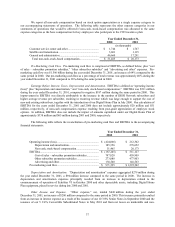

Dish Network 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

Results of Operations

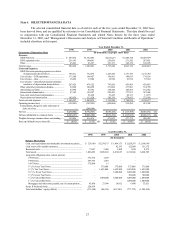

Year Ended December 31, 2002 Compared to the Year Ended December 31, 2001.

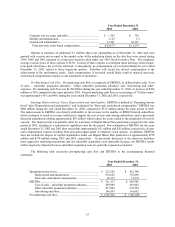

Revenue. “Total revenue” for the year ended December 31, 2002 was $4.821 billion, an increase of

$820 million or 20% compared to “Total revenue” for the year ended December 31, 2001 of $4.001 billion. The

increase in “Total revenue” was primarily attributable to continued DISH Network subscriber growth. The increase in

“Total revenue” was partially offset by our free and reduced price programming promotions, discussed below.

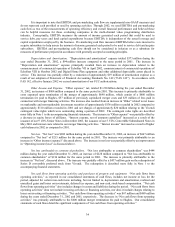

DISH Network “Subscription television services” revenue totaled $4.412 billion for the year ended

December 31, 2002, an increase of $824 million or 23% compared to the same period in 2001. DISH Network

“Subscription television services” revenue principally consists of revenue from basic, premium, local, international and

pay-per-view subscription television services. This increase was attributable to continued DISH Network subscriber

growth. DISH Network added approximately 1.35 million net new subscribers for the year ended December 31, 2002

compared to approximately 1.57 million net new subscribers during the same period in 2001. We believe the

reduction in net new subscribers for the year ended December 31, 2002, compared to the same period in 2001,

resulted from a number of factors, including the continued weak U.S. economy and stronger competition from

advanced digital cable and cable modems. Additionally, as the size of our subscriber base continues to increase,

even if percentage churn remains constant, increasing numbers of gross new subscribers are required to sustain net

subscriber growth. As of December 31, 2002, we had approximately 8.18 million DISH Network subscribers

compared to approximately 6.83 million at December 31, 2001, an increase of approximately 20%. DISH Network

“Subscription television services” revenue will continue to increase to the extent we are successful in increasing the

number of DISH Network subscribers and maintaining or increasing revenue per subscriber. While there can be no

assurance, notwithstanding our expectation of a continued slow U.S. economy, we expect to add at least 1 million net

new subscribers during 2003.

Monthly average revenue per subscriber was approximately $49.17 during the year ended December 31, 2002

and approximately $49.32 during the same period in 2001. The decrease in monthly average revenue per subscriber is

primarily attributable to certain promotions, discussed below, under which new subscribers received free programming

for the first three months of their term of service, and other promotions under which subscribers received discounted

programming for 12 months. This decrease was partially offset by a $1.00 price increase in February 2002, the

increased availability of local channels by satellite and an increase in subscribers with multiple set-top boxes.

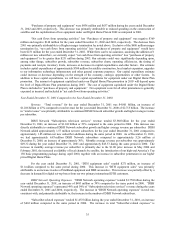

Impacts from our litigation with the networks in Florida, FCC rules governing the delivery of superstations

and other factors could cause us to terminate delivery of distant network channels and superstations to a material

portion of our subscriber base, which could cause many of those customers to cancel their subscription to our other

services. Any such terminations could result in a small reduction in average monthly revenue per subscriber and could

result in an increase in our percentage churn.

In April 2002, the FCC concluded that our “must carry” implementation methods were not in compliance with

the “must carry” rules. If the FCC finds our subsequent remedial actions unsatisfactory, we could be forced by

capacity constraints to reduce the number of markets in which we provide local channels. This could cause a

temporary increase in churn.

For the year ended December 31, 2002, “DTH equipment sales” totaled $288 million, an increase of

$17 million compared to the same period during 2001. “DTH equipment sales” consist of sales and maintenance of

digital set-top boxes and other digital satellite broadcasting equipment by our ETC subsidiary to Bell ExpressVu, a

subsidiary of Bell Canada, Canada’s national telephone company, and sales of DBS accessories in the United States.

The increase in “DTH equipment sales” principally resulted from an increase in sales of DBS accessories to DISH

Network subscribers. This increase was partially offset by a decrease in sales of digital set-top boxes to our

international DTH customers.