Assurant 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

8 < 2013 ASSURANT ANNUAL REPORT

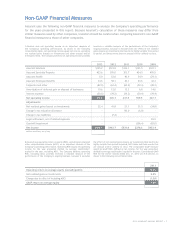

4 A reconciliation of stockholders’ equity, excluding AOCI, to GAAP equity is as shown below:

3 Assurant uses book value per diluted share excluding AOCI, as an

important measure of the Company’s stockholders’ value. Book value

per diluted share excluding AOCI equals total stockholders’ equity

excluding AOCI divided by diluted shares outstanding. The Company

believes book value per diluted share excluding AOCI provides investors

a valuable measure of stockholders’ value because it excludes the effect

of unrealized gains (losses) on investments, which tend to be highly

variable from period to period and other AOCI items. The comparable

GAAP measure would be book value per diluted share, defi ned as total

stockholders’ equity divided by diluted shares outstanding. Book value

per diluted share was $65.24 as of Dec. 31, 2013 and, for prior years,

as shown in the following reconciliation table.

2013 2012

2011 2010 2009

Book value per diluted share (excluding AOCI) $59.48 $53.87 $47.34 $41.65 $39.22

Changes due to effect of including AOCI 5.76 10.27 6.12 2.75 0.57

Book value per diluted share $65.24 $64.14 $53.46 $44.40 $39.79

2013 2012

2011 2010 2009

Stockholders’ equity (excluding AOCI) $4,407 $4,355 $4,316 $4,346 $4,639

AOCI 426 830 558 287 68

GAAP equity S4,833 $5,185 $4,874 $4,633 $4,707

(dollars in millions)