Ameriprise 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A R E C O R D Y E A R | 2 0 1 0 A N N U A L R E P O R T

Table of contents

-

Page 1

A RECORD YEAR | 2010 ANNUAL REPORT -

Page 2

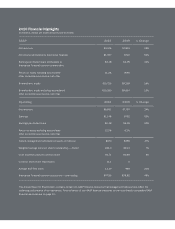

... comprehensive income, net of tax Owned, managed and administered assets (in billions) Weighted average common shares outstanding - diluted Cash dividends paid per common share Common stock share repurchases Average S&P 500 Index Ameriprise Financial common stock price - year ending 2010 $9,581... -

Page 3

Dear fellow shareholders, In 2010, Ameriprise Financial reached its fifth anniversary as a public company. When we began this journey, my management team and I believed without reservation in our potential. While we knew much work lay ahead, we were confident that we had the right strategy and that ... -

Page 4

..., a testament to the earnings power of our business. Our earnings, revenues and return on equity all reached new highs in 2010. On an operating basis, 0 2005 2006 2007 2008 2009 2010 Ameriprise Financial celebrated its fifth anniversary as a public company in 2010. Some highlights follow. ï,† 2 -

Page 5

...long-term financial goals, clients regained some confidence; still, their investing activity continued to be muted as they remained cautious about the economy and markets. Investors recognized our resilience and our results: The price of Ameriprise Financial common stock increased 48 percent in 2010... -

Page 6

.... Our advisors and clients can choose from more than 7,000 mutual funds from more than 275 companies. In addition, we expanded variable annuity choice by adding products from three non-affiliated companies, and we further enhanced our adviceembedded product platform with a new offering in our Active... -

Page 7

... Columbia acquisition transformed our domestic asset management business, making us the seventhlargest manager of long-term U.S. mutual fund assets. We expect to complete fund mergers in the first half of 2011, which will allow us to offer a comprehensive 2008 Acquired H&R Block Financial Advisors... -

Page 8

..., we offer a range of investment products that appeal to clients while helping provide appropriate returns for shareholders. The business delivered another solid year, driven by the success of a new variable product that contributed to total variable annuity balances reaching $63 billion at year end... -

Page 9

..., our universal and variable universal life insurance sales increased 17 percent for the year, in part due to our comprehensive focus on the role protection plays in each stage of a client's life. Ameriprise Auto & Home Insurance also continued its long-term growth trend, with the number of policies... -

Page 10

... variable universal life insurance provider No. 7 long-term mutual fund assets in the U.S. No. 9 variable annuity provider (see sources on page 10) And, we were one of the first financial services companies to re-establish a share buyback program, returning more than two-thirds of our 2010 earnings... -

Page 11

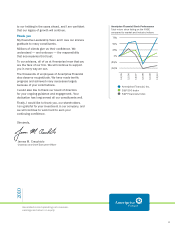

... in our company, and we will continue to work hard to earn your continuing confidence. Ameriprise Financial, Inc. S&P 500 Index S&P Financials Index Sincerely, James M. Cracchiolo Chairman and Chief Executive Officer 2010 Generated record operating net revenues, earnings and return on equity 9 -

Page 12

... offering brand of Columbia Management Investment Advisers, LLC. RiverSource insurance and annuity products are issued by RiverSource Life Insurance Company and, in New York, by RiverSource Life Insurance Co. of New York, Albany, NY, and distributed by RiverSource Distributors, Inc. Ameriprise Auto... -

Page 13

Ameriprise Financial, Inc. 2010 Form 10-K -

Page 14

-

Page 15

...latest practicable date. Class Common Stock (par value $.01 per share) DOCUMENTS INCORPORATED BY REFERENCE Part III: Portions of the registrant's Proxy Statement to be filed with the Securities and Exchange Commission in connection with the Annual Meeting of Shareholders to be held on April 27, 2011... -

Page 16

... Director Independence ...Principal Accountant Fees and Services ...160 162 162 162 162 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Selected Financial Data ...Management's Discussion and Analysis of Financial Condition and Results... -

Page 17

...of our U.S. advisor force, long-term U.S. mutual funds, variable annuities and variable universal life insurance. Our multi-platform network of affiliated financial advisors is the primary means by which we develop personal relationships with retail clients. As of December 31, 2010, we had a network... -

Page 18

... auto and home insurance). We use Columbia Management as the primary brand for our U.S. asset management products and services. Following the completion of the acquisition of the long-term asset management business of Columbia Management from Bank of America in April 2010, RiverSource Investments... -

Page 19

... Holding Corporation J. & W. Seligman & Co. Incorporated Ameriprise Financial Services, Inc. American Enterprise Investment Services Inc. Columbia Management Investment Distributors, Inc. RiverSource Life Insurance Company IDS Property Casualty Insurance Company Ameriprise Certificate Company... -

Page 20

...) and AEIS (defined below). AMPF Holding Corporation's results of operations are included in our Advice & Wealth Management segment. American Enterprise Investment Services Inc. (''AEIS'') is our registered clearing broker-dealer subsidiary. Brokerage transactions for accounts introduced by AFSI... -

Page 21

... helps them build their practices. The unbranded advisor network served by SAI, offers our own and other companies' mutual funds as well as the investment, annuity and protection products of other companies. Our affiliated financial advisors provide clients access to our diversified set of cash and... -

Page 22

...of securities, and use self-directed asset allocation and other financial planning tools. We also offer shares in public non-exchange traded Real Estate Investment Trusts (''REITs''), and other alternative investments and structured notes issued by unaffiliated companies. Through Ameriprise Achiever... -

Page 23

...-Brokerage and Other Products and Services.'' We also offer stand-alone checking, savings and money market accounts and certificates of deposit. We believe these products play a key role in our Advice & Wealth Management business by offering our clients an FDIC-insured alternative to other cash... -

Page 24

... in home loans/equity line of credit balances, $14 million in investment secured loan balances and $217 million in unsecured balances, net of premiums and discounts, and capitalized lender paid origination fees. Ameriprise Bank's strategy and operations are focused on serving branded advisor clients... -

