Ameriprise 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

2010

Introduced MORE WITHIN REACH®brand platform

And, we were one of the rst nancial services

companies to re-establish a share buyback program,

returning more than two-thirds of our 2010 earnings

to shareholders. This long-term strength, coupled

with our enduring commitment to re-engineering and

expense management, enabled us to emerge from

that difcult period in excellent nancial condition.

Today, with more than $1.5 billion in excess capital,

low indebtedness, a high-quality investment portfolio,

effective risk management and continuing expense

control, our operating foundation remains bedrock.

Looking ahead: Well-positioned for

sustainable growth

We have one of the nation’s largest advisor forces

and a three-million-strong client base. We have a

vital brand, and we are ideally suited to meet the

growing consumer demand for nancial advice. We

offer an exceptional breadth and depth of appealing

products. Our higher-return, less-capital-demanding

businesses are leading our growth. And we have the

nancial strength and exibility to invest and grow

when opportunities arise. In short, I feel good about

our position.

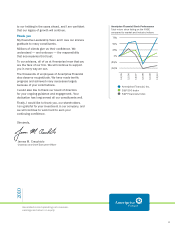

Five years ago, when we set out on our journey as

a public company, we could not have foreseen the

historically challenging times ahead, but we prepared

the company to be resilient, to thrive across market

cycles. While the nancial crisis of 2008-2009 may

have temporarily delayed our growth trajectory, we

have emerged stronger than ever — with a record

year and many accomplishments in 2010 — and are

poised for continued success in the years ahead.

I often remind people that at Ameriprise, we’ve “stuck

to our knitting.” That means we made a plan, and

we’ve continued to execute it, resisting temptation

to chase risky gains and avoiding calamity. With the

strength of our current position, we need only to stick

Leadership

No. 1 nancial planning

rm in the U.S.

No. 2 mutual fund

advisory program in

assets

No. 5 branded advisor

force in the U.S.

No. 6 variable universal

life insurance provider

No. 7 long-term mutual

fund assets in the U.S.

No. 9 variable annuity

provider

(see sources on page 10)