Dish Network 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

The repayment obligations of EDBS under the vendor financings for EchoStar IV and Echostar Orbital

Corporation under the vendor financing for EchoStar VII are guaranteed by EchoStar. The maximum potential

future payments under these guarantees are equal to the respective amounts of outstanding principal and accrued

interest.

In addition to our DBS business plan, we have a business plan for a two-satellite FSS Ku-band satellite

system and a two-satellite FSS Ka-band satellite system. We are currently funding the construction phase for one of

these satellites, EchoStar IX, a hybrid C/Ku/Ka-band satellite.

We currently own a 90% interest in VisionStar, Inc., (“VisionStar”) which holds a Ka-band FCC license at

the 113 degree orbital location. We did not complete construction or launch of the satellite by the milestone

deadlines and have requested an extension of these milestones from the FCC. Failure to receive an extension, of

which there can be no assurance, would render the license invalid. In the future, we may fund construction, launch

and insurance of this and additional satellites through cash from operations, public or private debt or equity

financing, joint ventures with others, or from other sources, although there is no assurance that such funding will be

available.

From time to time we evaluate opportunities for strategic investments or acquisitions that would complement

our current services and products, enhance our technical capabilities or otherwise offer growth opportunities. As a

result, acquisition discussions and offers, and in some cases, negotiations may take place and future material

investments or acquisitions involving cash, debt or equity securities or a combination thereof may result.

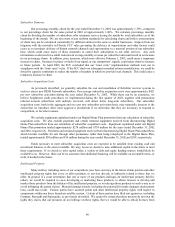

We expect that our future working capital, capital expenditure and debt service requirements will be satisfied

from existing cash and investment balances, and cash generated from operations. Our ability to generate positive future

operating and net cash flows is dependent, among other things, upon our ability to retain existing DISH Network

subscribers, our ability to manage the growth of our subscriber base, and our ability to grow our ETC business. To the

extent future subscriber growth exceeds our expectations, it may be necessary for us to raise additional capital to fund

increased working capital requirements. There may be a number of other factors, some of which are beyond our

control or ability to predict, that could require us to raise additional capital. These factors include unexpected increases

in operating costs and expenses, a defect in or the loss of any satellite, or an increase in the cost of acquiring subscribers

due to additional competition, among other things. If cash generated from our operations is not sufficient to meet our

debt service requirements or other obligations, we would be required to obtain cash from other financing sources.

However, there can be no assurance that such financing would be available on terms acceptable to us, or if available,

that the proceeds of such financing would be sufficient to enable us to meet all of our obligations.

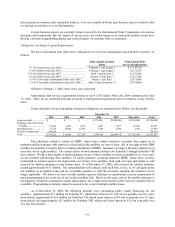

Security Ratings

Our current credit ratings are B1 and B+ on our long-term senior notes, and Caa1 and B- with respect to our

convertible subordinated notes, as rated by Moody’s Investor Services and Standard and Poor’s Rating Services,

respectively. Debt ratings by the various rating agencies reflect each agency’s opinion of the ability of issuers to repay

debt obligations as they come due. With respect to Moody’s, the B1 rating for senior debt indicates that the assurance

of interest and principal payment and principal security over any long period of time is small. For S&P, the B+ and B-

rating indicates the issuer is vulnerable to nonpayment of interest and principal obligations, but the issuer has the

capacity to meet its financial commitments on the obligations. With respect to Moody’s, the Caa1 rating for the

convertible subordinated debt indicates that the security presents elements of significant risk with respect to principal or

interest. In general, lower ratings result in higher borrowing costs. A security rating is not a recommendation to buy,

sell, or hold securities and may be subject to revision or withdrawal at any time by the assigning rating organization.

Each rating should be evaluated independently of any other rating.