Page 25

...of assets in our Columbia family of mutual funds, as well as the assets we manage for institutional clients in separately managed accounts, hedge funds, the general and separate accounts of the RiverSource Life companies, the assets of IDS Property Casualty and Ameriprise Certificate Company and the... -

Page 26

...teams to develop new products for our institutional clients. U.S. Asset Management Offerings Mutual Funds We provide investment advisory, distribution and other services to the Columbia family of mutual funds. The Columbia family of funds includes retail mutual funds (both open- and closed-end funds... -

Page 27

... the accounts of high-net-worth individuals and smaller institutional clients, including tax-exempt and not-for-profit organizations. Our services include investment of funds on a discretionary or non-discretionary basis and related services including trading, cash management and reporting. We offer... -

Page 28

... Threadneedle's mutual fund and hedge fund product range includes different risk-return options across regions, markets, asset classes and product structures, which include Open Ended Investment Companies (''OEICs''), Societe d'Investissement A Capital Variable (''SICAV''), unit trusts, Undertakings... -

Page 29

... ''Variable Annuities.'' Investment management performance is critical to the profitability of our RiverSource annuity business. Our branded advisors are the largest distributors of RiverSource annuity products, although they can offer variable annuities from a select number of unaffiliated insurers... -

Page 30

... We issue insurance policies through our life insurance subsidiaries and the Property Casualty companies (as defined below under ''Ameriprise Auto & Home Insurance Products''). The primary sources of revenues for this segment are premiums, fees and charges we receive to assume insurance-related risk... -

Page 31

... premium, in 2010 we began offering a term life insurance product that will generally pay the death benefit in the form of a monthly income stream to a date specified at issue. We also offer a chronic care rider, AdvanceSourceá"¼, on our new permanent insurance products. This rider allows its policy... -

Page 32

...'s affiliated insurance agency. Costco members represented 62% of all new policy sales of our Property Casualty companies in 2010. Through other alliances, we market our property casualty products to customers of Ford Motor Credit Company and offer personal home insurance products to customers of... -

Page 33

... of the rating considers a company's mix of business, market position and depth and experience of management. Information concerning the financial strength ratings for Ameriprise Financial, RiverSource Life and IDS Property Casualty can be found in Part II, Item 7 of this Annual Report on Form 10... -

Page 34

... that manage individual brokerage, mutual fund, insurance and banking client accounts. Over the years we have updated our platform to include new product lines such as brokerage, deposit, credit and products of other companies, wrap accounts and e-commerce capabilities for our financial advisors and... -

Page 35

..., disclosure, record-keeping, operational and marketing requirements. Investment companies are required by the SEC to adopt and implement written policies and procedures designed to prevent violations of the federal securities laws and to designate a chief compliance officer. Ameriprise Certificate... -

Page 36

..., marketing and contents of insurance policies and annuity contracts. Financial regulation of our RiverSource Life companies and Property Casualty companies is extensive, and their financial and intercompany transactions (such as intercompany dividends, capital contributions and investment activity... -

Page 37

...this transition will occur in 2011. Parent Company Regulation Ameriprise Financial is a publicly-traded company that is subject to the rules and regulations of the SEC and NYSE regarding public disclosure, financial reporting and internal controls and corporate governance principles. These rules and... -

Page 38

... business. Securities Exchange Act Reports and Additional Information We maintain an Investor Relations website at ir.ameriprise.com and we make available free of charge our annual, quarterly and current reports and any amendments to those reports as soon as reasonably practicable following the time... -

Page 39

... securities, loans, derivatives, alternative investments, seed capital and other commitments. It is difficult to predict how long and to what extent the aforementioned conditions will exist, which of our markets, products and businesses will be directly affected in terms of revenues, management fees... -

Page 40

... refrain from purchasing products, such as mutual funds, OEICs, variable annuities and variable universal life insurance, which have returns linked to the performance of the equity markets. If we are unable to offer appropriate product alternatives which encourage customers to continue purchasing in... -

Page 41

... customers or lenders could develop a negative perception of our long- or short-term financial prospects if we incur large investment losses or if the level of our business activity decreases due to a market downturn. Similarly, our access to funds may be impaired if regulatory authorities or rating... -

Page 42

..., economic downturns and corporate malfeasance can increase the number of companies, including those with investment-grade ratings, that default on their debt obligations. Default-related declines in the value of our fixed maturity securities portfolio or consumer credit products could cause our... -

Page 43

... of operations or financial condition. Fixed maturity, equity, trading securities and short-term investments, which are reported at fair value on the consolidated balance sheets, represent the majority of our total cash and invested assets. The determination of fair values by management in the... -

Page 44

...of protection products) by our RiverSource Life companies. In 2010, we expanded the offerings available to all of our branded advisors to include variable annuities issued by a limited number of unaffiliated insurance companies. As a result of this and further openings of our branded advisor network... -

Page 45

... and updating these requirements and other requirements relating to the business operations of insurance companies, including their underwriting and sales practices. The NAIC adopted a change to require principles-based reserves for variable annuities at the end of 2009, and continues to discuss... -

Page 46

... reducing new sales of insurance products, annuities and investment products; adversely affecting our relationships with our affiliated financial advisors and third-party distributors of our products; materially increasing the number or amount of policy surrenders and withdrawals by contractholders... -

Page 47

... offerings to policies underwritten fully by unaffiliated third-party insurers, and we have also implemented rate increases on certain in force policies as described in Item 1 of this Annual Report on Form 10-K- ''Business-Our Segments-Protection-RiverSource Insurance Products-Long Term Care... -

Page 48

... costs of acquiring new business, principally direct sales commissions and other distribution and underwriting costs that have been deferred on the sale of annuity, life and disability income insurance and, to a lesser extent, marketing and promotional expenses for personal auto and home insurance... -

Page 49

... and evolution in the financial markets of increasingly sophisticated products, such as those which incorporate automatic asset re-allocation, long/short trading strategies or multiple portfolios or funds, and business-driven hedging, compliance and other risk management strategies. Any such failure... -

