Assurant 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 ANNUAL REPORT

AND FORM 10-K

Table of contents

-

Page 1

2013 ANNUAL REPORT AND FORM 10-K -

Page 2

Financial Highlights Total Revenue Net Earned Premiums, Fees & Other Net Investment Income Net Operating Income1 Shareholders' Equity2 (U.S. dollars in millions) 2013 $9,048 8,347 650 467 4,407 2012 $8,508 7,712 713 449 4,355 2011 $8,273 7,530 690 438 4,316 2010 $8,528 7,766 703 560 4,346 2009 ... -

Page 3

...every aspect of life; • Shifting consumer interest in rental versus ownership of property, especially in the United States; • Desire for affordable and accessible health care coverage that can be customized to meet individual needs; • Need for choice in the beneï¬ts that employees can elect... -

Page 4

... changes in the housing, ï¬nancial services and health insurance sectors. In 2013, for example, the ï¬rst open enrollment period of the Affordable Care Act had a dramatic impact for consumers as well as on the healthcare industry. Similarly, as the U.S. housing market continued to rebound, new... -

Page 5

...product mix and revenue streams to deliver attractive long-term returns at Assurant Specialty Property. $589 million of 2013 Net Operating Income by Segment 21.2% Assurant Solutions Assurant Health During 2013, Assurant Health demonstrated agility and responded quickly to meet consumer needs. By... -

Page 6

... requires ongoing expense management and focus on the voluntary market for small-to-midsize businesses. These efforts will help Assurant Employee Beneï¬ts provide attractive returns longer term. Assurant Solutions 30.1% Assurant Specialty Property 19.3% OUR PURPOSE, OUR VALUES Within each of... -

Page 7

Global Reach Assurant operates in the United States as well as select worldwide markets, including: Argentina, Brazil, Canada, Chile, China, Germany, Ireland, Italy, Mexico, Puerto Rico, Spain and the United Kingdom. 2 0 1 3 ASSU RAN T AN N UA L R E P O RT > 5 -

Page 8

... UNUM Life Insurance Company of America Former Chair, Emerson Industrial Automation and former President, Emerson Europe Robert B. Pollock (2006) Howard L. Carver (2002) Former Ofï¬ce Managing Partner, Ernst & Young LLP David B. Kelso (2007) President and Chief Executive Ofï¬cer, Assurant... -

Page 9

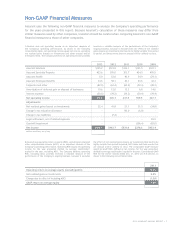

...to recur. 2013 Assurant Solutions Assurant Specialty Property Assurant Health Assurant Employee Beneï¬ts Corporate and other Amortization of deferred gain on disposal of businesses Interest expense Net operating income Adjustments: Net realized gains (losses) on investments Change in tax valuation... -

Page 10

... shares outstanding. The Company believes book value per diluted share excluding AOCI provides investors a valuable measure of stockholders' value because it excludes the effect of unrealized gains (losses) on investments, which tend to be highly variable from period to period and other AOCI items... -

Page 11

FORM 10-K -

Page 12

... and Procedures ...67 Other Information ...67 PART III ITEM 10 ITEM 11 ITEM 12 ITEM 13 ITEM 14 68 Directors, Executive Ofï¬cers and Corporate Governance ...68 Executive Compensation ...68 Security Ownership of Certain Beneï¬cial Owners and Management and Related Stockholder Matters ...69 Certain... -

Page 13

... Plaza, 41st Floor, New York, New York (Address of Principal Executive Ofï¬ces) (212) 859-7000 39-1126612 (I.R.S. Employer Identiï¬cation No.) 10005 (Zip Code) (Registrant's telephone number, including area code) SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT: Title of Each Class... -

Page 14

...the risk of ratings downgrades in the insurance industry); deterioration in the Company's market capitalization compared to its book value that could result in an impairment of goodwill; risks related to our international operations, including ï¬,uctuations in exchange rates; general global economic... -

Page 15

... services; renters insurance and related products; manufactured housing homeowners insurance; individual health and small employer group health insurance; group dental insurance; group disability insurance; and group life insurance. Assurant's mission is to be the premier provider of specialized... -

Page 16

... report. Assurant Solutions For the Years Ended December 31, 2012 December 31, 2013 Net earned premiums for selected product groupings: Domestic extended service contracts and warranties(1) International extended service contracts and warranties(1) Preneed life insurance Domestic credit insurance... -

Page 17

... areas: domestic and international extended service contracts ("ESCs") and warranties, including mobile device protection; preneed life insurance; and international credit insurance. Marketing and Distribution Assurant Solutions focuses on establishing strong, long-term relationships with leading... -

Page 18

... property preservation service provides inspections and repairs that help preserve the value of homes in the portfolios of our mortgage lender and servicer clients. Lender-placed and voluntary homeowners insurance The largest product line within Assurant Specialty Property is homeowners insurance... -

Page 19

... performed by Assurant Specialty Property using a proprietary insurance tracking administration system, or by the lenders themselves. A number of manufactured housing retailers in the U.S. use our proprietary premium rating technology to assist them in selling property coverage at the point of sale... -

Page 20

PART I ITEM 1 Business Products and Services Assurant Health competes in the individual medical insurance market by offering major medical insurance, short-term medical insurance, and limited beneï¬t coverages to individuals and families. Our products are offered with different plan options to ... -

