Assurant 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 ANNUAL REPORT

AND FORM 10-K

Table of contents

-

Page 1

2012 ANNUAL REPORT AND FORM 10-K -

Page 2

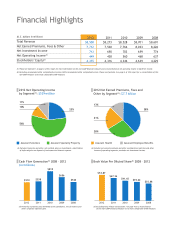

... million 11% 2012 Net Earned Premiums, Fees and Other by Segment(4): $7.7 billion 13% 10% 23% 21% 56% 28% 38% Assurant Solutions Assurant Specialty Property Assurant Health Assurant Employee Benefits (3) Excludes Corporate and other, net realized gains on investments, amortization of deferred... -

Page 3

... health care insurance that can be customized to meet consumers' needs • Small businesses offering more voluntary beneï¬ts so that their employees can choose coverage best suited for their circumstances • Growth beyond the U.S. in an emerging consumer middleclass, especially in Latin America... -

Page 4

... $13.8 million of additional investment income from a real estate joint venture partnership. Our affordable choice and supplemental products helped Assurant Health serve a broader spectrum of individual and small group customers. In 2012, we increased the total number of insured lives by six percent... -

Page 5

..., Marketing and Business Development, Assurant Gene E. Mergelmeyer President and Chief Executive Ofï¬cer, Assurant Specialty Property John S. Roberts President and Chief Executive Ofï¬cer, Assurant Employee Beneï¬ts Adam D. Lamnin President and Chief Executive Ofï¬cer, Assurant Health... -

Page 6

... of other companies. (dollars in millions, net of tax) Assurant Solutions Assurant Specialty Property Assurant Health Assurant Employee Beneï¬ts Corporate and other Amortization of deferred gain on disposal of businesses Interest expense Net operating income Adjustments: Net realized gains (losses... -

Page 7

FORM 10-K › -

Page 8

... ...61 PART III ITEM 10 ITEM 11 ITEM 12 ITEM 13 ITEM 14 62 Directors, Executive Officers and Corporate Governance...62 Executive Compensation...62 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters...62 Certain Relationships and Related Transactions, and... -

Page 9

... 12b-2 of the Act). The aggregate market value of the Common Stock held by non-affiliates of the registrant was $2,844 million at June 30, 2012 based on the closing sale price of $34.84 per share for the common stock on such date as traded on the New York Stock Exchange. The number of shares of the... -

Page 10

... premium rates we charge, increases in the claims we pay, fines or penalties, or other expenses; the effects of the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010, and the rules and regulations thereunder, on our health and employee benefits... -

Page 11

...-Assurant Solutions, Assurant Specialty Property, Assurant Health, and Assurant Employee Benefits-partner with clients who are leaders in their industries and build leadership positions in a number of specialty insurance market segments. These segments provide debt protection administration; credit... -

Page 12

... Life Insurance Preneed life insurance allows individuals to prepay for a funeral in a single payment or in multiple payments over a fixed number of years. The insurance policy proceeds are used to address funeral costs at death. These products are only sold in the U.S. and Canada and are generally... -

Page 13

... with those of our clients. Assurant Specialty Property For the Years Ended December 31, 2012 December 31, 2011 Net earned premiums and other considerations by major product grouping: Homeowners (lender-placed and voluntary) Manufactured housing (lender-placed and voluntary) Other(1) TOTAL Segment... -

Page 14

...A number of manufactured housing retailers in the U.S. use our proprietary premium rating technology to assist them in selling property coverage at the point of sale. Lender-placed and voluntary homeowners insurance The largest product line within Assurant Specialty Property is homeowners insurance... -

Page 15

...-term medical insurance, and limited benefit coverages to individuals and families. Our products are offered with different plan options to meet a broad range of customer needs and levels of affordability. Assurant Health also offers medical insurance to small employer groups. The Patient Protection... -

Page 16

.... The Affordable Care Act places several constraints on underwriting and mandates minimum levels of benefits for most medical coverage. It also imposes minimum loss ratio standards on many of our policies. Assurant Health has taken steps to adjust its products, pricing and business practices to... -

Page 17

... by regional sales support centers and a home office customer service department. Broker compensation in some cases includes an annual performance incentive, based on volume and retention of business. DRMS provides turnkey group disability and life insurance solutions to insurance carriers that want... -

Page 18

... 1 Business Outlook Time Insurance Company UDC Dental California Union Security Dental Care New Jersey Union Security Insurance Company Union Security Life Insurance Company of New York United Dental Care of Arizona United Dental Care of Colorado United Dental Care of Michigan United Dental Care of... -