Page 50

... our face-amount certificate company) to pay dividends or make other permitted payments. See Item 1 of this Annual Report on Form 10-K-''Regulation'' as well as the information contained in Part II, Item 7 under the heading ''Management's Discussion and Analysis of Financial Condition and Results of... -

Page 51

...in accounting standards applicable to our businesses and the financial services industry; and changes in general economic or market conditions. Stock markets in general have experienced volatility that has often been unrelated to the operating performance of a particular company. These broad market... -

Page 52

...: sales and product or service features of, or disclosures pertaining to, mutual funds, annuities, equity and fixed income securities, insurance products, brokerage services, financial plans and other advice offerings; trading practices within the Company's asset management business, supervision... -

Page 53

...; information security; the delivery of financial plans and the suitability of investments and product selection processes. The number of reviews and investigations has increased in recent years with regard to many firms in the financial services industry, including Ameriprise Financial. The Company... -

Page 54

... the information with respect to purchases made by or on behalf of Ameriprise Financial, Inc. or any ''affiliated purchaser'' (as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934) of our common stock during the fourth quarter of 2010: (a) Total Number of Shares Purchased 1,135... -

Page 55

... assets before consolidated investment entities Future policy benefits and claims Separate account liabilities Customer deposits Long-term debt Short-term borrowings Total liabilities before consolidated investment entities Total Ameriprise Financial, Inc. shareholders' equity(4) (1) 2009 2008 (in... -

Page 56

... of our four main operating segments, including the size of our U.S. advisor force, long-term U.S. mutual funds, variable annuities and variable universal life (''VUL'') insurance. Equity price, credit market and interest rate fluctuations can have a significant impact on our results of operations... -

Page 57

... for setting our financial performance targets and annual incentive award compensation targets. It is management's priority to increase shareholder value over a multi-year horizon by achieving our on-average, over-time financial targets. Our financial targets are Net operating revenue growth of... -

Page 58

... interest rate is compared to the amortized cost basis of the security. The significant inputs to cash flow projections consider potential debt restructuring terms, projected cash flows available to pay creditors and our position in the debtor's overall capital structure. For structured investments... -

Page 59

... to be carefully monitored by management. Deferred Acquisition Costs and Deferred Sales Inducement Costs For our annuity and life, disability income and long term care insurance products, our DAC and DSIC balances at any reporting date are supported by projections that show management expects there... -

Page 60

... Future policy benefits and claims related to fixed annuities and variable annuity guarantees include liabilities for fixed account values on fixed and variable deferred annuities, guaranteed benefits associated with variable annuities, equity indexed annuities and fixed annuities in a payout status... -

Page 61

...year of issue, with an average rate of approximately 5.6%. Life, Disability Income and Long Term Care Insurance Future policy benefits and claims related to life, disability income and long term care insurance include liabilities for fixed account values on fixed and variable universal life policies... -

Page 62

... hedging equity indexed annuities and stock market certificates are included within interest credited to fixed accounts and banking and deposit interest expense, respectively. The changes in fair value of derivatives hedging equity price risk of Ameriprise Financial, Inc. common stock granted... -

Page 63

... fees also include amounts received under marketing support arrangements for sales of mutual funds and other companies' products, such as through our wrap accounts, as well as surrender charges on fixed and variable universal life insurance and annuities. Net Investment Income Net investment... -

Page 64

... on a trade date basis. Premiums Premiums include premiums on property-casualty insurance, traditional life and health (disability income and long term care) insurance and immediate annuities with a life contingent feature. Premiums on auto and home insurance are net of reinsurance premiums and are... -

Page 65

...services and recognize management fees in our Asset Management segment, such as the assets of the general account, RiverSource Variable Product funds held in the separate accounts of our life insurance subsidiaries and client assets of CIEs. Investors in the mutual funds and face amount certificates... -

Page 66

... Years Ended December 31, 2010 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Premiums Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Interest credited to fixed accounts Benefits, claims... -

Page 67

... 2010 compared to $752 million for the prior year driven by improved client activity, market appreciation and net inflows in wrap account assets and variable annuities, as well as improved scale from the Columbia Management Acquisition. Our annual review of valuation assumptions for RiverSource Life... -

Page 68

... from the Columbia Management Acquisition, market appreciation and net inflows in wrap account assets and variable annuities, as well as increased client activity. Net investment income increased $311 million, or 16%, to $2.3 billion for the year ended December 31, 2010 compared to $2.0 billion... -

Page 69

... property funds. Operating other revenues increased $66 million, or 10%, to $760 million for the year ended December 31, 2010 compared to $694 million in the prior year primarily due to lower charges related to updating valuation assumptions and model changes, higher fees from variable annuity... -

Page 70

... the Columbia Management Acquisition, as well as higher performance based compensation partially offset by lower hedge fund performance compensation. Income Taxes Our effective tax rate on net income including net income attributable to noncontrolling interests was 21.0% for the year ended December... -

Page 71

... Management segment. In addition to purchases of affiliated and non-affiliated mutual funds and other securities on a stand-alone basis, clients may purchase mutual funds, among other securities, in connection with investment advisory fee-based ''wrap account'' programs or services, and pay fees... -

Page 72

... client activity. Management and financial advice fees increased $313 million, or 25%, to $1.5 billion for the year ended December 31, 2010 compared to $1.2 billion for the prior year driven by growth in average fee-based assets resulting from market appreciation and net inflows in wrap account... -

Page 73

...to $2.0 billion for the year ended December 31, 2010 compared to $1.7 billion for the prior year primarily driven by growth in average fee-based assets resulting from market appreciation and net inflows in wrap account assets, as well as increased client activity. Net investment income decreased $20... -

Page 74

... affiliated with Ameriprise Financial, Inc., RiverSource S&P 500 Index Fund and Columbia Money Market Fund. Aggregated equity rankings include Columbia Portfolio Builder Series and other balanced and asset allocation funds that invest in both equities and fixed income securities. Columbia Portfolio... -

Page 75

...'s World Express Funds investment business. Columbia assets under management were $355.5 billion at December 31, 2010 compared to $149.0 billion a year ago, driven by the Columbia Management Acquisition and market appreciation, partially offset by net outflows. Equity and fixed income investment... -