Page 21

... illness, cancer, accident, and gap insurance. These products are generally paid for by the employee through payroll deductions, and the employee is enrolled in the coverage(s) at the worksite. Group Dental Dental beneï¬t plans provide funding for necessary or elective dental care. Customers... -

Page 22

...Security Insurance Company Assurant Life of Canada Caribbean American Life Assurance Company Caribbean American Property Insurance Company John Alden Life Insurance Company Reliable Lloyds Standard Guaranty Insurance Company Time Insurance Company UDC Dental California Union Security Dental Care New... -

Page 23

... Insurance Company Union Security Life Insurance Company of New York United Dental Care of Arizona United Dental Care of Colorado United Dental Care of Michigan United Dental Care of Missouri United Dental Care of New Mexico United Dental Care of Ohio United Dental Care of Texas United Dental Care... -

Page 24

... enter and exit markets or to provide, terminate or cancel certain coverages; • imposing statutory accounting and annual statement disclosure requirements; • regulating product types and approving policy forms and mandating certain insurance beneï¬ts; • regulating premium rates, including the... -

Page 25

...such coverage; requirements to include the package of essential health beneï¬ts; increased costs to modify and/or sell our products; intensiï¬ed competitive pressures that limit our ability to increase rates due to state insurance exchanges; signiï¬cant risk of customer loss; new and higher taxes... -

Page 26

...-traded securities, Assurant is subject to certain legal and regulatory requirements applicable generally to public companies, including the rules and regulations of the U.S. Securities and Exchange Commission (the "SEC") and the New York Stock Exchange (the "NYSE") relating to public reporting and... -

Page 27

... to insure properties securing loans guaranteed by or sold to government-sponsored entities ("GSEs") and serviced by the mortgage loan servicers with whom we do business. In Assurant Health, we have exclusive distribution relationships for our individual health insurance products with a major mutual... -

Page 28

...by mortgage servicer clients of loan portfolios to other carriers could materially reduce our revenues and proï¬ts from this business. In our Assurant Health and Assurant Employee Beneï¬ts segments, a loss of one or more of the discount arrangements with PPOs could lead to higher medical or dental... -

Page 29

... our insurance products, warranties and other related products and services, (ii) terminate existing policies or contracts or permit them to lapse, (iii) choose to reduce the amount of coverage they purchase, and (iv) in the case of business customers of Assurant Health or Assurant Employee Bene... -

Page 30

... Assurant Specialty Property's lender-placed homeowners and lender-placed manufactured housing insurance products are designed to automatically provide property coverage for client portfolios, our concentration in certain catastrophe-prone states like Florida, California, Texas and New York may... -

Page 31

... net assets, net revenue, operating expenses, and net income or loss will decrease if the U.S. dollar strengthens against local currency. For example, Argentina, a country in which Assurant Solutions operates, is currently undergoing a currency crisis. These ï¬,uctuations in currency exchange rates... -

Page 32

...pay premiums for the duration of the disability or for a stated period, during which time the life insurance coverage continues. If interest rates decline, reserves for open and new claims in Assurant Employee Beneï¬ts may need to be calculated using lower discount rates, thereby increasing the net... -

Page 33

... environmental protection laws resulting from our commercial mortgage loan portfolio and real estate investments may weaken our ï¬nancial strength and reduce our proï¬tability. For more information, please see Item 1, "Business-Regulation-Environmental Regulation." ASSURANT, INC. - 2013 Form 10... -

Page 34

... judgments relating to recoverability of deferred tax assets, use of tax loss and tax credit carryforwards, levels of expected future taxable income and available tax planning strategies. The assumptions in making these judgments are updated periodically on the basis of current business conditions... -

Page 35

... our Fortis Financial Group ("FFG") division to The Hartford Financial Services Group, Inc. ("The Hartford") and in 2000 we sold our Long Term Care ("LTC") division to John Hancock Life Insurance Company ("John Hancock"), now a subsidiary of Manulife Financial Corporation. Most of the assets backing... -

Page 36

... Market Risks-Credit Risk." Due to the structure of our commission program, we are exposed to risks related to the creditworthiness and reporting systems of some of our agents, third party administrators and clients in Assurant Solutions and Assurant Specialty Property. We are subject to the credit... -

Page 37

... our lender-placed insurance products including those relating to rates, agent compensation, consumer disclosure, continuous coverage requirements, loan tracking services and other services that we provide to mortgage servicers; • disputes over coverage or claims adjudication; • disputes over... -

Page 38

... and new rates in New York. Proposed changes to the program would affect annual lender-placed hazard and real estate owned policies issued in the State of New York, which accounted for approximately $101,000 and $79,000 of Assurant Specialty Property's net earned premiums for full year 2013 and 2012... -

Page 39

...-Health Insurance Premium Rebate Liability" for more information about the minimum medical loss ratio and the Company's rebate estimate calculations. In addition, the Affordable Care Act imposes limitations on the deductibility of compensation and certain other payments. ASSURANT, INC. - 2013 Form... -

Page 40

... ï¬rst open enrollment period, uncertainty remains with respect to a number of provisions of the Affordable Care Act, including with respect to mechanics of the public and private exchanges and the application of the Affordable Care Act's requirements to various types of health insurance plans. In... -

Page 41

... Employee Beneï¬ts has a headquarters building in Kansas City, Missouri. Assurant Health has a headquarters building in Milwaukee, Wisconsin. We lease ofï¬ce space for various ofï¬ces and service centers located throughout the U.S. and internationally, including our New York, New York corporate... -

