Assurant 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 ASSURANT ANNUAL REPORT > 1

“

“

In 2013, our Assurant team strengthened our core

businesses and adapted our specialty offerings to meet

changing consumer needs. During the year, we completed

several strategic acquisitions and prudently managed

shareholders’ capital. Consistently, we focused our actions

on long-term, profi table growth and upheld our commitment

to help customers protect what matters most to them.

Robert B. Pollock

President and CEO

Assurant

We returned approximately $470 million to shareholders through stock

repurchases and dividends. We again increased our dividend, just as we

have each year since our initial public offering in 2004. We did so while

also committing $360 million to strategic transactions that broaden our

footprint and expand our array of specialty services.

Our investments to support profi table growth continue to focus on areas

that are aligned with fi ve broad marketplace trends:

• Greater reliance on mobile devices in every aspect of life;

• Shifting consumer interest in rental versus ownership of property,

especially in the United States;

• Desire for affordable and accessible health care coverage that can be

customized to meet individual needs;

• Need for choice in the benefi ts that employees can elect from their

small-to-midsize employer; and

• More middle-class consumers in Latin American countries.

Our actions in 2013 reinforced the strategic importance of these

macro-trends for Assurant. Looking ahead, we will allocate more of

our resources to the targeted areas with the greatest potential for

ongoing profi table growth.

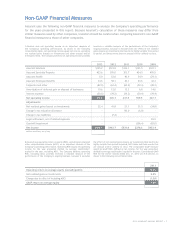

Assurant’s net earned premiums, fees and other income were $8.3 billion

in 2013, an 8.2 percent increase from the previous year. Net operating

income

(1)

was $466.5 million, also a year-over-year improvement.

Operating return on equity, excluding accumulated other comprehensive

income (AOCI)

(2)

was 10.6 percent. Our book value per diluted share,

excluding AOCI

(3)

, was up 10.4 percent – marking our third consecutive

year of double-digit growth.

A Message to Our Shareholders