Dish Network 2002 Annual Report Download - page 68

Download and view the complete annual report

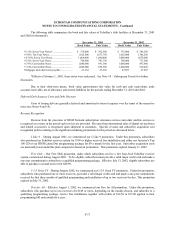

Please find page 68 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-8

1. Organization and Business Activities

Principal Business

The operations of EchoStar Communications Corporation (“ECC,” and together with its subsidiaries, or referring

to particular subsidiaries in certain circumstances, “EchoStar” or the “Company”) include two interrelated business

units:

• The DISH Network - a direct broadcast satellite (“DBS”) subscription television service in the United States.

and

• EchoStar Technologies Corporation (“ETC”) - engaged in the design and development of DBS set-top

boxes, antennae and other digital equipment for the DISH Network (“EchoStar receiver systems”) and the

design, development and distribution of similar equipment for international satellite service providers.

Since 1994, EchoStar has deployed substantial resources to develop the “EchoStar DBS System.” The

EchoStar DBS System consists of EchoStar’s FCC-allocated DBS spectrum, eight DBS satellites (“EchoStar I”

through “EchoStar VIII”), EchoStar receiver systems, digital broadcast operations centers, customer service

facilities, and other assets utilized in its operations. EchoStar's principal business strategy is to continue developing

its subscription television service in the United States to provide consumers with a fully competitive alternative to

cable television service.

Recent Developments

Termination of the Proposed Merger of EchoStar with Hughes

During October, 2001, EchoStar signed agreements with Hughes Electronics Corporation (“Hughes”) and

General Motors (“GM”), which is Hughes’ parent company, related to a proposed merger with Hughes in a stock-for-

stock transaction.

On October 10, 2002, the Federal Communications Commission (“FCC”) announced that it had declined to

approve the application for transfer of the licenses necessary to allow our merger with Hughes to close and designated

the application for hearing by an administrative law judge. On October 31, 2002, the U.S. Department of Justice

(“DOJ”), twenty-three states, the District of Columbia and Puerto Rico filed a complaint for permanent injunctive relief

in the United States District Court for the District of Columbia against EchoStar, GM and Hughes.

On December 9, 2002, EchoStar reached a settlement with GM and Hughes to terminate the proposed merger. In

connection with the proposed merger and subsequent termination, EchoStar recorded charges to earnings for the

following fees:

• Termination fee: Upon termination of the merger, we recorded a charge to earnings of approximately

$690 million related to merger termination costs. These costs consisted of a $600 million termination fee

paid to Hughes, approximately $57 million related to capitalized merger costs which were charged to

earnings upon termination of the merger and approximately $33 million related to unamortized bridge

commitment fees, which were expensed upon termination of the merger.

• Bridge Commitment fees: In connection with the proposed merger, EchoStar and Hughes obtained a

$5.525 billion bridge financing commitment and EchoStar paid approximately $55 million of

commitment fees. Approximately $7 million of deferred commitment fees were expensed upon issuance

of the 9 1/8% Senior Notes due 2009 by EchoStar DBS Corporation (“EDBS”) and approximately $15

million of deferred commitment fees were expensed upon closing of the $1.5 billion equity investment in

EchoStar by Vivendi. The remaining $33 million was expensed upon termination of the merger

explained above.