Page 42

...to the Notes to Consolidated Financial Statements for a description of certain matters, which description is incorporated herein by reference. Although the Company cannot predict the outcome of any pending or future ITEM 4 Not applicable. Mine Safety Disclosures 30 ASSURANT, INC. - 2013 Form 10-K -

Page 43

... S&P 400 Multi-line Insurance Index TOTAL VALUES/RETURN TO STOCKHOLDERS (Includes reinvestment of dividends) Base Period 12/31/08 100 100 100 100 100 Indexed Values Years Ending 12/31/10 12/31/11 133.83 145.32 145.51 148.59 173.98 170.96 168.03 122.51 135.36 146.98 Company / Index Assurant, Inc... -

Page 44

... ITEM 5 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Annual Return Percentage Years Ending Company / Index Assurant, Inc. S&P 500 Index S&P 400 MidCap Index S&P 500 Multi-line Insurance Index* S&P 400 Multi-line Insurance Index* * 12... -

Page 45

... and for the years ended December 31, 2012 2011 2010 ASSURANT, INC. FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA 2013 Consolidated Statement of Operations Data: Revenues Net earned premiums Net investment income Net realized gains (losses) on investments(1) Amortization of deferred gain on disposal... -

Page 46

...in a decrease to net income but did not have any related tax benefit. (4) During 2011, we had an $80,000 release of a capital loss valuation allowance related to deferred tax assets. (5) Policy liabilities include future policy benefits and expenses, unearned premiums and claims and benefits payable... -

Page 47

...2012. The increase was primarily related to a $143,457 (after-tax) decrease in reportable catastrophe losses in our Assurant Specialty Property segment, partially offset by lower net income in our Assurant Health and Assurant Employee Beneï¬ts segments. In addition, our Corporate and Other net loss... -

Page 48

...in net earned premiums. Also, Twelve Months 2012 results included an additional $14,337 (after-tax) of investment income from real estate joint venture partnerships. The ï¬rst open enrollment period under the Affordable Care Act began late in 2013. During the enrollment period, Assurant Health bene... -

Page 49

...claims, and enrollment by state, legal entity and market for medical businesses subject to MLR requirements for the MLR reporting year. In addition, the projection models include quality improvement expenses, state assessments and taxes. Health Insurance Premium Rebate Liability The Affordable Care... -

Page 50

... 36,641 475 14,943 Short Duration Contracts: Group term life 0 4,135 169,972 Group disability 0 2,537 1,156,693 Medical 0 125,817 68,869 Dental 0 5,140 2,402 Property and warranty 0 2,514,356 201,336 Credit life and disability 0 314,420 39,419 Extended service contracts 0 3,331,936 6,622 All other... -

Page 51

... term life, discount rate decreased by 100 basis points Group term life, as reported Group term life, discount rate increased by 100 basis points Medical IBNR reserves calculated using generally accepted actuarial methods represent the largest component of reserves for short duration medical claims... -

Page 52

... homeowners, multi-family housing, credit property, credit unemployment and warranty insurance and some longer-tail coverages (e.g. asbestos, environmental, other general liability and personal accident). Claim reserves for these lines are calculated on a product line basis using generally accepted... -

Page 53

...to individual voluntary limited beneï¬t health policies issued in 2007 and later are deferred and amortized over the estimated average terms of the underlying contracts. These acquisition costs relate to commission expenses which result from commission schedules that pay signiï¬cantly higher rates... -

Page 54

.... The calculation of reported expense and liability associated with these plans requires an extensive use of assumptions including factors such as discount rates, expected long-term returns on plan assets, employee retirement and termination rates and future 42 ASSURANT, INC. - 2013 Form 10-K -

Page 55

... recoverability of deferred tax assets, use of tax loss and tax credit carryforwards, levels of expected future taxable income and available tax planning strategies. The assumptions used in making these judgments are updated periodically by management based on current business conditions that affect... -

Page 56

... Solutions reporting unit exceeded its net book value by 10.5%, while the Assurant Specialty Property reporting unit exceeded its net book value by 17.4%. In cases where Step 1 testing was performed, the following describes the valuation methodologies used in 2013 and 2012 to derive the estimated... -

Page 57

... 2011, the FASB issued amendments to the other expenses guidance to address how health insurers should recognize and classify in their statements of operations fees mandated by the Affordable Care Act. The Affordable Care Act imposes an annual fee on health insurers for each ASSURANT, INC. - 2013... -

Page 58

... related to a $143,457 (after-tax) decrease in reportable catastrophe losses in our Assurant Specialty Property segment. Partially offsetting this item was lower net income in our Assurant Health and Assurant Employee Beneï¬ts segments. In addition, the Corporate and Other net loss increased as net... -

Page 59

... information regarding Assurant Solutions' segment results of operations: For the Years Ended December 31, 2013 2012 Revenues: Net earned premiums Net investment income Fees and other income Total revenues Beneï¬ts, losses and expenses: Policyholder beneï¬ts Selling, underwriting and general... -

Page 60

... net earned premiums increased primarily attributable to service contract growth in the automotive and retail markets from both new and existing clients including $17,123 related to a new block of business assumed during Twelve Months 2012. International service contract and credit businesses net... -