Page 19

... enter and exit markets or to provide, terminate or cancel certain coverages; • imposing statutory accounting and annual statement disclosure requirements; • regulating product types and approving policy forms and mandating certain insurance benefits; • regulating premium rates, including the... -

Page 20

... Patient Protection and Affordable Care Act Although health insurance is generally regulated at the state level, recent legislative actions were taken at the federal level that impose added restrictions on our business, in particular Assurant Health and Assurant Employee Benefits. In March 2010... -

Page 21

... threatened releases of hazardous substances at properties securing mortgage loans held by us. Other Information Customer Concentration No one customer or group of affiliated customers accounts for 10% or more of the Company's consolidated revenues. Financial Information about Reportable Business... -

Page 22

... agents and brokers operate. The minimum loss ratios imposed by the Affordable Care Act compelled health insurers to decrease broker commission levels beginning in 2011. Similarly, the Company decreased its commission levels for distribution channels that market Assurant Health's individual medical... -

Page 23

... the costs of medical and dental care, as well as repair and replacement costs on our real and personal property lines, increasing the costs of paying claims. Inflationary pressures may also affect the costs associated with our preneed insurance policies, particularly those that are guaranteed to... -

Page 24

... Assurant Specialty Property's lender-placed homeowners and lender-placed manufactured housing insurance products are designed to automatically provide property coverage for client portfolios, our concentration in certain catastrophe-prone states like Florida, California and Texas may increase... -

Page 25

... and Qualitative Disclosures About Market Risk-Inflation Risk" for additional information. Assurant Employee Benefits calculates reserves for long-term disability and life waiver of premium claims using net present value calculations based on interest rates at the time reserves are established and... -

Page 26

...premiums for the duration of the disability or for a stated period, during which time the life insurance coverage continues. If interest rates decline, reserves for open and/or new claims in Assurant Employee Benefits would need to be calculated using lower discount rates, thereby increasing the net... -

Page 27

... of deferred tax assets, use of tax loss and tax credit carryforwards, levels of expected future taxable income and available tax planning strategies. The assumptions in making these judgments are updated periodically on the basis of current business conditions affecting the Company and overall... -

Page 28

... Financial Group ("FFG") division to The Hartford Financial Services Group, Inc. ("The Hartford") and in 2000 we sold our Long Term Care ("LTC") division to John Hancock Life Insurance Company ("John Hancock"), now a subsidiary of Manulife Financial Corporation. Most of the assets backing reserves... -

Page 29

... credit risk of some of the clients and/or agents with which we contract in Assurant Solutions and Assurant Specialty Property. For example, we advance agents' commissions as part of our preneed insurance product offerings. These advances are a percentage of the total face amount of coverage. There... -

Page 30

... Estimates-Health Insurance Premium Rebate Liability" for more information about the minimum medical loss ratio and the Company's rebate estimate calculations. In addition, the Affordable Care Act imposes limitations on the deductibility of compensation and certain other payments. Assurant Health... -

Page 31

...New York. Proposed changes to the program would affect annual lender-placed hazard and real estate owned policies issued in the State of New York, which accounted for approximately $79,000 and $64,000 of Assurant Specialty Property's net earned premiums for the years ended December 31, 2012 and 2011... -

Page 32

...on us or that changes the way we are able to do business may significantly harm our business or results of operations in the future. For example, some states have imposed new time limits for the payment of uncontested covered claims and require health care and dental service plans to pay interest on... -

Page 33

... integrity of the applicant's board of directors and executive officers, the applicant's plans for the future operations of the domestic insurer and any anti-competitive results that may arise from the consummation of the acquisition of control. ASSURANT, INC. - 2012 Form 10-K Applicable laws, our... -

Page 34

... Employee Benefits has a headquarters building in Kansas City, Missouri. Assurant Health has a headquarters building in Milwaukee, Wisconsin. We lease office space for various offices and service centers located throughout the U.S. and internationally, including our New York, New York corporate... -

Page 35

... 400 Midcap Index and the S&P 500 Index, as the broad equity market indexes, and the S&P 400 Multi-Line Insurance Index $150 and S&P 500 Multi-Line Insurance Index, as the published industry indexes. The graph assumes that the value of the investment in the common stock and each index was $100 on... -

Page 36

... ITEM 5 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Annual Return Percentage Years Ending Company / Index Assurant, Inc. S&P 500 Index S&P 400 MidCap Index S&P 500 Multi-line Insurance Index* S&P 400 Multi-line Insurance Index* * 12... -

Page 37

... costs and value of businesses acquired Underwriting, general and administrative expenses Interest expense Goodwill impairment(3) Total benefits, losses and expenses Income before provision for income taxes Provision for income taxes(4) NET INCOME As of and for the years ended December 31, 2011 2010... -

