Assurant 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT, INC.2012 Form10-K 7

PARTI

ITEM 1 Business

Assurant Health

For the Years Ended

December31, 2012

December31, 2011

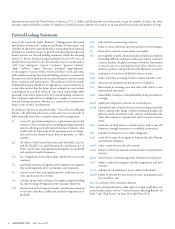

Net earned premiums and other considerations:

Individual markets $ 1,178,878 $ 1,251,447

Small employer group 410,581 466,853

TOTAL $ 1,589,459 $ 1,718,300

Segment net income $ 52,000 $ 40,886

Loss ratio(1) 73.9% 74.0%

Expense ratio(2) 26.0% 26.3%

Combined ratio(3) 98.5% 98.8%

Equity(4) $ 304,166 $ 405,200

(1) The loss ratio is equal to policyholder benefits divided by net earned premiums and other considerations.

(2) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income

are not included in the above table.)

(3) The combined ratio is equal to total benefits, losses and expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income are not

included in the above table.)

(4) Equity excludes accumulated other comprehensive income.

Products and Services

Assurant Health competes in the individual medical insurance market

by o ering major medical insurance, short-term medical insurance, and

limited bene t coverages to individuals and families. Our products are

o ered with di erent plan options to meet a broad range of customer

needs and levels of a ordability. Assurant Health also o ers medical

insurance to small employer groups.

e Patient Protection and A ordable Care Act and the Health Care

and Education Reconciliation Act of 2010, and the rules and regulations

thereunder (together, “the A ordable Care Act”) were signed into law

in March2010 and represent signi cant changes to the U.S. health

care system. e legislation is far-reaching and is intended to expand

access to health insurance coverage over time. e legislation includes

requirements that most individuals obtain health insurance coverage

beginning in 2014 and that most large employers o er coverage to their

employees or they will be required to pay a nancial penalty. In addition,

the new laws encompass certain new taxes and fees, including limitations

on the amount of executive compensation that is tax deductible and

new fees which may not be deductible for income tax purposes. We

believe that the Act will lead to sweeping and fundamental changes to

the U.S. health care system and the health insurance industry.

e legislation will also impose new requirements and restrictions,

including, but not limited to, guaranteed coverage requirements,

prohibitions on some annual and all lifetime limits on amounts paid

on behalf of or to our members, increased restrictions on rescinding

coverage, the establishment of minimum medical loss ratio (“MLR”)

requirements, the establishment of state insurance exchanges and

essential bene t packages, and greater limitations on product pricing.

One provision of the A ordable Care Act, e ective January1, 2011,

established a MLR designed to ensure that a minimum percentage of

premiums is paid for clinical services or health care quality improvement

activities. e A ordable Care Act established a MLR of 80% for

individual and small group business and 85% for large group business.

If the actual loss ratios, calculated in a manner prescribed by the

Department of Health and Human Services (“HHS”), are less than

the required MLR, premium rebates are payable to the policyholders

by August1 of the subsequent year. Although the HHS has issued

nal regulations to implement the MLR and rebate provisions of the

A ordable Care Act, certain issues remain to be fully clari ed, including

further clari cation on the state insurance exchanges, the risk mitigation

programs, essential bene t package requirements, the actuarial value

calculations, and the new fees to be enacted.

Although the dynamics and characteristics of the post-reform market

will be di erent, we believe there are still signi cant opportunities

for Assurant Health to sell individual medical insurance products.

Specialty expertise will still be required and we believe that we can earn

adequate pro ts in this business over the long-term, without making

large commitments of capital. In order to achieve these goals, we have

taken signi cant steps to reduce operating and distribution costs and

modify our product lines. We have reduced operating costs signi cantly

and redesigned our product portfolio to o er certain supplemental and

a ordable choice products, and we continue to build on these e orts.

We may re ne our strategy as new regulations are issued or additional

regulatory agency actions are taken in the wake of the A ordable Care

Act. e full impact of the Act will not be known for many years.

Individual Medical

Our medical insurance products are sold to individuals, primarily

between the ages of 18 and 64, and their families, who do not have

employer-sponsored coverage. We o er a wide variety of bene t plans

at di erent price points, which allow customers to tailor their coverage

to t their unique needs.

Small Employer Group Medical

Our group medical insurance is primarily sold to small companies with

two to fty employees, although larger employer coverage is available.

As of December31, 2012, our average group size was approximately

ve employees.

E ective in March2012 we entered into a new provider network

arrangement with Aetna Signature Administrators ®. is multi-year

agreement provides our major medical customers with access to more