Page 61

...presents information regarding Assurant Specialty Property's segment results of operations: For the Years Ended December 31, 2013 2012 Revenues: Net earned premiums Net investment income Fees and other income Total revenues Beneï¬ts, losses and expenses: Policyholder beneï¬ts Selling, underwriting... -

Page 62

... new rates in New York. Proposed changes to the program would affect annual lender-placed hazard and real estate owned policies issued in the State of New York, which accounted for approximately $101,000 and $79,000 of Assurant Specialty Property's net earned premiums for Twelve Months 2013 and 2012... -

Page 63

... and general expenses Total beneï¬ts, losses and expenses Segment income before provision for income taxes Provision for income taxes SEGMENT NET INCOME Net earned premiums: Individual Small employer group TOTAL Insured lives by product line: Individual Small employer group TOTAL Ratios: Loss ratio... -

Page 64

.... Net earned premiums from our small employer group business decreased $3,315, or 1%, due to a decline in renewal business, partially offset by new sales and premium rate increases. Net investment income decreased $27,644, primarily due to less investment income from real estate joint venture... -

Page 65

... presents information regarding Assurant Employee Beneï¬ts' segment results of operations: For the Years Ended December 31, 2012 2013 Revenues: Net earned premiums Net investment income Fees and other income Total revenues Beneï¬ts, losses and expenses: Policyholder beneï¬ts Selling, underwriting... -

Page 66

... 73.1%, primarily driven by favorable disability, life and dental loss experience. The expense ratio increased to 37.4% from 35.4% primarily as a result of decreased net earned premiums. Corporate and Other The table below presents information regarding the Corporate and Other segment's results of... -

Page 67

...713,128 $ 2011 565,486 29,645 80,903 3,102 5,351 21,326 7,838 713,651 (24,119) 689,532 Fixed maturity securities Equity securities Commercial mortgage loans on real estate Policy loans Short-term investments Other investments Cash and cash equivalents Total investment income Investment expenses NET... -

Page 68

... the non-binding broker quotes with Level 2 inputs, these securities are categorized as Level 3. A non-pricing service source prices certain privately placed corporate bonds using a model with observable inputs including, but not limited to, the credit rating, credit spreads, sector add-ons, and... -

Page 69

...Our Industry- Changes in regulation may reduce our proï¬tability and limit our growth." Along with solvency regulations, the primary driver in determining the amount of capital used for dividends is the level of capital needed to maintain desired ï¬nancial strength ratings from A.M. Best. ASSURANT... -

Page 70

... and maturity of investments and net investment income. Cash is primarily used to pay insurance claims, agent commissions, operating expenses and taxes. We generally invest our subsidiaries' excess funds in order to generate investment income. We conduct periodic asset liability studies to measure... -

Page 71

...87% funded status at December 31, 2013 and 2012, respectively. The change in funded status is mainly due to favorable investment returns as well as contributions made to the plan and an increase in the discount rate used to determine the projected beneï¬t obligation. The Company's funding policy is... -

Page 72

...September 2015, provided we are in compliance with all covenants. The 2011 Credit Facility has a sublimit for letters of credit issued thereunder of $50,000. The proceeds of these loans may be used for our commercial paper program or for general corporate purposes. The Company may increase the total... -

Page 73

... catastrophe loss payments, changes in the timing of payments, including commissions and the Company's deï¬ned contribution plan match, partially offset by increased net written premiums in our Assurant Solutions and Assurant Specialty Property segments. Investing Activities: Net cash used... -

Page 74

... rate risk is the possibility that the fair value of liabilities will change more or less than the market value of investments in response to changes in interest rates, including changes in investment yields and changes in spreads due to credit risks and other factors. 62 ASSURANT, INC. - 2013 Form... -

Page 75

... tailored to the anticipated cash outï¬,ow characteristics of our insurance and reinsurance liabilities. Our group long-term disability and group term life waiver of premium reserves are also sensitive to interest rates. These reserves are discounted to the valuation date at the valuation interest... -

Page 76

... point change in portfolio yield 0 5.36% 0 50 5.44% 0.08% 100 5.52% 0.16% Credit Risk We have exposure to credit risk primarily from customers, as a holder of ï¬xed maturity securities and by entering into reinsurance cessions. Our risk management strategy and investment policy is to invest... -

Page 77

... partially mitigated this risk by purchasing derivative contracts with payments tied to the CPI. See "- Derivatives." In addition, we have inï¬,ation risk in our individual and small employer group health insurance businesses to the extent that medical costs increase with inï¬,ation, and we have not... -

Page 78

... contracts. Under insurance statutes, our insurance companies may use derivative ï¬nancial instruments to hedge actual or anticipated changes in their assets or liabilities, to replicate cash market instruments or for certain income-generating activities. These statutes generally prohibit the use... -

Page 79

...management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company's assets that could have a material effect on the ï¬nancial statements. Because of its inherent limitations, internal... -

Page 80

... "Investor Relations" section of our website at www.assurant.com which is not incorporated by reference herein. We intend to post any amendments to or waivers from the Code of Ethics that apply to our executive ofï¬cers or directors on our website. ITEM 11 Executive Compensation The information in... -

Page 81

... Accounting Fees and Services ITEM 12 Security Ownership of Certain Beneï¬cial Owners and Management and Related Stockholder Matters The information in the 2014 Proxy Statement under the captions "Securities Authorized for Issuance Under Equity Compensation Plans," "Security Ownership of Certain... -

