Creative 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

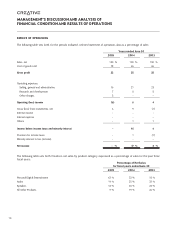

Operating expenses

SG&A expenses in fiscal year 2004 increased marginally by 3% compared to fiscal year 2003. The increase in SG&A

expenses was mainly attributable to an increase in sales and marketing expenses, which were in line with the increase in net

sales, and an increase in expenses related to the company’s European operations due to the strengthening of the Euro

compared to the U.S. dollar during fiscal year 2004. As a percentage of sales, SG&A expenses were 21% of sales compared

to 23% of sales in fiscal year 2003. R&D expenses increased by 18% primarily due to an increase in resources to develop

new products. As a percentage of sales, R&D expenses remained at 8% of sales in fiscal year 2004 compared to fiscal year

2003.

Net investment gain (loss)

Net investment gain of $72.6 million in fiscal year 2004 comprised a $52.9 million gain from sales of investments and a $23.1

million non-cash gain on a “deemed disposal” of interests in SigmaTel offset by $3.4 million in write-downs of unquoted

investments. The net gain of $52.9 million in fiscal year 2004 from sales of investments includes a $38.1 million net gain

from the sale of interests in SigmaTel (see Note 14 of “Notes to Consolidated Financial Statements”). Net investment loss

of $6.0 million in fiscal year 2003 included write-downs of quoted and unquoted investments of $13.6 million offset partially

by net gains of $7.6 million from the sale of quoted investments.

Net interest

Net interest income of $3.6 million in fiscal year 2004 increased by $2.5 million compared to $1.1 million in fiscal year 2003.

The increase was mainly due to higher average cash balance and interest rates in fiscal year 2004 compared to fiscal year

2003.

Others

Other income of $5.7 million in fiscal year 2004 increased by $2.0 million compared to $3.7 million in fiscal year 2003. The

increase was mainly due to an increase in share of equity-method investees’ profits by $2.5 million to $0.3 million in fiscal

year 2004, compared to share of losses of $2.2 million in fiscal year 2003. Exchange gain was reduced by $0.9 million to

$4.5 million in fiscal year 2004 compared to $5.4 million in fiscal year 2003.

Provision for income taxes

Creative was granted a new Pioneer Certificate under the International Headquarters Award that will expire in March 2010.

Under the new Pioneer Certificate, profits arising from qualifying activities will be exempted from income tax in Singapore,

subject to certain conditions. As a result of obtaining the new Pioneer Certificate, fiscal year 2004 tax write-back includes

a $12.3 million reversal of income taxes. The reversal was related to corporate taxes provided for in full for profits arising

from qualifying activities from the commencement date of the new Pioneer Certificate until the second quarter of fiscal year

2004, based on the standard tax rates of 24.5% for fiscal year 2001, 22% for fiscal years 2002 and 2003, and 20% for fiscal

year 2004. These standard corporate income tax rates continue to be applicable to profits arising from activities excluded

from the new Pioneer Certificate. Excluding the $12.3 million reversal of income taxes, Creative’s provision for income taxes

for fiscal year 2004 as a percentage of operating income was 8% compared to 10% in the prior fiscal year. The lower tax

provision in fiscal year 2004 was primarily due to changes in the mix of taxable income arising from various geographical

regions and the new Pioneer Certificate granted to Creative.