Page 76

...: Years Ended December 31, 2010 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Amortization of deferred acquisition costs General and... -

Page 77

... legal expenses and lower hedge fund performance compensation. Annuities Our Annuities segment provides variable and fixed annuity products of RiverSource Life companies to retail clients. Prior to the fourth quarter of 2010, our variable annuity products were distributed through affiliated advisors... -

Page 78

... Years Ended December 31, 2010 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Premiums Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Interest credited to fixed accounts Benefits, claims... -

Page 79

... variable universal life separate account balances. This segment earns intersegment revenues from fees paid by the Asset Management segment for marketing support and other services provided in connection with the availability of RiverSource Variable Series Trust, Columbia Funds Variable Insurance... -

Page 80

...and model changes and an increase in net investment income and premiums. Management and financial advice fees increased $7 million, or 15%, to $54 million for the year ended December 31, 2010 compared to $47 million for the prior year primarily due to higher management fees from VUL separate account... -

Page 81

... expenses in 2010 included higher disability income and long-term care insurance claims and higher reserves for universal life products with secondary guarantees compared to the prior year. Amortization of DAC increased $24 million, or 15%, to $183 million for the year ended December 31, 2010... -

Page 82

... $25 million benefit from the payments related to the Reserve Funds matter in 2010. Total expenses increased $224 million, or 81%, to $500 million for the year ended December 31, 2010 compared to $276 million for the prior year primarily reflecting expenses of CIEs. Operating expenses, which exclude... -

Page 83

... Years Ended December 31, 2009 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Premiums Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Interest credited to fixed accounts Benefits, claims... -

Page 84

... average S&P 500 Index on a period-over-period basis, lower short term interest rates and lower client activity, offset by growth in spread products, net inflows in wrap accounts and Asset Management and expense controls. Operating results for 2008 were impacted by market dislocation, money market... -

Page 85

... for the year ended December 31, 2009 compared to $1.6 billion in the prior year primarily due to lower client activity levels and lower asset-based fees driven by lower equity markets, partially offset by revenues resulting from our 2008 acquisitions. Net investment income increased $1.2 billion to... -

Page 86

...or 7%, to $1.8 billion for the year ended December 31, 2009 compared to $1.9 billion in the prior year reflecting lower equity markets and client activity levels, partially offset by expenses resulting from our 2008 acquisitions. Interest credited to fixed accounts increased $113 million, or 14%, to... -

Page 87

...and legal expenses, partially offset by cost controls. Operating general and administrative expense in 2008 included a $77 million expense related to the mark-to-market of Lehman Brothers securities that we purchased from various 2a-7 money market mutual funds managed by RiverSource Investments, LLC... -

Page 88

... daily average S&P 500 Index on a period-over-period basis, partially offset by net inflows. Wrap account assets increased $22.1 billion, or 30%, compared to the prior year due to net inflows and market appreciation. Financial planning fees were lower for the year ended December 31, 2009 compared to... -

Page 89

... and client activity levels, partially offset by expenses resulting from our 2008 acquisitions. General and administrative expense increased $144 million, or 13%, to $1.3 billion for the year ended December 31, 2009. Integration charges were $64 million for the year ended December 31, 2009 compared... -

Page 90

... with Ameriprise Financial, Inc., RiverSource S&P 500 Index Fund, RiverSource Cash Management Fund and RiverSource Tax Free Money Market Fund. Aggregated equity rankings include RiverSource Portfolio Builder Series and other balanced and asset allocation funds that invest in both equities and fixed... -

Page 91

...: Years Ended December 31, 2009 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Amortization of deferred acquisition costs General and... -

Page 92

... Years Ended December 31, 2009 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Premiums Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Interest credited to fixed accounts Benefits, claims... -

Page 93

... due to fixed and variable annuity net inflows and higher yields on the longer-term investments in our fixed income investment portfolio. Premiums increased $19 million, or 22%, to $104 million for the year ended December 31, 2009, due to higher sales of immediate annuities with life contingencies... -

Page 94

... Years Ended December 31, 2009 GAAP Revenues Management and financial advice fees Distribution fees Net investment income Premiums Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Interest credited to fixed accounts Benefits, claims... -

Page 95

...to the write-off of certain capitalized software costs in 2008 and lower premium taxes compared to the prior year. Corporate & Other The following table presents the results of operations of our Corporate & Other segment: Years Ended December 31, 2009 GAAP Revenues Net investment income (loss) Other... -

Page 96

... securities that we purchased from various 2a-7 money market mutual funds managed by our subsidiary, RiverSource Investments, LLC and $36 million for the cost of guaranteeing specific client holdings in an unaffiliated money market mutual fund, partially offset by higher performance compensation... -

Page 97

... profit, risk and expenses, and adjusting the rates used to discount expected cash flows to reflect a current market estimate of our nonperformance risk. The nonperformance risk adjustment is based on broker quotes for credit default swaps that are adjusted to estimate the risk of our life insurance... -

Page 98

..., Ameriprise Financial Services, Inc. (''AFSI'') and our clearing broker-dealer subsidiary, American Enterprise Investment Services, Inc. (''AEIS''), our Auto and Home insurance subsidiary, IDS Property Casualty Insurance Company (''IDS Property Casualty''), doing business as Ameriprise Auto & Home... -

Page 99

... ended December 31: 2010 RiverSource Life(1) AEIS(2) ACC(3) Columbia Management Investment Advisers, LLC Columbia Management Investment Services Corporation Threadneedle Ameriprise Trust Company Securities America Financial Corporation AFSI(2) IDS Property Casualty(4) Ameriprise Captive Insurance... -

Page 100

...the years ended December 31: 2010 RiverSource Life Ameriprise Bank, FSB AEIS(1) ACC Columbia Management Investment Advisers, LLC Columbia Management Investment Services Corporation Threadneedle Ameriprise Trust Company Securities America Financial Corporation AFSI(1) IDS Property Casualty Ameriprise... -

Page 101

... paid cash of $866 million for the Columbia Management Acquisition in 2010. Net cash used in investing activities for the year ended December 31, 2009 was $6.4 billion compared to $140 million for the year ended December 31, 2008. Cash used for purchases of Available-for-Sale securities increased... -