Page 82

...2013, 2012 and 2011 F-1 F-2 F-3 F-4 F-5 F-6 F-8 (a)2. Consolidated Financial Statement Schedules The following consolidated ï¬nancial statement schedules of Assurant, Inc. are attached hereto: Schedule Schedule Schedule Schedule Schedule I-Summary of Investments other than Investments in Related... -

Page 83

... by reference from Exhibit 10.15 to the Registrant's Form 10-K, originally ï¬led on February 23, 2012).* Form of Assurant, Inc. Restricted Stock Unit Award Agreement for Time-based Awards under the Assurant, Inc. Long Term Equity Incentive Plan (incorporated by reference from Exhibit 10.8 to the... -

Page 84

... of Amendment to Assurant, Inc. Change of Control Employment Agreement, effective as of February 1, 2010 (incorporated by reference from Exhibit 10.1 to the Registrant's Form 8-K, originally ï¬led on February 1, 2010).* American Security Insurance Company Investment Plan Document (incorporated by... -

Page 85

...) the Consolidated Statements of Comprehensive Income, (iv) the Consolidated Statements of Changes in Stockholders' Equity, (v) the Consolidated Statements of Cash Flows, and (vi) Notes to Consolidated Financial Statements. * Management contract or compensatory plan. ASSURANT, INC. - 2013 Form10... -

Page 86

... duly authorized on February 18, 2014. ASSURANT, INC. By: Name: Title: /s/ROBERT B. POLLOCK Robert B. Pollock President and Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons on behalf... -

Page 87

... period ended December 31, 2013 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the ï¬nancial statement schedules listed in the index appearing under Item 15(a)2 present fairly, in all material respects, the information set... -

Page 88

... value (cost-$417,535 in 2013 and $422,703 in 2012) Commercial mortgage loans on real estate, at amortized cost Policy loans Short-term investments Collateral held/pledged under securities agreements Other investments TOTAL INVESTMENTS Cash and cash equivalents Premiums and accounts receivable, net... -

Page 89

... beneï¬ts Amortization of deferred acquisition costs and value of business acquired Underwriting, general and administrative expenses Interest expense TOTAL BENEFITS, LOSSES AND EXPENSES Income before provision for income taxes Provision for income taxes NET INCOME Earnings Per Share Basic Diluted... -

Page 90

... net periodic beneï¬t cost and change in funded status, net of taxes of $(51,302), $(163), and $5,439, respectively Total other comprehensive (loss) income TOTAL COMPREHENSIVE INCOME $ See the accompanying notes to the consolidated financial statements Years Ended December 31, 2013 2012... -

Page 91

...Statements of Changes in Stockholders' Equity AT DECEMBER 31, 2013, 2012 AND 2011 ...2012 Stock plan exercises Stock plan compensation expense Change in tax beneï¬t from sharebased payment arrangements Dividends Acquisition of common stock Net income Other comprehensive loss Balance, December 31, 2013... -

Page 92

...Commercial mortgage loans on real estate Other invested assets Property and equipment and other Subsidiary, net of cash transferred(1) Equity interest(2) Change in short-term investments Change in policy loans Change in collateral held/pledged under securities agreements NET CASH (USED IN) INVESTING... -

Page 93

... END OF PERIOD $ 1,717,184 $ 909,404 $ 1,166,713 Supplemental information: Income taxes paid $ 132,487 $ 289,850 $ 223,950 Interest paid on debt $ 70,741 $ 60,188 $ 60,244 (1) 2013 includes the acquisition of Field Asset Services Group Limited and Lifestyle Services Group Limited. 2012 includes the... -

Page 94

...housing homeowners insurance, individual health and small employer group health insurance, group dental insurance, group disability insurance, and group life insurance. Assurant, Inc. (the "Company") is a holding company whose subsidiaries provide specialized insurance products and related services... -

Page 95

... unrealized loss. Net unrealized gains and losses on securities classiï¬ed as availablefor-sale, less deferred income taxes, are included in AOCI. Commercial mortgage loans on real estate are reported at unpaid balances, adjusted for amortization of premium or ASSURANT, INC. - 2013 Form 10-K F-9 -

Page 96

... deï¬ciency testing is performed annually and generally reviewed quarterly. Such testing involves the use of best estimate assumptions including the anticipation of investment income to determine if anticipated future policy premiums are adequate to recover all DAC and related claims, beneï¬ts... -

Page 97

... individual voluntary limited beneï¬t health policies issued in 2007 and later are deferred and amortized over the estimated average terms of the underlying contracts. These acquisition costs relate to commission expenses which result from commission schedules that pay signiï¬cantly higher rates... -

Page 98

... impaired. For 2013 and 2012, the Assurant Employee Beneï¬ts and Assurant Health reporting units did not have goodwill. Other Intangible Assets Other intangible assets that have ï¬nite lives, including but not limited to, customer contracts, customer relationships and marketing relationships, are... -

Page 99

...rates on our asset portfolio. Changes in the estimated liabilities are reported as a charge or credit to policyholder beneï¬ts as the estimates are revised. Long Duration Contracts The Company's long duration contracts include preneed life insurance policies and annuity contracts, traditional life... -

Page 100

... charges assessed against policy balances. Revenues are recognized ratably as earned income over the premium-paying periods of the policies for the group worksite insurance products. For a majority of individual medical contracts issued prior to 2003, a limited number of individual medical contracts... -

