Dish Network 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

months are considered other than temporary and are recorded as charges to earnings, absent specific factors to the

contrary.

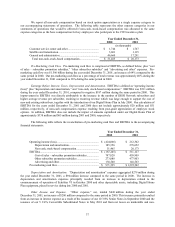

As of December 31, 2002, we recorded unrealized gains of approximately $6 million as a separate

component of stockholders’ deficit. During the year ended December 31, 2002, we also recorded an aggregate

charge to earnings for other than temporary declines in the fair market value of certain of our marketable investment

securities of approximately $117 million, and established a new cost basis for these securities. This amount does not

include realized gains of approximately $12 million on the sales of marketable investment securities. Our

approximately $2.8 billion of restricted and unrestricted cash, cash equivalents and marketable investment securities

include debt and equity securities which we own for strategic and financial purposes. The fair market value of these

strategic marketable investment securities aggregated approximately $73 million as of December 31, 2002. During the

year ended December 31, 2002, our portfolio generally, and our strategic investments particularly, experienced and

continue to experience, volatility. If the fair market value of our marketable securities portfolio does increase to cost

basis or if we become aware of any market or company specific factors that indicate that the carrying value of

certain of our securities is impaired, we may be required to record additional charges to earnings in future periods

equal to the amount of the decline in fair value.

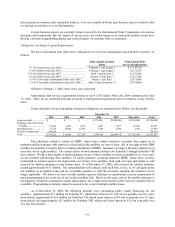

We also have made strategic equity investments in certain non-marketable investment securities. The

securities of these companies are not publicly traded. Our ability to create realizable value from our strategic

investments in companies that are not public is dependent on the success of their business and their ability to obtain

sufficient capital to execute their business plans. Since private markets are not as liquid as public markets, there is also

increased risk that we will not be able to sell these investments, or that when we desire to sell them that we will not be

able to obtain full value for them. We evaluate our non-marketable investment securities on a quarterly basis to

determine whether the carrying value of each investment is impaired. This quarterly evaluation consists of reviewing,

among other things, company business plans and current financial statements, if available, for factors which may

indicate an impairment in our investment. Such factors may include, but are not limited to, cash flow concerns,

material litigation, violations of debt covenants and changes in business strategy.

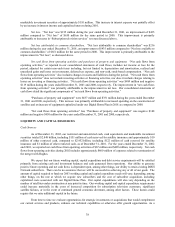

We made a strategic investment in StarBand Communications, Inc. During the first quarter of 2002, we

determined that the carrying value of our investment in StarBand, net of approximately $8 million of equity in losses of

StarBand already recorded during 2002, was not recoverable and recorded an impairment charge of approximately $28

million to reduce the carrying value of our StarBand investment to zero. This determination was based, among other

things, on our continuing evaluation of StarBand’s business model, including further deterioration of StarBand’s

limited available cash, combined with increasing cash requirements, resulting in a critical need for additional funding,

with no clear path to obtain that cash. Further, during April 2002, we changed our sales and marketing relationship

with StarBand and ceased subsidizing StarBand equipment. StarBand subsequently filed for bankruptcy during June

2002.

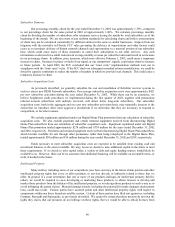

As of December 31, 2002, we estimated the fair value of our fixed-rate debt and mortgages and other notes

payable to be approximately $5.9 billion using quoted market prices where available, or discounted cash flow analyses.

The interest rates assumed in such discounted cash flow analyses reflect interest rates currently being offered for loans

with similar terms to borrowers of similar credit quality. The fair value of our fixed rate debt and mortgages is affected

by fluctuations in interest rates. A hypothetical 10% decrease in assumed interest rates would increase the fair value of

our debt by approximately $200 million. To the extent interest rates increase, our costs of financing would increase at

such time as we are required to refinance our debt. As of December 31, 2002, a hypothetical 10% increase in assumed

interest rates would increase our annual interest expense by approximately $46 million.

We have not used derivative financial instruments for speculative purposes. We have not hedged or

otherwise protected against the risks associated with any of our investing or financing activities.

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Our Consolidated Financial Statements are included in this report beginning on page F-1.