Page 102

... our defined benefit postretirement plans. See Note 22 to our Consolidated Financial Statements for additional information. Total loan funding commitments, which are not included in the table above due to uncertainty with respect to timing of future cash flows, were $2.1 billion at December 31, 2010... -

Page 103

... DAC and DSIC or market volatility underlying the Company's valuation and hedging of guaranteed living benefit annuity riders; or from assumptions regarding anticipated claims and losses relating to the Company's automobile and home insurance products; changes in capital requirements that may be... -

Page 104

...our annuities, banking, brokerage client cash balances, and face amount certificate products and UL insurance products, the value of DAC and DSIC assets associated with variable annuity and variable UL products, the values of liabilities for guaranteed benefits associated with our variable annuities... -

Page 105

... of brokerage client cash balances. The increase in equity exposure at December 31, 2010 compared to the prior year is primarily due to the inclusion of Columbia Management in the asset-based management and distribution fees category at December 31, 2010. The increase in the estimated positive net... -

Page 106

... account portion of annuity and insurance products of RiverSource Life companies and their investment portfolios. We guarantee an interest rate to the holders of these products. Premiums and deposits collected from clients are primarily invested in fixed rate securities to fund the client credited... -

Page 107

... We pay interest on certain brokerage client cash balances and have the ability to reset these rates from time to time based on prevailing economic and business conditions. We earn revenue to fund the interest paid from interest-earning assets or fees from off-balance sheet deposits at FDIC insured... -

Page 108

... during the terms of the treaties. As of December 31, 2010, our largest reinsurance credit risk is related to a long term care coinsurance treaty with life insurance subsidiaries of Genworth Financial, Inc. See Note 7 to our Consolidated Financial Statements for additional information on reinsurance... -

Page 109

...: Ameriprise Financial, Inc. Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Operations-Years ended December 31, 2010, 2009 and 2008 ...Consolidated Balance Sheets-December 31, 2010 and 2009 ...Consolidated Statements of Cash Flows-Years ended December 31, 2010... -

Page 110

...of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of Ameriprise Financial, Inc. We have audited the accompanying consolidated balance sheets of Ameriprise Financial, Inc. (the Company) as of December 31, 2010 and 2009, and the related consolidated statements of... -

Page 111

... Inc. Years Ended December 31, 2010 Revenues Management and financial advice fees Distribution fees Net investment income Premiums Other revenues Total revenues Banking and deposit interest expense Total net revenues Expenses Distribution expenses Interest credited to fixed accounts Benefits, claims... -

Page 112

... of consolidated investment entities Total assets Liabilities and Equity Liabilities: Future policy benefits and claims Separate account liabilities Customer deposits Short-term borrowings Long-term debt Accounts payable and accrued expenses Other liabilities Total liabilities before consolidated... -

Page 113

... cash Trading securities and equity method investments, net Future policy benefits and claims, net Receivables Brokerage deposits Accounts payable and accrued expenses Derivatives collateral, net Other, net Changes in operating assets and liabilities of consolidated investment entities, net Net cash... -

Page 114

..., except share data) Balances at January 1, 2008 Change in accounting principles, net of tax Comprehensive loss: Net loss Other comprehensive loss, net of tax: Change in net unrealized securities losses Change in net unrealized derivatives losses Change in defined benefit plans Foreign currency... -

Page 115

... the valuations of reserves, deferred acquisition costs (''DAC'') and deferred sales inducement costs (''DSIC'') related to insurance and living benefit guarantees which resulted in a $32 million pretax charge ($21 million after-tax). In the second quarter of 2010, the Company made an adjustment for... -

Page 116

...the recognition of deferred tax assets and liabilities. These accounting estimates reflect the best judgment of management and actual results could differ. Cash and Cash Equivalents Cash equivalents include time deposits and other highly liquid investments with original maturities of 90 days or less... -

Page 117

... rate is compared to the amortized cost basis of the security. The significant inputs to cash flow projections consider potential debt restructuring terms, projected cash flows available to pay creditors and the Company's position in the debtor's overall capital structure. For structured investments... -

Page 118

... balance has been determined to be fully collectible. Revolving unsecured consumer lines, including credit card loans, are charged off at 180 days past due. Closed-end consumer loans, other than loans secured by one to four family properties, are charged off at 120 days past due and are generally... -

Page 119

...exclusive benefit of variable annuity contractholders and variable life insurance policyholders, who assume the related investment risk. Income and losses on separate account assets accrue directly to the contractholder or policyholder and are not reported in the Company's Consolidated Statements of... -

Page 120

... policy benefits and claims, whereas the fair value of stock market certificate embedded derivatives is included in customer deposits. The changes in the fair value of the equity indexed annuity and investment certificate embedded derivatives are reflected in interest credited to fixed accounts... -

Page 121

... Statements of Operations. For annuity, life and health insurance products, key assumptions underlying those long-term projections include interest rates (both earning rates on invested assets and rates credited to contractholder and policyholder accounts), equity market performance, mortality... -

Page 122

... or payout status are based on future estimated payments using established industry mortality tables and interest rates. Life and Health Insurance Future policy benefits and claims related to life and health insurance include liabilities for fixed account values on fixed and variable universal life... -

Page 123

... when it is reported. Liabilities for estimates of benefits that will become payable on future claims on term life, whole life and health insurance policies are based on the net level premium method, using anticipated premium payments, mortality and morbidity rates, policy persistency and interest... -

Page 124

... fees also include amounts received under marketing support arrangements for sales of mutual funds and other companies' products, such as through the Company's wrap accounts, as well as surrender charges on fixed and variable universal life insurance and annuities. Net Investment Income Net... -

Page 125

... on property-casualty insurance, traditional life and health (DI and LTC) insurance and immediate annuities with a life contingent feature. Premiums on auto and home insurance are net of reinsurance premiums and are recognized ratably over the coverage period. Premiums on traditional life and health... -

Page 126

... to market risk related to certain variable annuity riders. Prior to January 1, 2008, the Company recorded these derivatives in accordance with accounting guidance for derivative contracts held for trading purposes and contracts involved in energy trading and risk management activities. The new... -