Page 101

... revenue on a pro-rata basis over the contract term. The Company's short duration contracts primarily include group term life, group disability, medical, dental, vision, property and warranty, credit life and disability, and extended service contracts and individual medical contracts issued... -

Page 102

... to the Company's ï¬nancial position and results of operations. In July 2011, the FASB issued amendments to the other expenses guidance to address how health insurers should recognize and classify in their statements of operations fees mandated by the Patient Protection and Affordable Care Act and... -

Page 103

4 Investments existing collateral protection service offerings for customers of Assurant Specialty Property. On October 25, 2013, the Company acquired Lifestyle Services Group, a mobile phone insurance provider based in the U.K. The acquisition-date fair value of the consideration transferred ... -

Page 104

... and Puerto Rico, with no individual state's exposure (including both general obligation and revenue securities) exceeding 0.5% of the overall investment portfolio as of December 31, 2013 and 2012. At December 31, 2013 and 2012, the securities include general obligation and revenue bonds issued by... -

Page 105

...713,128 $ 2011 565,486 29,645 80,903 3,102 5,351 21,326 7,838 713,651 (24,119) 689,532 Fixed maturity securities Equity securities Commercial mortgage loans on real estate Policy loans Short-term investments Other investments Cash and cash equivalents Total investment income Investment expenses NET... -

Page 106

...backed or asset-backed securities. For corporate debt securities, the split between the credit and non-credit losses is driven principally by assumptions regarding the amount and timing of projected future cash ï¬,ows. The net present value is calculated by discounting the Company's best estimate of... -

Page 107

... or internal estimates. In addition to prepayment assumptions, cash ï¬,ow estimates vary based on assumptions regarding the underlying collateral including default rates, recoveries and changes in value. The net present value is calculated by discounting the Company's best estimate of projected... -

Page 108

... real estate, on properties located throughout the U.S. and Canada. At December 31, 2013, approximately 38% of the outstanding principal balance of commercial mortgage loans was concentrated in the states of California, New York, and Utah. Although the Company has a diversiï¬ed loan portfolio... -

Page 109

... concentrations. At December 31, 2013, the Company had mortgage loan commitments outstanding of approximately $16,625. The Company is also committed to fund additional capital contributions of $26,815 to real estate joint ventures. The Company has short term investments and ï¬xed maturities of... -

Page 110

... only certain investments or certain assets and liabilities within these line items are measured at estimated fair value. Other investments are comprised of investments in the Assurant Investment Plan, American Security Insurance Company Investment Plan, Assurant Deferred Compensation Plan, a modi... -

Page 111

... occur when market observable inputs that were previously available become unavailable in the current period. The remaining unpriced securities are submitted to independent brokers who provide non-binding broker quotes or are priced by other qualiï¬ed sources. ASSURANT, INC. - 2013 Form 10-K F-25 -

Page 112

... governments Asset-backed Commercial mortgage-backed Residential mortgage-backed Corporate Equity Securities Non-redeemable preferred stocks Other investments Other assets Financial Liabilities Other liabilities TOTAL LEVEL 3 ASSETS AND LIABILITIES Balance, beginning of period Total gains (losses... -

Page 113

... assets and liabilities has been consistent. • Level 1 Securities The Company's investments and liabilities classiï¬ed as Level 1 as of December 31, 2013 and 2012, consisted of mutual funds and money market funds, foreign government ï¬xed maturities and common stocks that are publicly listed... -

Page 114

... by a pricing service using single broker quotes due to insufï¬cient information to provide an evaluated price as of December 31, 2013 and 2012, respectively. The single broker quotes are provided by market makers or broker-dealers who are recognized as market participants in the markets in which... -

Page 115

... include commercial mortgage loans, goodwill and ï¬nite-lived intangible assets. For its 2013 and 2011 fourth quarter annual goodwill impairment tests, a qualitative assessment was performed for the Assurant Specialty Property reporting unit; for the Assurant Solutions Reporting unit, the Company... -

Page 116

... Level 1 Level 2 0 $ 51,678 51,678 $ 0 $ 0 0 $ Carrying Value Financial Assets Commercial mortgage loans on real estate Policy loans TOTAL FINANCIAL ASSETS Financial Liabilities Policy reserves under investment products (Individual and group annuities, subject to discretionary withdrawal)(1) Funds... -

Page 117

... is as follows: Insurance premiums receivable Other receivables Allowance for uncollectible amounts TOTAL $ $ 7. Income Taxes The Company and the majority of its subsidiaries are subject to U.S. tax and ï¬le a U.S. consolidated federal income tax return. Information about domestic and foreign... -

Page 118

...of businesses Compensation related Employee and post-retirement beneï¬ts Other Total deferred tax asset Less valuation allowance Deferred tax assets, net of valuation allowance Deferred Tax Liabilities Deferred acquisition costs Net unrealized appreciation on securities Total deferred tax liability... -

Page 119

... depreciation TOTAL $ $ Depreciation expense for 2013, 2012 and 2011 amounted to $50,652, $49,595 and $55,193, respectively. Depreciation expense is included in underwriting, general and administrative expenses in the consolidated statements of operations. ASSURANT, INC. - 2013 Form 10-K F-33 -

Page 120

...net book value exceeds the estimated fair value, then Step 1 is failed, and Step 2 is performed to determine the amount of the potential impairment. Step 2 utilizes acquisition accounting guidance and requires the fair value calculation of all individual assets and liabilities of the reporting unit... -

