Circuit City 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Overview

We are a direct marketer of brand name and private label products. Our operations are organized in two primary

reportable segments – Computer Products and Industrial Products. Our Computer Products segment markets personal

desktop computers, notebook computers and computer related products in North America and Europe. We assemble

our own PCs and sell them under our own trademarks, which we believe gives us a competitive advantage. We also sell

personal computers manufactured by other leading companies, such as Hewlett Packard, E-Machines and Sony. Our

Industrial Products segment markets material handling equipment, storage equipment and consumable industrial items

in North America. We offer more than 100,000 products and continuously update our product offerings to address the

needs of our customers, which include large, mid-sized and small businesses, educational and government entities as

well as individual consumers. We reach customers by multiple channels, utilizing relationship marketers, e-commerce

web sites, mailed catalogues and retail outlet stores. We also participate in the emerging market for on-demand, web-

based software applications through the marketing of our PCS Profitability Suite™

of hosted software, which we began

during 2004, and in which we have not yet recognized any revenues and have incurred considerable losses to date.

Computers and computer related products account for 92% of our net sales, and, as a result, we are dependent on the

general demand for information technology products.

The market for computer products is subject to intense price competition and is characterized by narrow gross

profit margins. The North American industrial products market is highly fragmented and we compete against multiple

distribution channels. Distribution of information technology and our industrial products is working capital intensive,

requiring us to incur significant costs associated with the warehousing of many products, including the costs of leasing

warehouse space, maintaining inventory and inventory management systems, and employing personnel to perform the

associated tasks. We supplement our on-hand product availability by maintaining relationships with major distributors

and manufacturers, utilizing a combination of stocking and drop-shipment fulfillment.

The primary component of our operating expenses historically has been employee related costs, which includes

items such as wages, commissions, bonuses, and employee benefits. We have made substantial reductions in our

workforce and closed or consolidated several facilities over the past several years. In response to poor economic

conditions in the United States, we implemented a plan in the first quarter of 2004 to streamline our United States

computer business. This plan consolidated duplicative back office and warehouse operations, which resulted in annual

savings of approximately $8 million excluding severance and other restructuring costs of approximately $3 million,

which were recognized in fiscal 2004. With evidence of a prolonged economic downturn in Europe, we took measures

to align our cost structure with expected potentially lower revenues and decreasing gross margins, initiating several

cost reduction plans there during 2004 and 2005. Actions taken in 2005 to increase efficiency and profitability in our

European operations resulted in the elimination of approximately 240 positions, and are expected to result in

approximately $6.0 million in annual savings excluding severance and restructuring costs of approximately $3.7

million, which were recognized in fiscal 2005. Our restructuring actions and other cost savings measures implemented

over the last several years resulted in reducing our consolidated selling, general and administrative expenses from

16.5% of net sales in 2002 to 12.7% of net sales in 2005. We will continue to monitor our costs and evaluate the need

for additional actions.

The discussion of our results of operations and financial condition that follows will provide information that will

assist in understanding our financial statements and information about how certain accounting principles and estimates

affect the consolidated financial statements. This discussion should be read in conjunction with the consolidated

financial statements included herein.

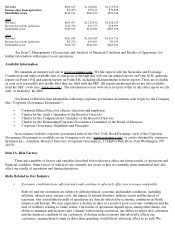

Highlights from 2005

•

Sales increase of 9.7% to $2.1 billion from $1.9 billion in 2004

•

Continued growth (26%) in e

-

commerce sales

• Decrease of selling, general and administrative expense to 12.7% of net sales from 13.5% of net sales in

2004

•

Increase in income from operations of $15.8 million or 83.2%

•

Successful restructuring of our European operations

• Expansion of our revolving credit agreement to $120 million to cover our United States and United

Kingdom needs