Page 127

... pool of assets, primarily syndicated loans and, to a lesser extent, high-yield bonds. Multiple tranches of debt securities are issued by a CDO, offering investors various maturity and credit risk characteristics. The debt securities issued by the CDOs are non-recourse to the Company. The CDO's debt... -

Page 128

... of December 31, 2010 and the Consolidated Statements of Operations for the year ended December 31, 2010: December 31, 2010 Before Consolidation Total assets Total liabilities Total Ameriprise Financial shareholders' equity Noncontrolling interests equity Total liabilities and equity $ $ 124,379 114... -

Page 129

... 3 assets and liabilities held by consolidated investment entities measured at fair value on a recurring basis: 2010 Corporate Debt Securities Balance, January 1 Cumulative effect of accounting change Total gains (losses) included in: Net income Other comprehensive income Purchases, sales, issuances... -

Page 130

...recognized in net investment income related to changes in the fair value of financial assets and liabilities for which the fair value option was elected were $58 million for the year ended December 31, 2010. The majority of the syndicated loans and debt have floating rates; as such, changes in their... -

Page 131

... The following is a summary of Ameriprise Financial investments: December 31, 2010 Available-for-Sale securities, at fair value Commercial mortgage loans, net Trading securities Policy loans Other investments Total $ (in millions) 32,619 $ 2,577 565 733 559 37,053 $ 2009 32,546 2,663 556 720... -

Page 132

...equity. The following tables provide information about Available-for-Sale securities with gross unrealized losses and the length of time that individual securities have been in a continuous unrealized loss position: December 31, 2010 Less than 12 months Description of Securities Number of Securities... -

Page 133

...period(3) Reclassification of gains included in net income Impact of DAC, DSIC, benefit reserves and reinsurance recoverables Balance at December 31, 2010 (1) Deferred Income Tax $ Accumulated Other Comprehensive Income (Loss) Related to Net Unrealized Securities Gains (Losses) $ (168) (1,479) 492... -

Page 134

...credit quality. See Note 2 for information regarding the Company's accounting policies related to loans and the allowance for loan losses. Allowance for Loan Losses The following table presents a rollforward of the allowance for loan losses for the year ended December 31, 2010 and the ending balance... -

Page 135

... deferred fees and costs are not material to the Company's total loan balance. During the year ended December 31, 2010, the Company purchased $283 million and $59 million and sold $415 million and $40 million of consumer bank loans and syndicated loans, respectively. Credit Quality Information... -

Page 136

...of NY) for term life insurance and 2002 (2003 for RiverSource Life of NY) for individual fixed and variable universal life insurance. Policies issued prior to these dates are not subject to these same reinsurance levels. Generally, the maximum amount of life insurance risk retained by the Company is... -

Page 137

... 30, 2010, the Company acquired the long-term asset management business of Columbia Management from Bank of America. The acquisition is expected to further enhance the scale and performance of its retail mutual fund and institutional asset management businesses. Our initial estimate of the purchase... -

Page 138

...the Company had impairment charges of $8 million related to Asset Management contracts. Estimated intangible amortization expense as of December 31, 2010 for the next five years was as follows: (in millions) 2011 2012 2013 2014 2015 $ 46 46 44 38 38 10. Deferred Acquisition Costs and Deferred Sales... -

Page 139

...Equity indexed annuity embedded derivatives Variable annuity fixed sub-accounts Variable annuity GMWB Variable annuity GMAB Other variable annuity guarantees Total annuities VUL/UL insurance VUL/UL insurance additional liabilities Other life, disability income and long term care insurance Auto, home... -

Page 140

..., the Company discontinued new sales of equity indexed annuities. Variable Annuities Purchasers of variable annuities can select from a variety of investment options and can elect to allocate a portion to a fixed account. A vast majority of the premiums received for variable annuity contracts are... -

Page 141

... asset allocation models (of the five that are available prior to withdrawal). Credits are applied annually for a specified number of years to increase the guaranteed amount as long as withdrawals have not been taken. Variable annuity contractholders age 79 or younger at contract issue can also... -

Page 142

... The liabilities for guaranteed benefits are supported by general account assets. The following table summarizes the distribution of separate account balances by asset type for variable annuity contracts providing guaranteed benefits: December 31, 2010 (in millions) Mutual funds: Equity Bond Other... -

Page 143

... these interest rate risks. Certain investment certificate products have returns tied to the performance of equity markets. The Company guarantees the principal for purchasers who hold the certificate for the full 52-week term and purchasers may participate in increases in the stock market based on... -

Page 144

... in open market transactions. On June 8, 2009, the Company issued $300 million of unsecured senior notes which mature June 28, 2019, and incurred debt issuance costs of $3 million. Interest payments are due semi-annually in arrears on June 28 and December 28. On March 11, 2010, the Company issued... -

Page 145

... of Ameriprise Financial long-term debt were as follows: (in millions) 2011 2012 2013 2014 2015 Thereafter Total future maturities $ - - - - 700 1,564 2,264 $ Short-term borrowings During 2010, the Company entered into repurchase agreements in exchange for cash, which it accounts for as secured... -

Page 146

... variable annuity riders using internal valuation models. These models calculate fair value by discounting expected cash flows from benefits plus margins for profit, risk and expenses less embedded derivative fees. The projected cash flows used by these models include observable capital market... -

Page 147

... tables present the balances of assets and liabilities of Ameriprise Financial measured at fair value on a recurring basis: December 31, 2010 Level 1 Assets Cash equivalents Available-for-Sale securities: Corporate debt securities Residential mortgage backed securities Commercial mortgage backed... -

Page 148

... government bonds and obligations Common and preferred stocks Other structured investments Other debt obligations Total Available-for-Sale securities Trading securities Separate account assets Other assets Total assets at fair value Liabilities Future policy benefits and claims Customer deposits... -

Page 149

...in net income related to Level 3 assets and liabilities of Ameriprise Financial held at December 31: 2010 Benefits, Claims, Losses and Settlement Expenses 2009 Benefits, Claims, Losses and Settlement Expenses Net Investment Income Available-for-Sale securities: Corporate debt securities Residential... -