Page 38

... deferred tax assets on a capital loss carryover. (5) Policy liabilities include future policy benefits and expenses, unearned premiums and claims and benefits payable. (6) Total stockholders' equity divided by the basic shares of common stock outstanding. At December 31, 2012, 2011, 2010, 2009 and... -

Page 39

... Months 2011. Partially offsetting this item was improved net income in our Assurant Health and Assurant Employee Benefits segments and an increase of $20,652 (after-tax) in net realized gains on investments. Twelve Months 2012 includes $162,634 (after-tax) of Assurant Specialty Property reportable... -

Page 40

... 2013 net earned premiums and fees at Assurant Employee Benefits to be consistent with 2012. We anticipate increased sales from our voluntary products to offset expected lower sales of traditional employer-paid products. We plan to lower our discount rate for new long-term disability claims incurred... -

Page 41

...are periodically reviewed and updated, the calculation of reserves is not an exact process. Reserves do not represent precise calculations of expected future claims, but instead represent our best estimates at a point in time of the ultimate costs of settlement and administration of a claim or group... -

Page 42

... disabled life mortality and claim recovery rates, claim management practices, awards for social security and other benefit offsets and yield rates earned on assets supporting the reserves. Group long term disability and group term life waiver of premium reserves are discounted because the payment... -

Page 43

... months of the incurred date. Changes in medical loss development may increase or decrease the MLR rebate liability. Property and Warranty Our Property and Warranty lines of business include lender-placed homeowners, manufactured housing homeowners, multi-family housing, credit property, credit... -

Page 44

... premiums over the premium-paying period. These acquisition costs consist primarily of first year commissions paid to agents. For preneed investment-type annuities, preneed life insurance policies with discretionary death benefit growth issued after January 1, 2009, universal life insurance policies... -

Page 45

... to monthly pay credit insurance business consist mainly of direct response advertising costs and are deferred and amortized over the estimated average terms and balances of the underlying contracts. Acquisition costs relating to group term life, group disability, group dental and group vision... -

Page 46

... requirements. The calculation of reported expense and liability associated with these plans requires an extensive use of assumptions including factors such as discount rates, expected long-term returns on plan assets, employee retirement and termination rates and future compensation increases. We... -

Page 47

... 31, 2012 381,262 $ 259,452 - - 640,714 $ 2011 379,645 259,452 - - 639,097 Assurant Solutions Assurant Specialty Property Assurant Health Assurant Employee Benefits TOTAL $ $ For each reporting unit, we first compare its estimated fair value with its net book value. If the estimated fair value... -

Page 48

... interest rate declines further increase the net unrealized investment portfolio gain position, we could determine that we need to record an impairment charge related to goodwill in Assurant Solutions and Assurant Specialty Property. definition of the types of costs incurred by insurance entities... -

Page 49

... Months 2011. Partially offsetting this item was improved net income in our Assurant Health and Assurant Employee Benefits segments and an increase of $20,652 (after-tax) in net realized gains on investments. Twelve Months 2012 includes $162,634 (after-tax) of Assurant Specialty Property reportable... -

Page 50

... benefits, losses and expenses divided by net earned premiums and other considerations and fees and other income excluding the preneed business. (4) 2012 & 2010 selling, underwriting and general expenses include $26,458 and $47,612, respectively, of intangible asset impairment charges. 42 ASSURANT... -

Page 51

... existing clients including $17,123 related to a new block of business assumed during Twelve Months 2012. International service contract and credit businesses net earned premiums increased primarily in our Latin America and European regions from both new and existing clients. Fees and other income... -

Page 52

... in Latin America, and the favorable impact of foreign exchange rates. Partially offsetting these increases was a $23,261 decrease in our domestic credit insurance business, due to the continued run-off of this product line. Preneed face sales increased $24,808, to $759,692 for Twelve Months 2011... -

Page 53

... New York. Proposed changes to the program would affect annual lender-placed hazard and real estate owned policies issued in the State of New York, which accounted for approximately $79,000 and $64,000 of Assurant Specialty Property's net earned premiums for Twelve Months 2012 and Twelve Months 2011... -

Page 54

... within net earned premiums and other considerations. (5) As of January 1, 2011, insured lives consist of all policies, including supplemental coverages and self-funded group products, purchased by policyholders. Prior periods consisted only of medical policies. 46 ASSURANT, INC. - 2012 Form 10... -

Page 55

...to lower sales and a continued high level of policy lapses, partially offset by premium rate increases. Twelve Months 2011 included a premium rebate accrual of $41,589 associated with the MLR requirement included in the Affordable Care Act for our comprehensive health coverage business. There was no... -

