash

December 31, December 31,

2001 2002 2001 2002

Government bonds ....................................... $ 43,659 $ 712,521 $ – $ 9,962

Corporate notes and bonds........................... 550,364 470,633 – –

Corporate equity securities........................... 40,633 20,763 – –

Commercial paper ........................................ 515,752 – – –

Restricted cash.............................................. – – 1,288 10

$ 1,150,408 $1,203,917 $ 1,288 $ 9,972

As of December 31, 2002, marketable investment securities and restricted cash include debt securities of $478

million with contractual maturities of one year or less, $692 million with contractual maturities between one and five

years and $23 million with contractual maturities greater than five years. Actual maturities may differ from contractual

maturities as a result of EchoStar’s ability to sell these securities prior to maturity.

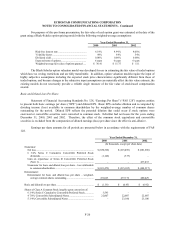

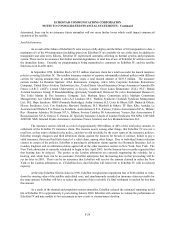

Inventories

Inventories are stated at the lower of cost or market value. Cost is determined using the first-in, first-out

method. Proprietary products are built by contract manufacturers to EchoStar’s specifications. Manufactured

inventories include materials, labor, freight-in, royalties and manufacturing overhead. Inventories consist of the

following (in thousands):

December 31,

2001 2002

Finished goods - DBS .......................................................................... $ 127,186 $ 104,769

Raw materials ....................................................................................... 45,725 25,873

Finished goods - remanufactured and other......................................... 19,548 16,490

Work-in-process ................................................................................... 7,924 7,964

Consignment......................................................................................... 3,611 5,161

Reserve for excess and obsolete inventory .......................................... (13,247) (9,967)

$ 190,747 $ 150,290

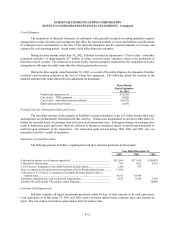

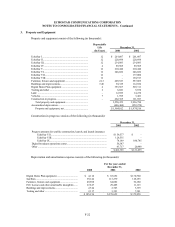

Property and Equipment

Property and equipment are stated at cost. Cost includes capitalized interest of approximately $5 million, $26

million and $24 million during the years ended December 31, 2000, 2001 and 2002, respectively. The costs of satellites

under construction are capitalized during the construction phase, assuming the eventual successful launch and in-orbit

operation of the satellite. If a satellite were to fail during launch or while in-orbit, the resultant loss would be charged to

expense in the period such loss was incurred. The amount of any such loss would be reduced to the extent of insurance

proceeds received, if any, as a result of the launch or in-orbit failure. Depreciation is recorded on a straight-line basis