Page 150

... by discounting estimated cash flows and incorporating adjustments for prepayment, administration expenses, severity and credit loss estimates, with discount rates based on the Company's estimate of current market conditions. Loans held for sale are measured at the lower of cost or market and... -

Page 151

...withdrawal behavior, penalty fees, expense margin and the Company's nonperformance risk specific to these liabilities. Banking and brokerage customer deposits are liabilities with no defined maturities and fair value is the amount payable on demand at the reporting date. Separate Account Liabilities... -

Page 152

... and GMAB Other derivatives: Interest rate Interest rate lock commitments Equity GMDB EIA EIA embedded derivatives Stock market certificates Stock market certificates embedded derivatives Seed money Ameriprise Financial Franchise Advisor Deferred Equity Plan Foreign exchange Foreign currency Total... -

Page 153

... rate contracts Equity contracts Credit contracts Embedded derivatives(1) Total GMWB and GMAB Other derivatives: Equity GMDB EIA EIA embedded derivatives Stock market certificates Stock market certificates embedded derivatives Seed money Ameriprise Financial Franchise Advisor Deferred Equity Plan... -

Page 154

... of its Ameriprise Financial Franchise Advisor Deferred Equity Plan. In the fourth quarter of 2010, the Company extended the contract through 2011. As part of the contract, the Company expects to cash settle the difference between the value of a fixed number of shares at the contract date (which may... -

Page 155

... variability in future cash flows is 25 years and relates to forecasted debt interest payments. Fair Value Hedges During the first quarter of 2010, the Company entered into and designated as fair value hedges three interest rate swaps to convert senior notes due 2015, 2019 and 2020 from fixed rate... -

Page 156

...retirement. Compensation expense related to the Company match is recognized on a straight-line basis over the vesting period. Ameriprise Financial 2008 Employment Incentive Equity Award Plan The 2008 Plan is designed to align new employees' interests with those of the shareholders of the Company and... -

Page 157

... for Ameriprise Financial common stock upon the director's termination of service. The employee awards generally vest ratably over three to four years. Compensation expense for deferred share units and restricted stock units is based on the market price of Ameriprise Financial stock on the date of... -

Page 158

.... The Employee Advisor Deferral Plan also gives qualifying employee advisors the choice to defer a portion of their cash-based compensation beginning in 2010. This deferral can be in the form of share-based awards or other investment options. Deferrals are not subject to future service requirements... -

Page 159

... Franchise Advisor Deferral Plan. See Note 16 for additional information. In 2009, the Company issued and sold 36 million shares of its common stock. The proceeds of $869 million were used for general corporate purposes, including the Company's acquisition of the long-term asset management business... -

Page 160

... Company has five broker-dealer subsidiaries, American Enterprise Investment Services, Inc., Ameriprise Financial Services, Inc., Securities America, Inc. (''SAI''), RiverSource Distributors, Inc. and Columbia Management Investment Distributors, Inc. The broker-dealers are subject to the net capital... -

Page 161

... benefits and claims Investment impairments and write-downs Deferred compensation Unearned revenues Accrued liabilities Investment related Net operating loss and tax credit carryforwards Other Gross deferred income tax assets Deferred income tax liabilities: Deferred acquisition costs Deferred sales... -

Page 162

... 1997 through 2004 tax returns in recent years as part of the overall examination of the American Express Company consolidated returns. However, for federal income tax purposes these years continue to remain open as a consequence of certain issues under appeal. In the fourth quarter of 2010, the IRS... -

Page 163

... funded, while other employees receive payments at the time of retirement or termination under applicable labor laws or agreements. The components of the net periodic benefit cost for all pension plans were as follows: Years Ended December 31, 2010 Service cost Interest cost Expected return on plan... -

Page 164

...The weighted average assumptions used to determine net periodic benefit cost for pension plans were as follows: 2010 Discount rates Rates of increase in compensation levels Expected long-term rates of return on assets 5.28% 4.22 8.00 2009 6.22% 4.23 8.20 2008 6.17% 4.22 8.20 In developing the 2010... -

Page 165

... 2010 Asset Category Equity securities: U.S. large cap stocks U.S. small cap stocks Non-U.S. large cap stocks Emerging markets Debt securities: U.S. investment grade bonds U.S. high yield bonds Non-U.S. investment grade bonds Private real estate investment trust Hedge funds Pooled pension funds Cash... -

Page 166

...the reporting date Purchases, sales, and settlements, net Balance at December 31, 2009 Actual return on plan assets: Relating to assets still held at the reporting date Purchases, sales, and settlements, net Balance at December 31, 2010 The Company's pension plans expect to make benefit payments to... -

Page 167

...Company also made contributions equal to 1% of base pay each pay period, which were automatically invested in the Ameriprise Financial Stock Fund. Under the 401(k) Plan, employees become eligible for contributions under the plan during the pay period they reach 60 days of service. Fixed and variable... -

Page 168

...: sales and product or service features of, or disclosures pertaining to, mutual funds, annuities, equity and fixed income securities, insurance products, brokerage services, financial plans and other advice offerings; trading practices within the Company's asset management business, supervision... -

Page 169

...; information security; the delivery of financial plans and the suitability of investments and product selection processes. The number of reviews and investigations has increased in recent years with regard to many firms in the financial services industry, including Ameriprise Financial. The Company... -

Page 170

... charges investment and advisory management fees to the other segments. All costs related to shared services are allocated to the segments based on a rate times volume or fixed basis. The Advice & Wealth Management segment provides financial planning and advice, as well as full service brokerage... -

Page 171

... variable universal life separate account balances. This segment earns intersegment revenues from fees paid by the Asset Management segment for marketing support and other services provided in connection with the availability of RiverSource Variable Series Trust, Columbia Funds Variable Insurance... -

Page 172

...deposit interest expense Net revenues Depreciation and amortization expense All other expenses Total expenses Pretax income (loss) Income tax provision Net income Less: Net income attributable to noncontrolling interests Net income attributable to Ameriprise Financial Year Ended... $ Corporate & Other... -

