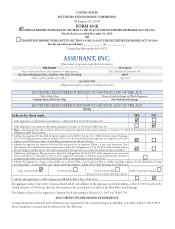

Assurant 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ASSURANT, INC.2012 Form10-K 11

PARTI

ITEM 1 Business

U.S. Insurance Regulation

We are subject to the insurance holding company laws in the states

where our insurance companies are domiciled. ese laws generally

require insurance companies within the insurance holding company

system to register with the insurance departments of their respective

states of domicile and to furnish reports to such insurance departments

regarding capital structure, ownership, nancial condition, general

business operations and intercompany transactions. ese laws also

require that transactions between a liated companies be fair and

equitable. In addition, certain intercompany transactions, changes of

control, certain dividend payments and transfers of assets between the

companies within the holding company system are subject to prior

notice to, or approval by, state regulatory authorities.

Like all U.S. insurance companies, our insurance subsidiaries are subject

to regulation and supervision in the jurisdictions in which they do

business. In general, this regulation is designed to protect the interests

of policyholders, and not necessarily the interests of shareholders and

other investors. To that end, the laws of the various states and other

jurisdictions establish insurance departments with broad powers with

respect to such things as:

•licensing and authorizing companies and intermediaries (including

agents and brokers) to transact business;

•regulating capital, surplus and dividend requirements;

•regulating underwriting limitations;

•

regulating companies’ ability to enter and exit markets or to provide,

terminate or cancel certain coverages;

•

imposing statutory accounting and annual statement disclosure

requirements;

•

regulating product types and approving policy forms and mandating

certain insurance bene ts;

•

regulating premium rates, including the ability to disapprove or

reduce the premium rates companies may charge;

•

regulating claims practices, including the ability to require companies

to pay claims on terms other than those mandated by underlying

policy contracts;

•regulating certain transactions between a liates;

•regulating the form and content of disclosures to consumers;

•regulating the type, amounts and valuation of investments;

•mandating annual tests to analyze adequacy of reserves;

•

mandating assessments or other surcharges for guaranty funds and

the ability to recover such assessments in the future through premium

increases; and

•

regulating market conduct and sales practices of insurers and agents.

Dividend Payment Limitations

Our holding company’s assets consist primarily of the capital stock

of our subsidiaries. Accordingly, our holding company’s future cash

ows depend upon the availability of dividends and other statutorily

permissible payments from our subsidiaries. e ability to pay such

dividends and to make such other payments is regulated by the states

in which our subsidiaries are domiciled. ese dividend regulations

vary from state to state and by type of insurance provided by the

applicable subsidiary, but generally require our insurance subsidiaries

to maintain minimum solvency requirements and limit the amount

of dividends these subsidiaries can pay to the holding company. For

more information, please see Item7, “Management’s Discussion and

Analysis of Financial Condition and Results of Operations—Liquidity

and Capital Resources—Regulatory Requirements.”

Risk Based Capital Requirements

In order to enhance the regulation of insurer solvency, the National

Association of Insurance Commissioners (“NAIC”) has established certain

risk-based capital standards applicable to life, health and property and

casualty insurers. Risk-based capital, which regulators use to assess the

su ciency of an insurer’s statutory capital, is calculated by applying

factors to various asset, premium, expense, liability and reserve items.

Factors are higher for items which in the NAIC’s view have greater

underlying risk. e NAIC periodically reviews the risk-based capital

formula and changes to the formula could occur in the future.

Investment Regulation

Insurance company investments must comply with applicable laws

and regulations that prescribe the kind, quality and concentration

of investments. ese regulations require diversi cation of insurance

company investment portfolios and limit the amount of investments

in certain asset categories.

Financial Reporting

Regulators closely monitor the nancial condition of licensed insurance

companies and our insurance subsidiaries are required to le periodic

nancial reports with insurance regulators. Moreover, states regulate

the form and content of these statutory nancial statements.

Products and Coverage

Insurance regulators have broad authority to regulate many aspects

of our products and services. For example, some jurisdictions require

insurers to provide coverage to persons who would not be considered

eligible insurance risks under standard underwriting criteria, dictating

the types of insurance and the level of coverage that must be provided

to such applicants. Additionally, certain non-insurance products and

services, such as service contracts, may be regulated by regulatory bodies

other than departments of insurance.

Pricing and Premium Rates

Nearly all states have insurance laws requiring insurers to le price

schedules and policy forms with the state’s regulatory authority. In many

cases, these price schedules and/or policy forms must be approved prior

to use, and state insurance departments have the power to disapprove

increases or require decreases in the premium rates we charge.