Assurant 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1ASSURANT - 2012 Annual Report

Robert B. Pollock

President and Chief Executive Offi cer, Assurant

A Message to O ur Shareholders

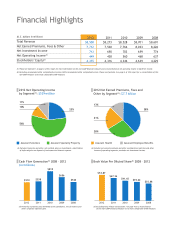

Assurant’s net earned premiums, fees and other income were

$7.7 billion in 2012, a two percent increase from the previous

year. Net operating income(1) increased to $449.3 million

despite signifi cant catastrophe losses. Operating return on

equity, excluding Accumulated Other Comprehensive Income

(AOCI)(2) was 10.4 percent. Our book value per diluted

share, excluding AOCI(3), was up 13.8 percent year-over-year

refl ecting strong earnings and continued share repurchases.

Our strong capital position, risk management expertise and

ability to generate free cash fl ow added to our solid fi nancial

foundation. We returned $472 million to shareholders

through stock repurchases and common dividends. In fact,

we have increased our dividend for nine consecutive years —

every year since our initial public offering in 2004.

Overall, we made great progress in 2012. Looking ahead, we

see many opportunities to grow profi tability. In doing so, we

will search for ways to compete differently – a cornerstone

of our specialty strategy.

Consumer markets are changing quickly. Our profi table

growth strategy outlines both opportunities we will consider

as well as the ways we will approach new, attractive

markets. Five trends are driving our actions and investments

for the future:

• Dramatic expansion of mobile devices in everything the

consumer does

• Shifts in consumer behavior toward rental versus ownership

of housing in the United States

• Expectations of affordable access to health care insurance

that can be customized to meet consumers’ needs

• Small businesses offering more voluntary benefi ts so that

their employees can choose coverage best suited for their

circumstances

• Growth beyond the U.S. in an emerging consumer middle-

class, especially in Latin America.

We will build on our momentum of 2012 and strive to achieve

steady improvements in all of our Assurant businesses in the

year to come.

ADAPTING TO AN EVOLVING LANDSCAPE

During 2012, regulators and policymakers continued to

evolve rules affecting the insurance and fi nancial services

sectors. At both the state and federal levels, we expanded

our outreach and engagement to help shape better outcomes

for our customers and clients, as well as our company and

shareholders.

Many aspects of the Patient Protection and Affordable Care

Act are still being defi ned, even as the industry responds to

shifting consumer needs and prepares for health insurance

exchanges in January 2014. Several reforms have been

enacted to improve the housing and mortgage markets

in the U.S. We have taken the opportunity to refi ne and

improve our processes and to offer new, more fl exible

products for the future. Economic pressures, especially in

Europe, mandate operational rigor and restraint as markets

fi nd their footing and stabilize. All of these factors and

more reinforce the importance of innovation and agility as

we further reduce operating costs, realign resources and

leverage shared effi ciencies across the Assurant enterprise.

2012 RESULTS FROM OPERATIONS

Assurant Solutions

Achieving a 14 percent operating return on equity by 2014

is the focus at Assurant Solutions, where we took many

steps in 2012 towards achievement of that goal. For the

year, net operating income was down signifi cantly due to

the impairment of certain intangible assets and charges

for workforce restructuring to address challenges primarily

affecting our domestic credit and European operations.

Net earned premiums, fees and other income improved

year-over-year in several areas targeted for growth. Our

pre-funded funeral insurance business remains an important

contributor to Assurant Solutions’ overall results with

sizable increases both in fee income and sales. In 2012,

service contract premiums in the U.S. improved as we

benefi ted from the continuing rebound in the automotive

sector. International credit and service contract premiums

also increased during the year, predominantly in Latin

America. We now service mobile customers in 16 countries,

a refl ection of our expanded capabilities, global footprint

and phased rollout of our partnership with Telefónica.

By focusing on expense management and profi table growth,

both in the U.S. and internationally, we expect modest

earnings improvements in the year ahead and achievement

of our longer-term ROE target in 2014.

In 2012, our Assurant team accelerated action in key specialty areas

critical to long-term, pro table growth. We did so while prudently

managing our capital for shareholders and serving our customers

withcompassion and responsiveness.

›