Page 173

... Consolidated Balance Sheets and correspondingly charged to general and administrative expense on the Consolidated Statements of Operations. 28. Quarterly Financial Data (Unaudited) 2010 12/31 Net revenues Pretax income Net income Net income attributable to Ameriprise Financial Earnings per share... -

Page 174

... Officer and Chief Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2010. In making this assessment, the Company's management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission... -

Page 175

... with the standards of the Public Company Accounting Oversight Board (United States), the 2010 consolidated financial statements of Ameriprise Financial, Inc., and our report dated February 28, 2011, expressed an unqualified opinion thereon. 27FEB200923311029 Minneapolis, Minnesota February 28... -

Page 176

..., Mr. Sweeney served as Senior Vice President and General Manager of Banking, Brokerage and Managed Products of AEFC since April 2002. Prior thereto, he served as Senior Vice President and Head, Business Transformation, Global Financial Services of American Express from March 2001 until April... -

Page 177

..., she served as Vice President-Business Planning and Communications for the Group President, Global Financial Services at American Express. John R. Woerner-President-Insurance and Chief Strategy Officer Mr. Woerner (42) has been our President-Insurance and Chief Strategy Officer since February 2008... -

Page 178

...the Ameriprise Advisor Group Deferred Compensation Plan, and 1,223,986 shares of common stock issuable under the Amended Franchise Advisor Deferred Equity Plan. Information concerning the market for our common shares and our shareholders can be found in Part II, Item 5 of this Annual Report on Form... -

Page 179

... incorporated herein by reference. 2. Financial schedules required to be filed by Item 8 of this form, and by Item 15(b): Schedule I-Condensed Financial Information of Registrant (Parent Company Only) All other financial schedules are not required under the related instructions, or are inapplicable... -

Page 180

... caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. AMERIPRISE FINANCIAL, INC. (Registrant) Date: February 28, 2011 By /s/ Walter S. Berman Walter S. Berman Executive Vice President and Chief Financial Officer Power of Attorney KNOW ALL PERSONS BY THESE... -

Page 181

... Siri S. Marshall Director Date: February 28, 2011 By /s/ Jeffrey Noddle Jeffrey Noddle Director Date: February 28, 2011 By /s/ H. Jay Sarles H. Jay Sarles Director Date: February 28, 2011 By /s/ Robert F. Sharpe, Jr. Robert F. Sharpe, Jr. Director Date: February 28, 2011 By /s/ William... -

Page 182

(This page has been left blank intentionally.) -

Page 183

Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of Ameriprise Financial, Inc. We have audited the consolidated financial statements of Ameriprise Financial, Inc. as of December 31, 2010 and 2009, and for each of the three years in the period ended ... -

Page 184

Schedule I-Condensed Financial Information of Registrant (Parent Company Only) Table of Contents Condensed Statements of Operations ...Condensed Balance Sheets ...Condensed Statements of Cash Flows ...Notes to Condensed Financial Information of Registrant ...F-3 F-4 F-5 F-6 F-2 -

Page 185

... Financial Information of Registrant Condensed Statements of Operations (Parent Company Only) Years Ended December 31, 2010 Revenues Management and financial advice fees Distribution fees Net investment income Other revenues Total revenues Banking and deposit interest expense Total net revenues... -

Page 186

...' Equity Liabilities: Accounts payable and accrued expenses Due to subsidiaries Debt Other liabilities Total liabilities Shareholders' Equity: Common shares ($.01 par value; shares authorized, 1,250,000,000; shares issued, 301,366,044 and 295,839,581, respectively) Additional paid-in capital... -

Page 187

... paid to shareholders Repurchase of common shares Proceeds from issuance of common stock Issuances of debt, net of issuance costs Exercise of stock options Excess tax benefits from share-based compensation Other, net Net cash provided by (used in) financing activities Net increase (decrease) in cash... -

Page 188

... 31, 2010, the debt of Ameriprise Financial included $397 million of repurchase agreements, which are accounted for as secured borrowings. • • 3. Guarantees, Commitments and Contingencies The Parent Company is the guarantor for an operating lease of IDS Property Casualty Insurance Company. All... -

Page 189

... Proxy Statement for the Annual Meeting of Shareholders held on April 28, 2010, File No. 001-32525, filed on March 19, 2010). Ameriprise Financial Deferred Compensation Plan, as amended and restated effective April 1, 2010 (incorporated by reference to Exhibit 10.2 of the Quarterly Report on Form 10... -

Page 190

.... and Ameriprise Certificate Company, dated as of March 2, 2009 (incorporated by reference to Exhibit 10.19 of the Annual Report on Form 10-K, File No. 1-32525, filed on March 2, 2009). Ratio of Earnings to Fixed Charges. Portions of the Ameriprise Financial, Inc. 2010 Annual Report to Shareholders... -

Page 191

... 101* The following materials from Ameriprise Financial, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2010, formatted in XBRL: (i) Consolidated Statements of Operations for the years ended December 31, 2010, 2009 and 2008; (ii) Consolidated Balance Sheets at December 31... -

Page 192

(This page has been left blank intentionally.) -

Page 193

... The following graph compares the cumulative five-year total return for shareholders of Ameriprise Financial, Inc. common stock with the cumulative total returns of the S&P 500 Index and the S&P Financials Index. The graph tracks the performance of a $100 investment in our common stock and in each... -

Page 194

... from the investment community should be sent to: Investor Relations 243 Ameriprise Financial Center Minneapolis, MN 55474 Trademarks The following trademarks of Ameriprise Financial, Inc. and its affiliates appear in this report: Active Portfolios® MORE WITHIN REACH® New Retirement Mindscape... -

Page 195

...State University Former Chairman PNC Bank, NA, New Jersey Kim M. Sharan President Financial Planning and Wealth Strategies and Chief Marketing Officer Joseph E. Sweeney President Advice & Wealth Management Products and Services William F. Truscott CEO, U.S. Asset Management and President, Annuities... -

Page 196

ameriprise.com © 2011 Ameriprise Financial, Inc. All rights reserved. 400425 G (3/11)