Page 121

... Company performed a Step 1 test for the Specialty Property reporting unit in 2012 and for the Assurant Solutions reporting unit in 2013, 2012 and 2011. Based on these tests, it was determined that goodwill was not impaired at either reporting unit. 11. VOBA and Other Intangible Assets Information... -

Page 122

... policies and investment-type annuity contracts Life insurance no longer offered Universal life and other products no longer offered FFG, LTC and other disposed businesses Medical All other Short Duration Contracts: Group term life Group disability Medical Dental Property and warranty Credit life... -

Page 123

... Short duration and long duration medical methodologies used for settling claims and benefits payable are similar. (3) The Company's net retained credit life and disability claims and benefits payable were $54,483, $64,031 and $69,264 at December 31, 2013, 2012 and 2011. ASSURANT, INC. - 2013 Form... -

Page 124

12 Reserves Short Duration Contracts The Company's short duration contracts are comprised of group term life, group disability, medical, dental, property and warranty, credit life and disability, extended service contract and all other. The principal products and services included in these ... -

Page 125

..., universal life funds are subject to surrender charges that vary by product, age, sex, year of issue, risk class, face amount and grade to zero over a period not longer than 20 years. PreNeed Business-AMLIC Division Interest and discount rates for preneed life insurance issued or acquired after... -

Page 126

... material credit exposure are reviewed at the time of execution. The A.M. Best ratings for existing reinsurance agreements are reviewed on a periodic basis, at least annually. The following table provides the reinsurance recoverable as of December 31, 2013 grouped by A.M. Best rating: Best Ratings... -

Page 127

... of December 31, 2013 and 2012, respectively, for the beneï¬t of others related to certain reinsurance arrangements. The Company utilizes ceded reinsurance for loss protection and capital management, business dispositions, and in the Assurant Solutions and Assurant Specialty Property segments, for... -

Page 128

...on the underlying business. A substantial portion of Assurant Solutions and Assurant Specialty Property's reinsurance activities are related to agreements to reinsure premiums and risks related to business generated by certain clients to the clients' own captive insurance companies or to reinsurance... -

Page 129

..., provided the Company is in compliance with all covenants. The 2011 Credit Facility has a sublimit for letters of credit issued thereunder of $50,000. The proceeds of these loans may be used for the Company's commercial paper program or for general corporate purposes. The Company may increase the... -

Page 130

... also applied the "long form" method to calculate its beginning pool of windfall tax beneï¬ts related to employee stock-based compensation awards as of the adoption date of the guidance. For the years ended December 31, 2013, 2012 and 2011, the Company recognized compensation costs net of a 5% per... -

Page 131

... of the Company's stock and peer insurance group. The expected term for grants issued during the years ended December 31, 2013, 2012 and 2011 was assumed to equal the average of the vesting period of the PSUs. The risk-free rate was based on the U.S. Treasury yield curve in effect at the time of... -

Page 132

.... In July 2012, the Company issued 110,699 shares to employees at a discounted price of $31.36 for the offering period of January 1, 2012 through June 30, 2012. The compensation expense recorded related to the ESPP was $1,098, $1,396 and $1,306 for the years ended December 31, 2013, 2012 and 2011... -

Page 133

..., 2012 Other comprehensive (loss) income before reclassiï¬cations Amounts reclassiï¬ed from accumulated other comprehensive income Net current-period other comprehensive (loss) income Balance at December 31, 2013 $ $ OTTI 23,861 (2,237) 4,803 2,566 26,427 $ $ $ ASSURANT, INC. - 2013 Form 10... -

Page 134

... before tax Provision for income taxes Net of tax NET OF TAX (1) These accumulated other comprehensive income components are included in the computation of net periodic pension cost. See Note 20 - Retirement and Other Employee Benefits for additional information F-48 ASSURANT, INC. - 2013 Form 10... -

Page 135

...premiums when collected under SAP, but are initially recorded as contract deposits under GAAP, with cost of insurance recognized as revenue when assessed and other contract charges recognized over the periods for which services are provided; 4) the classiï¬cation and carrying amounts of investments... -

Page 136

... be appropriate from time to time up to the maximum permitted. The funding policy considers several factors to determine such additional amounts including items such as the amount of service cost plus 15% of the Assurant Pension Plan deï¬cit and the capital position of the Company. During 2013, we... -

Page 137

...ts 2013 2012 (147,288) $ (282,491) $ (4,119) (151,407) $ (4,975) (287,466) $ 2011 (286,535) (5,756) (292,291) Retirement Health Beneï¬ts 2013 2012 11,710 $ 261 $ 6,102 17,812 $ 7,035 7,296 $ 2011 3,741 7,968 11,709 Net gain (loss) Prior service (cost) credit $ $ $ $ ASSURANT, INC. - 2013 Form... -

Page 138

...ï¬ts 2013 2012 2011 3.71% 4.40% 5.11% 0% 0% 0% Retirement Health Beneï¬ts 2013 2012 2011 4.12% 4.64% 5.55% 6.75% 6.75% 7.50% Discount rate Expected long-term return on plan assets * Assumed rates of compensation increases are also used to determine net periodic benefit cost. Assumed rates varied... -