Page 56

...to less favorable disability and life insurance loss experience, partially offset by improved dental insurance experience. Twelve Months 2011 results include a decrease in the reserve interest discount rate primarily for new long-term disability claims as well as 48 ASSURANT, INC. - 2012 Form 10-K -

Page 57

...for Twelve Months 2011. The increase is primarily due to increased employee related benefits and new business investments for areas targeted for growth partially offset by decreased policyholder benefits incurred of $7,535 associated with discontinued businesses. ASSURANT, INC. - 2012 Form 10-K 49 -

Page 58

...step impairment test, described above. For all reporting units in 2012 and 2010 and for the Assurant Solutions reporting unit in 2011, the Company performed its goodwill impairment test using the two step process. During 2011, for the Assurant Specialty Property reporting unit, the Company chose the... -

Page 59

... (25,580) 703,190 Fixed maturity securities Equity securities Commercial mortgage loans on real estate Policy loans Short-term investments Other investments Cash and cash equivalents Total investment income Investment expenses NET INVESTMENT INCOME $ $ Net investment income increased $23,596, or... -

Page 60

...If the Company cannot corroborate the non-binding broker quotes with Level 2 inputs, these securities are categorized as Level 3. A non-pricing service source prices certain privately placed corporate bonds using a model with observable inputs including, but not limited to, the credit rating, credit... -

Page 61

... rated life and health subsidiaries due to concerns about the impact of the Affordable Care Act. On December 11, 2012, Standard and Poor's ("S&P") revised the outlook on the financial strength ratings of American Bankers Life Assurance Company of Florida and American Memorial Life Insurance Company... -

Page 62

... 31, 2012 and 2011, respectively. The change in under-funded status is mainly due to favorable investment returns as well as contributions made to the plan, partially offset by a decrease in the discount rate used to determine the projected benefit obligation. The Company's funding policy is to... -

Page 63

... the Years Ended December 31, 2012 Net cash provided by (used in): Operating activities(1) Investing activities Financing activities NET CHANGE IN CASH (1) Includes effect of exchange rates changes on cash and cash equivalents. 2011 849,633 $ (196,588) (636,848) 16,197 $ 2010 540,313 (8,876) (699... -

Page 64

... due to increased catastrophe loss payments, changes in the timing of payments, including commissions and the Company's defined contribution match, partially offset by increased net written premiums in our Assurant Solutions and Assurant Specialty Property segments. Net cash provided by operating... -

Page 65

... of our insurance and reinsurance liabilities. Our group long-term disability and group term life waiver of premium reserves are also sensitive to interest rates. These reserves are discounted to the valuation date at the valuation interest rate. The valuation interest rate is determined... -

Page 66

... results of this analysis on our reported portfolio yield as of the dates indicated: INTEREST RATE MOVEMENT ANALYSIS OF PORTFOLIO YIELD OF FIXED MATURITY SECURITIES INVESTMENT PORTFOLIO As of December 31, 2012 -100 -50 5.20% 5.28% (0.16)% (0.08)% As of December 31, 2011 -100 -50 5.52% 5.58% (0.11... -

Page 67

...of Assurant preneed insurance policies, with reserves of $303,652 and $300,548 as of December 31, 2012 and 2011, respectively, have death benefits that are guaranteed to grow with the CPI. In times of rapidly rising inflation, the credited death benefit growth on these liabilities increases relative... -

Page 68

...and forward contracts. Under insurance statutes, our insurance companies may use derivative financial instruments to hedge actual or anticipated changes in their assets or liabilities, to replicate cash market instruments or for certain income-generating activities. These statutes generally prohibit... -

Page 69

...the Exchange Act. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted... -

Page 70

... The information in the 2013 Proxy Statement under the captions "Securities Authorized for Issuance Under Equity Compensation Plans," "Security Ownership of Certain Beneficial Owners" and "Security Ownership of Management" is incorporated herein by reference. 62 ASSURANT, INC. - 2012 Form 10... -

Page 71

... "Corporate Governance" is incorporated herein by reference. ITEM 14 Principal Accounting Fees and Services The information in the 2013 Proxy Statement under the caption "Fees of Principal Accountants" in "Audit Committee Matters" is incorporated herein by reference. ASSURANT, INC. - 2012 Form 10... -

Page 72

... section of our website, located at www.assurant.com. Pursuant to the rules and regulations of the SEC, the Company has filed or incorporated by reference certain agreements as exhibits to this Annual Report on Form 10-K. These agreements may contain representations and warranties by the parties... -

Page 73

... the Assurant, Inc. Long Term Equity Incentive Plan (incorporated by reference from Exhibit 10.20 to the Registrant's Form 10-K, originally filed on February 23, 2012).* Form of Restricted Stock Agreement for Executive Officers under the Assurant, Inc. Long Term Equity Incentive Plan (incorporated... -

