Ameriprise 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

This report is not a solicitation for any of the products or

services mentioned. Investment products, including shares

of mutual funds, are not FDIC or otherwise federally insured,

are not deposits or obligations, or guaranteed by any nancial

institution, and involve investment risks, including possible loss

of principal and uctuation in value.

Actual results may vary materially from our plans, estimates

and beliefs. Please review carefully the discussion captioned

“Forward-Looking Statements” contained in Part II, Item 7 on

our Annual Report on Form 10-K for the year ended Dec. 31,

2010.

Rankings Sources: No. 1 nancial planning rm in the U.S.:

Ameriprise helped pioneer the nancial planning process more

than 30 years ago. We have more nancial planning clients and

more CERTIFIED FINANCIAL PLANNERTM professionals than any

other company based on data led at advisorinfo.sec.gov

and documented by the CFP Board of Standards, Inc., as

of Dec. 31, 2010. No. 2 mutual fund advisory program in

assets: Cerulli Edge - U.S. Managed Accounts 4Q 2010

edition, data as of 3Q 2010. No. 5 branded advisor force in

the U.S.: Company reports as of Dec. 31, 2010. No. 6 variable

universal life insurance provider (total assets): Towers Watson,

VALUETM Variable Life Survey, as of 4Q 2010. No. 7 long-term

mutual fund assets in the U.S.: ICI Complex Assets through

Dec. 31, 2010. No. 9 variable annuity provider (total assets):

Morningstar Annuity Research Center, Variable Annuity Sales

and Asset Survey, 3Q 2010.

Ameriprise Financial Services, Inc. offers nancial advisory

services, investments, insurance and annuity products.

Columbia Funds are distributed by Columbia Management

Investment Distributors, Inc., member FINRA, and managed

by Columbia Managment Investment Advisers, LLC. Seligman

is an offering brand of Columbia Management Investment

Advisers, LLC.

RiverSource insurance and annuity products are issued by

RiverSource Life Insurance Company and, in New York, by

RiverSource Life Insurance Co. of New York, Albany, NY, and

distributed by RiverSource Distributors, Inc.

Ameriprise Auto & Home Insurance issues auto, home and

umbrella insurance underwritten by IDS Property Casualty

Insurance Company or, in some states, Ameriprise Insurance

Company (AIC), DePere, WI.

The Threadneedle group of companies constitutes the

Ameriprise Financial international investment platform. The

group consists of wholly owned subsidiaries of Ameriprise

Financial, Inc. and provides services independent from

Ameriprise Financial Services, Inc., including Ameriprise

Financial Services’ broker-dealer business.

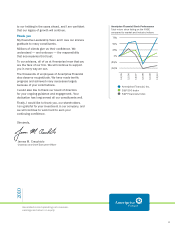

Since becoming an independent public company in 2005, we

have strived to deliver effective shareholder communications

while continuing to reduce the related expense and

environmental impact. Starting with the 2008 proxy season,

Ameriprise Financial was one of the first large companies to

implement the Notice & Access program for the distribution of

proxy materials, which significantly reduced the total number of

annual reports and proxy statements we print. We have continued

to reduce this annual expense: We expect to reduce the cost

of our 2010 Annual Report to Shareholders by more than 80%

compared to 2005.

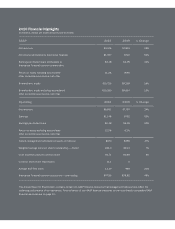

Disclosures (in millions) 2005 2006 2007 2008 2009 2010

Reported Net

Income (Loss) $574 $631 $814 $(36) $722 $1,097

Realized Net

(Gains) Losses,

after-tax(1)

(43) (33) (29) 506 (34) (22)

Integration,

Separation and

Restructuring

Charges, AMEX

Assurance and

Discontinued

Operations after-

tax(1)

119 235 154 51 64 73

Operating

Earnings $650 $833 $939 $521 $752 $1,148

(1) After-tax is calculated using the statutory tax rate of 35%.

(in dollars) 2005 2006 2007 2008 2009 2010

GAAP Earnings

per Diluted Share $2.32 $2.54 $3.39 $(.16) $2.95 $4.18

Operating

Adjustments 0.31 0.81 0.52 2.48 0.13 0.20

Operating

Earnings Per

Diluted Share

$2.63 $3.35 $3.91 $2.32 $3.08 $4.38

(in millions) 2005 2006 2007 2008 2009 2010

Reported Net

Revenues $7,341 $7,985 $8,506 $6,918 $7,805 $9,976

CIE Impact — (75) 3 49 (22) (362)

Realized Net

(Gains) Losses (67) (51) (44) 777 (53) (33)

AMEX Assurance (138) — — — — —

Operating Net

Revenues $7,136 $7,859 $8,465 $7,744 $7,730 $9,581

(in millions) 2005 2006 2007 2008 2009 2010

Return (net

income (loss)

for the last 12

months)

$574 $631 $814 $(36) $722 $1,097

Equity excluding

AOCI(1) $7,022 $7,927 $7,988 $7,722 $8,208 $9,769

Return on equity

excluding AOCI 8.2% 8.0% 10.2% -0.5% 8.8% 11.2%

Operating return $650 $833 $939 $521 $752 $1,148

Equity excluding

AOCI(1) $7,022 $7,927 $7,988 $7,722 $8,208 $9,769

Less

adjustments(2) 309 273 59 — — 455

Operating equity

excluding AOCI $6,713 $7,654 $7,929 $7,722 $8,208 $9,314

Operating

return on equity

excluding AOCI

9.7% 10.9% 11.8% 6.7% 9.2% 12.3%

(1) Equity excluding AOCI is calculated using a ve point average of quarter-end Ameriprise Financial

shareholders’ equity excluding AOCI for the last ve quarters.

(2) Adjustments for 2005, 2006 and 2007 reect a ve point average of quarter-end assets and

liabilities of discontinued operations and equity allocated to expected separation costs as of the

last day of the preceding four quarters and the current quarter. The adjustment for 2010 reects

a ve point average of appropriated retained earnings of the CIEs for the last ve quarters.

(in millions) 2005 2010

Advice & Wealth Management and Asset Management

Pretax segment income $195 $619

Realized (gains) losses 11 (4)

Integration charges — 102

Pretax operating earnings $206 $717

Annuities and Protection

Pretax segment income $984 $1,052

Realized (gains) losses (50) (10)

AMEX Assurance (82) —

Pretax operating earnings $852 $1,042

Percent pretax segment operating earnings from high

capital businesses 81% 59%

Percent pretax segment operating earnings from low

capital businesses 19% 41%