Page 139

... market conditions and the modiï¬ed portfolio structure. Actual return on plan assets was 9.0% and 13.6% for the years ended December 31, 2013 and 2012, respectively. The assumed health care cost trend rates used in measuring the accumulated postretirement beneï¬t obligation and net periodic... -

Page 140

...The Plans' long-term asset allocation targets are 30% equity, 50% fixed income and 20% investment funds. Current target asset allocations for equity securities include allocations for investment funds. The Company invests certain plan assets in investment funds, examples of which include real estate... -

Page 141

... the Company's qualiï¬ed pension plan and other post retirement beneï¬t plan assets at December 31, 2012 by asset category, is as follows: Qualiï¬ed Pension Beneï¬ts Financial Assets Cash and cash equivalents: Short-term investment funds $ Equity securities: Common stock- U.S. listed small cap... -

Page 142

... the change in fair value associated with the MIMSF and Private Equity Partners XI Limited Partnership, the only Level 3 ï¬nancial assets. Retirement Pension Beneï¬t Health Beneï¬t $ 54,398 $ 3,522 1,578 95 5,526 55 $ 61,502 $ 3,672 Beginning balance at December 31, 2012 Purchases Actual return... -

Page 143

...Health, Assurant Employee Beneï¬ts, and Corporate & Other. Assurant Solutions provides mobile device protection, debt protection administration, credit-related insurance, warranties and service contracts and pre-funded funeral insurance. Assurant Specialty Property provides lender-placed homeowners... -

Page 144

...956 Segment Assets: Segment assets, excluding goodwill $ 11,333,833 $ 3,387,027 $ 1,067,423 $ 2,477,192 $ 8,115,290 $ 26,380,765 Goodwill 639,097 TOTAL ASSETS $ 27,019,862 Year Ended December 31, 2011 Specialty Employee Corporate Property Health Beneï¬ts & Other F-58 ASSURANT, INC. - 2013 Form 10... -

Page 145

...: 2013 Solutions: Credit Service contracts Preneed Other TOTAL Specialty Property: Homeowners (lender-placed and voluntary) Manufactured housing (lender-placed and voluntary) Other TOTAL Health: Individual Small employer group TOTAL Employee Beneï¬ts: Group dental Group disability Group life Group... -

Page 146

..., the weighted average common shares used in calculating basic earnings per common share and those used in calculating diluted earnings per common share for each period presented below. Years Ended December 31, 2012 2013 Numerator Net income Deduct dividends paid Undistributed earnings Denominator... -

Page 147

... in the Assurant Specialty Property segment, American Security Insurance Company ("ASIC") and American Bankers Insurance Company of Florida ("ABIC"), reached an agreement with the New York Department of Financial Services (the "NYDFS") regarding the Company's lender-placed insurance business in the... -

Page 148

...: Common stocks Non-redeemable preferred stocks TOTAL EQUITY SECURITIES Commercial mortgage loans on real estate, at amortized cost Policy loans Short-term investments Collateral held/pledged under securities agreements Other investments TOTAL INVESTMENTS $ F-62 ASSURANT, INC. - 2013 Form 10-K -

Page 149

...,399 in 2012) Equity securities available for sale, at fair value (amortized cost-$12,157 in 2013 and $15,701 in 2012) Short-term investments Other investments Total investments Cash and cash equivalents Receivable from subsidiaries, net Income tax receivable Accrued investment income Property and... -

Page 150

... undistributed net income of subsidiaries TOTAL REVENUES Expenses General and administrative expenses Interest expense TOTAL EXPENSES Income before beneï¬t for income taxes Beneï¬t for income taxes NET INCOME $ $ 176,872 60,357 237,229 425,831 113,125 $ 538,956 F-64 ASSURANT, INC. - 2013 Form... -

Page 151

...stock Change in tax beneï¬t from share-based payment arrangements Acquisition of common stock Dividends paid Change in obligations to return borrowed securities Change in receivables under securities loan agreements NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES Effect of exchange rate changes... -

Page 152

... Insurance Information ASSURANT, INC. FOR THE YEARS ENDED DECEMBER 31, 2013, 2012 & 2011 Future policy beneï¬ts and expenses Beneï¬ts claims, losses and settlement expenses 895,504 890,409 715,656 1,169,075 4,888 Deferred Acquisition (in thousands) Cost Segment Unearned premiums Claims... -

Page 153

...Property and liability insurance TOTAL EARNED PREMIUMS Beneï¬ts: Life insurance Accident and health insurance Property and liability insurance TOTAL POLICYHOLDER BENEFITS $ $ $ ASSURANT, INC. FOR THE YEAR ENDED DECEMBER 31, 2011 Ceded to other Assumed from Direct amount Companies other Companies... -

Page 154

... TOTAL 2011: Valuation allowance tax carryforward Valuation allowance Valuation allowance on real estate Valuation allowance balances Valuation allowance Valuation allowance recoverables TOTAL for foreign NOL deferred $ for deferred tax assets for mortgage loans for uncollectible agents for... -

Page 155

...Avenue New York, NY 10017 Telephone: 646.471.3000 www.pwc.com FORM 10-K AND OTHER REPORTS Copies of the 2013 Annual Report on Form 10-K and other reports ï¬led with the U.S. Securities and Exchange Commission (SEC) also are available, without charge, from the Assurant Investor Relations website at... -

Page 156

Assurant, Inc. One Chase Manhattan Plaza 41st Floor New York, NY 10005 Telephone: 212.859.7000 www.assurant.com