Page 74

... 27, 2009).* Form of Amendment to Assurant, Inc. Change of Control Employment Agreement, effective as of February 1, 2010 (incorporated by reference from Exhibit 10.1 to the Registrant's Form 8-K, originally filed on February 1, 2010).* American Security Insurance Company Investment Plan Document... -

Page 75

... duly authorized on February 20, 2013. ASSURANT, INC. By: /s/ROBERT B. POLLOCK Name: Robert B. Pollock Title: President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons on behalf... -

Page 76

This page intentionally left blank 68 ASSURANT, INC. - 2012 Form 10-K -

Page 77

...insurance contracts on January 1, 2012. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted... -

Page 78

... value (cost-$422,703 in 2012 and $357,411 in 2011) Commercial mortgage loans on real estate, at amortized cost Policy loans Short-term investments Collateral held/pledged under securities agreements Other investments TOTAL INVESTMENTS Cash and cash equivalents Premiums and accounts receivable, net... -

Page 79

... costs and value of business acquired Underwriting, general and administrative expenses Interest expense Goodwill impairment TOTAL BENEFITS, LOSSES AND EXPENSES Income before provision for income taxes Provision for income taxes NET INCOME Earnings Per Share Basic Diluted Dividends per share Share... -

Page 80

... periodic benefit cost and change in funded status, net of taxes of $(163), $5,439 and $7,303, respectively Total other comprehensive income TOTAL COMPREHENSIVE INCOME See the accompanying notes to the consolidated financial statements $ Years Ended December 31, 2012 2011 483,705 $ 538,956 $ 2010... -

Page 81

... 1, 2010, as previously reported Cumulative effect of adjustment resulting from new accounting guidance Adjusted balance, January 1, 2010 Stock plan exercises Stock plan compensation expense Change in tax benefit from share-based payment arrangements Dividends Acquisition of common stock Net income... -

Page 82

...277) Equity securities available for sale (186,962) (34,556) Commercial mortgage loans on real estate (126,578) (88,649) Other invested assets (41,640) (66,499) Property and equipment and other (56,457) (35,747) Subsidiary, net of cash transferred(1) (3,500) (45,080) Change in short-term investments... -

Page 83

...Company provides debt protection administration, credit-related insurance, warranties and service contracts, pre-funded funeral insurance, solar project insurance, lender-placed homeowners insurance, renters insurance and related products, manufactured housing homeowners insurance, individual health... -

Page 84

... value of the underlying policies. Short-term investments include money market funds and short maturity investments. These amounts are reported at cost, which approximates fair value. The Company engages in collateralized transactions in which fixed maturity securities, especially bonds issued... -

Page 85

...policy information received from ceding companies. Any subsequent differences arising on such estimates are recorded in the period in which they are determined. Long Duration Contracts Acquisition costs for pre-funded funeral ("preneed") life insurance policies issued prior to 2009 and certain life... -

Page 86

...2011, the Assurant Employee Benefits and Assurant Health reporting units did not have goodwill. F-10 ASSURANT, INC. - 2012 Form 10-K Value of Businesses Acquired VOBA is an identifiable intangible asset representing the value of the insurance businesses acquired. The amount is determined using best... -

Page 87

... Long Term Care ("LTC") contracts), group worksite policies, group life conversion policies and certain medical policies. The Company's short duration contracts include group term life contracts, group disability contracts, medical contracts, dental contracts, property and warranty contracts, credit... -

Page 88

... charges assessed against policy balances. Revenues are recognized ratably as earned income over the premium-paying periods of the policies for the group worksite insurance products. For a majority of individual medical contracts issued prior to 2003, a limited number of individual medical contracts... -

Page 89

... revenue on a pro-rata basis over the contract term. The Company's short duration contracts primarily include group term life, group disability, medical, dental, vision, property and warranty, credit life and disability, and extended service contracts and individual medical contracts issued... -

Page 90

...deferred acquisition costs and value of business acquired Underwriting, general and administrative expenses Total benefits, losses and expenses Income before provision for income taxes Provision for income taxes Net income Earnings per share Basic Diluted $ $ $ F-14 ASSURANT, INC. - 2012 Form 10... -

Page 91

... SureDeposit business, the leading provider of security deposit alternatives to the multi-family housing industry, for $45,080. In connection with the acquisition, the Company recorded $25,350 of intangible assets, all of which are amortizable, and $19,608 of goodwill. ASSURANT, INC. - 2012 Form 10... -

Page 92

...respectively. No other country represented more than 5% of our foreign government securities as of December 31, 2012 and December 31, 2011. The Company has European investment exposure in its corporate fixed maturity and equity securities of $1,054,820 with an unrealized gain of $122,420 at December... -

