Creative 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS

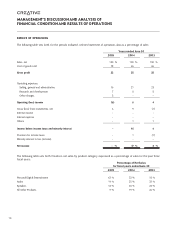

The following table presents the contractual obligations and commercial commitments of Creative as of June 30, 2005:

Payments Due by Period (US$’000)

Less than 1 to 3 4 to 5 After 5

Contractual Obligations Total 1 year years years years

Long Term Debt $ 198,111 $ 3,556 $ 7,111 $ 182,111 $ 5,333

Capital Lease Obligations 4,715 3,827 888 – –

Operating Leases 27,824 8,648 5,385 1,909 11,882

Unconditional Purchase Obligations 44,939 44,939 – – –

Other Obligations 5,481 5,003 478 – –

Total Contractual Cash Obligations

$ 281,070 $ 65,973 $ 13,862 $ 184,020 $ 17,215

Unconditional purchase obligations are defined as contractual obligations for purchase of goods or services, which are

enforceable and legally binding on the Company and that specify all significant terms, including fixed or minimum quantities

to be purchased, fixed, minimum or variable price provisions and the approximate timing of the transaction. The expected

timing of payment of the obligations set forth above is estimated based on current information. Timing of payments and

actual amounts paid may be different depending on the time of receipt of goods or services or changes to agreed-upon

amounts for some obligations.

As of June 30, 2005, Creative has utilized approximately $2.0 million under guarantees and letters of credit.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Please refer to Note 1 of “Notes to Consolidated Financial Statements” for the discussion of recently issued accounting

pronouncements.

Current and Expected Liquidity (Cont’d)

Management believes that Creative has adequate resources to meet its projected working capital and other cash needs for

at least the next twelve months. To date, inflation has not had a significant impact on Creative’s operating results.