Page 93

...,580 703,190 Fixed maturity securities Equity securities Commercial mortgage loans on real estate Policy loans Short-term investments Other investments Cash and cash equivalents Total investment income Investment expenses NET INVESTMENT INCOME $ $ No material investments of the Company were non... -

Page 94

...the market value has been less than cost, the financial condition and rating of the issuer, whether any collateral is held, the intent and ability of the Company to retain the F-18 ASSURANT, INC. - 2012 Form 10-K investment for a period of time sufficient to allow for recovery for equity securities... -

Page 95

...and timing of projected future cash flows. The net present value is calculated by discounting the Company's best estimate of projected future cash flows at the effective interest rate implicit in the security at the date of acquisition. For residential and commercial mortgage-backed and asset-backed... -

Page 96

... real estate, on properties located throughout the U.S. and Canada. At December 31, 2012, approximately 38% of the outstanding principal balance of commercial mortgage loans was concentrated in the states of California, New York, and Utah. Although the Company has a diversified loan portfolio... -

Page 97

... has short term investments and fixed maturities of $580,953 and $562,553 at December 31, 2012 and 2011, respectively, on deposit with various governmental authorities as required by law. The Company utilizes derivative instruments in managing the Assurant Solutions segment preneed life insurance... -

Page 98

... certain investments or certain assets and liabilities within these line items are measured at estimated fair value. Other investments are comprised of investments in the Assurant Investment Plan, American Security Insurance Company Investment Plan, Assurant Deferred Compensation Plan, a modified... -

Page 99

...Foreign governments Asset-backed Commercial mortgage-backed Residential mortgage-backed Corporate Equity securities: Common stocks Non-redeemable preferred stocks Short-term investments Collateral held/pledged under securities agreements Other investments Cash equivalents Other assets Assets held in... -

Page 100

... Residential mortgage-backed Corporate Equity Securities Non-redeemable preferred stocks Other investments Other assets Financial Liabilities Other liabilities TOTAL LEVEL 3 ASSETS AND LIABILITIES Total gains (losses) (realized/ unrealized) included in earnings Year Ended December 31, 2011 Net... -

Page 101

... Level 1 as of December 31, 2012 and December 31, 2011, consisted of mutual funds and money market funds, foreign government fixed maturities and common stocks that are publicly listed and/or actively traded in an established market. • Level 2 Securities The Company's Level 2 securities are valued... -

Page 102

... not be recoverable. These assets include commercial mortgage loans, goodwill and finite-lived intangible assets. For its 2012 fourth quarter annual goodwill impairment test, the Company performed a Step 1 analysis for the Assurant Solutions and Assurant Specialty Property reporting units. Based on... -

Page 103

...fair values for the Company's policy reserves under investment products are determined using discounted cash flow analysis. Key inputs to the valuation include projections of policy cash flows, reserve run-off, market yields and risk margins. Funds held under reinsurance: the carrying value reported... -

Page 104

... 31, 2012 and 2011. December 31, 2012 Fair Value Level 1 Level 2 0 $ 52,938 52,938 $ 0 $ 0 0 $ Carrying Value Financial Assets Commercial mortgage loans on real estate Policy loans TOTAL FINANCIAL ASSETS Financial Liabilities Policy reserves under investment products (Individual and group annuities... -

Page 105

7 Income Taxes 7. Income Taxes The Company and the majority of its subsidiaries are subject to U.S. tax and file a U.S. consolidated federal income tax return. Information about current and deferred tax expense (benefit) follows: 2012 Current expense: Federal & state Foreign Total current expense... -

Page 106

...: December 31, 2012 Deferred Tax Assets Policyholder and separate account reserves Accrued liabilities Investments, net Net operating loss carryforwards Deferred gain on disposal of businesses Compensation related Employee and post-retirement benefits Other Total deferred tax asset Less valuation... -

Page 107

... depreciation TOTAL $ $ Depreciation expense for 2012, 2011 and 2010 amounted to $49,595, $55,193 and $59,017, respectively. Depreciation expense is included in underwriting, general and administrative expenses in the consolidated statements of operations. ASSURANT, INC. - 2012 Form 10-K F-31 -

Page 108

... ASSURANT, INC. - 2012 Form 10-K value calculation of all individual assets and liabilities of the reporting unit (excluding goodwill, but including any unrecognized intangible assets). The net fair value of assets less liabilities is then compared to the reporting unit's total estimated fair value... -

Page 109

... 2010 impairments at Assurant Employee Benefits and Assurant Health reflects the effects of the Affordable Care Act, the low interest rate environment, continuing high unemployment, the slow pace of the economic recovery and increased net book values, primarily related to their investment portfolios... -

Page 110

... and other products no longer offered FFG, LTC and other disposed businesses Medical All other Short Duration Contracts: Group term life Group disability Medical Dental Property and warranty Credit life and disability Extended service contracts All other TOTAL Future Policy Benefits and Expenses... -

Page 111

... Company's product lines with the most significant claims and benefits payable balances: group term life, group disability, medical and property and warranty lines of business. Claims and benefits payable is comprised of case and IBNR reserves. Group Term Life Balance as of December 31, 2009, gross... -

Page 112

12 Reserves Short Duration Contracts The Company's short duration contracts are comprised of group term life, group disability, medical, dental, property and warranty, credit life and disability, extended service contract and all other. The principal products and services included in these ... -

Page 113

... varies by product series and premium paying period. minimum benefit increases associated with an inflation index, assumed benefit increases equaled the discount rate less 3.0% in 2012 and 2011. The reserves for annuities issued by the AMLIC division are based on assumed interest rates credited on... -

Page 114

...material credit exposure are reviewed at the time of execution. The A.M. Best ratings for existing reinsurance agreements are reviewed on a periodic basis, at least annually. The following table provides the reinsurance recoverable as of December 31, 2012 grouped by A.M. Best rating: Best Ratings of... -

Page 115

...as of December 31, 2012 and 2011, respectively, for the benefit of others related to certain reinsurance arrangements. The Company utilizes ceded reinsurance for loss protection and capital management, business dispositions, and in the Assurant Solutions and Assurant Specialty Property segments, for... -

Page 116

... contribute funds to increase the value of the separate account assets relating to Modified Guaranteed Annuity business sold if such value declines below the value of the associated liabilities. If The Hartford fails to fulfill these obligations, the Company will be obligated to make these payments... -

Page 117

.... Long-Term Equity Incentive Plan ("ALTEIP"), which authorized the granting of up to 3,400,000 new shares of the Company's common stock to employees, officers and non-employee directors. In May 2010, the Company's shareholders approved an amended and restated ALTEIP, ASSURANT, INC. - 2012 Form 10... -

Page 118

... the Company's stockholders' equity excluding AOCI divided by the number of fully diluted total shares outstanding at the end of the period. Revenue growth is defined as the year-over-year change in total revenues as disclosed in the Company's annual statement of operations. Total stockholder return... -

Page 119

... awards were granted under the 2004 Assurant Long-Term Incentive Plan ("ALTIP"), which authorized the granting of up to 10,000,000 new shares of the Company's common stock to employees and officers under the ALTIP, Business Value Rights Program ("BVR") and CEO Equity Grants Program. Under the ALTIP... -

Page 120

...of amortization of prior service cost included in net income, net of taxes $ $ $ Year Ended December 31, 2012 2011 27,503 $ 15,907 $ (77) 15,155 $ $ (994) 10,334 $ $ 2010 26,544 (1,034) 9,820 19. Statutory Information The Company's insurance subsidiaries prepare financial statements on the basis... -

Page 121

...subsidiaries participate in a non-contributory, qualified defined benefit pension plan covering substantially all employees. This Plan is considered "qualified" because it meets the requirements of Internal Revenue Code Section 401(a) ("IRC 401(a)") and the Employee Retirement Income Security Act of... -

Page 122

... Health Benefits") for retired employees and their dependents. On July 1, 2011, the Company terminated certain health care benefits for employees who did not qualify for "grandfathered" status and no longer offers these benefits to new hires. The Company contribution, plan design and other terms... -

Page 123

... year period. The difference between actual as compared to expected asset returns for the Plans will be fully reflected in the market-related value of plan assets over the next five years using the methodology described above. The estimated net loss and prior service cost of Pension Benefits that... -

Page 124

... Benefits 2012 2011 2010 4.40% 5.11% 5.73% 0% 0% 0% Retirement Health Benefits 2012 2011 2010 4.64% 5.55% 6.06% 6.75% 7.50% 7.50% Discount rate Expected long- term return on plan assets * Assumed rates of compensation increases are also used to determine net periodic benefit cost. Assumed rates... -

Page 125

... The Company invests certain plan assets in investment funds, examples of which include real estate investment funds and private equity funds, during 2012. Amounts allocated for these investments are included in the equity securities caption of the fair value hierarchy at December 31, 2012, provided... -

Page 126

... Other Employee Benefits The fair value hierarchy for the Company's qualified pension plan and other post retirement benefit plan assets at December 31, 2012 by asset category, is as follows: Qualified Pension Benefits Financial Assets Cash and cash equivalents: Short-term investment funds Equity... -

Page 127

... Other Employee Benefits The fair value hierarchy for the Company's qualified pension plan and other post retirement benefit plan assets at December 31, 2011 by asset category, is as follows: Qualified Pension Benefits Financial Assets Cash and cash equivalents: Short-term investment funds Equity... -

Page 128

... Solutions provides debt protection administration, credit-related insurance, warranties and service contracts, and pre-funded funeral insurance. Assurant Specialty Property provides lender-placed homeowners insurance and manufactured housing homeowners insurance. Assurant Health provides individual... -

Page 129

... The following tables summarize selected financial information by segment for the years ended December 31, 2012, 2011 and 2010: Year Ended December 31, 2012 Specialty Employee Corporate Solutions Property Health Benefits & Other 2,579,220 $ 2,054,041 $ 1,589,459 $ 1,014,264 $ 0 396... -

Page 130

... 258,777 8,392 267,169 $ $ $ $ $ $ Revenue is based in the country where the product was sold and long-lived assets, which are primarily property and equipment, are based on the physical location of those assets. The Company has no reportable major customers. F-54 ASSURANT, INC. - 2012 Form 10-K -

Page 131

...product are as follows: 2012 Solutions: Credit Service contracts Preneed Other TOTAL Specialty Property: Homeowners (lender-placed and voluntary) Manufactured housing (lender-placed and voluntary) Other TOTAL Health: Individual Small employer group markets TOTAL Employee Benefits: Group dental Group... -

Page 132

... of 2012, the company took a non-cash charge of $20,419 (after-tax) for the impairment of certain other intangible assets in the Assurant Solutions segment. During the third quarter of 2011, the Company recorded reportable catastrophe losses of $52,323 (after-tax) in the Assurant Specialty Property... -

Page 133

...credit outstanding as of December 31, 2012 and 2011, respectively. In February 2012, the Company and two of its insurance company subsidiaries (American Security Insurance Company and American Bankers Insurance Company of Florida) received subpoenas from the New York Department of Financial Services... -

Page 134

... Asset-backed Commercial mortgage-backed Residential mortgage-backed Corporate TOTAL FIXED MATURITY SECURITIES Equity securities: Common stocks Non-redeemable preferred stocks TOTAL EQUITY SECURITIES Commercial mortgage loans on real estate, at amortized cost Policy loans Short-term investments... -

Page 135

... (Parent Only) ASSURANT, INC. (in thousands except number of shares) December 31, 2012 2011 Assets Investments: Equity investment in subsidiaries Fixed maturity securities available for sale, at fair value (amortized cost-$648,399 in 2012 and $334,115 in 2011) Equity securities available for sale... -

Page 136

... II-Condensed Income Statement (Parent Only) ASSURANT, INC. (in thousands) Revenues Net investment income Net realized gains (losses) on investments Fees and other income Equity in undistributed net income of subsidiaries TOTAL REVENUES Expenses General and administrative expenses Interest expense... -

Page 137

... preferred stock Change in tax benefit from share-based payment arrangements Acquisition of common stock Dividends paid Change in receivables under securities loan agreements Change in obligations to return borrowed securities NET CASH USED IN FINANCING ACTIVITIES Effect of exchange rate changes on... -

Page 138

Schedule III-Supplementary Insurance Information ASSURANT, INC. FOR THE YEARS ENDED DECEMBER 31, 2012, 2011 & 2010 Future Deferred policy Acquisition benefits and Cost expenses Premium Claims and revenue Net benefits and other investment payable considerations income Benefits claims, losses and ... -

Page 139

... Force Premiums: Life insurance Accident and health insurance Property and liability insurance TOTAL EARNED PREMIUMS Benefits: Life insurance Accident and health insurance Property and liability insurance TOTAL POLICYHOLDER BENEFITS $ $ $ ASSURANT, INC. FOR THE YEAR ENDED DECEMBER 31, 2011 Direct... -

Page 140

... for reinsurance recoverables TOTAL 2011: Valuation allowance for foreign NOL deferred tax carryforward Valuation allowance for deferred tax assets Valuation allowance for mortgage loans on real estate Valuation allowance for uncollectible agents balances Valuation allowance for uncollectible... -

Page 141

-

Page 142

-

Page 143

...of Assurant news releases, the 2012 Annual Report on Form 10-K and other reports ï¬led with the U.S. Securities and Exchange Commission (SEC) also are available, without charge, from the Assurant Investor Relations website at http://ir.assurant.com. STOCK LISTING Assurant is traded on the New York... -

Page 144

Assurant, Inc. One Chase Manhattan Plaza 41st Floor New York, NY 10005 Telephone: 212.859.7000 www.assurant.com