Air New Zealand 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

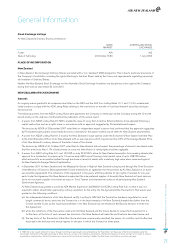

StockExchangeListings

Air New Zealand’s Ordinary Shares are listed on:

NZSX

MARKET

AUSTRALIAN STOCK

EXCHANGE

Ticker:

Date of full listing:

AIR

24 October 1989

AIZ

1 July 2002

PLACEOFINCORPORATION

NewZealand

In New Zealand, the Company’s Ordinary Shares are listed with a “non-standard” (NS) designation. This is due to particular provisions of

the Company’s Constitution, including the rights attaching to the Kiwi Share1 held by the Crown and requirements regulating ownership

and transfer of Ordinary Shares.

Neither the New Zealand Stock Exchange nor the Australian Stock Exchange has taken any disciplinary action against the Company

during the financial year ended 30 June 2012.

NEWZEALANDSTOCKEXCHANGE

General:

An ongoing waiver granted to all companies dual listed on the NZX and the ASX from Listing Rules 11.1.1 and 11.1.4 to enable dual

listed issuers to comply with the ASX Listing Rules relating to the restrictions on transfer of restricted (vendor) securities during an

escrow period.

The following waivers from the NZSX Listing Rules were granted to the Company or relied upon by the Company during the 12 month

period ending on the date two months before the publication of the annual report:

1. A waiver from NZSX Listing Rule 8.1.7(b) to enable the issue of Long Term Incentive Scheme Options to be adjusted following a

capital restructure such as a rights issue, in accordance with an approach suggested by PricewaterhouseCoopers.

The decision by NZXR of 3 December 2007 noted that an independent expert’s opinion had confirmed that the approach suggested

by PricewaterhouseCoopers would create economic neutrality for the option holders and all other Air New Zealand shareholders.

2. A waiver from NZSX Listing Rule 8.1.3 to allow Air New Zealand to issue options under the Executive Officer Option Incentive Plan

to the Chief Executive Officer of Air New Zealand with an exercise price which may be less than 90% of the Average Market Price

of Air New Zealand’s ordinary shares at the date of issue of the shares.

The decision by NZXR of 31 October 2007 noted that Air New Zealand did not expect the percentage of shares to be issued under

the Plan to be more than 1.1% of total shares on issue and that dilution of voting rights would be negligible.

3. A waiver from NZX Listing Rule 9.1.1 and 10.5.5(f) on July 23 2009 to allow Air New Zealand exemption from seeking shareholder

approval for a transaction to acquire up to 14 narrow body A320 aircraft having a total market value of up to US$750 million,

which amounts to an acquisition (either through purchase or lease) of assets with a relatively high value when measured against

Air New Zealand’s Average Market Capitalisation.

4. In December 2011 Air New Zealand and Her Majesty the Queen in Right of New Zealand acting by and through the Chief Executive

of the Ministry of Economic Development (the Crown) entered into an agreement for the provision by Air New Zealand of air travel

services (the Agreement). The initial term of the Agreement is five years, with the potential for two rights of renewal for one year

each. Under the Agreement Air New Zealand is appointed the sole preferred supplier of domestic New Zealand air travel services

and a non-exclusive supplier of air travel services on Trans Tasman and international routes to all participating New Zealand

Government Agencies.

Air New Zealand was granted a waiver by NZX Market Supervision (NZXMS) from NZSX Listing Rule 9.2.1 so that it was not

required to obtain shareholder approval by ordinary resolution for the entry into the Agreement (the Transaction). That waiver was

granted on the following conditions:

(a) two independent directors of Air New Zealand certify in writing to NZX that the Transaction has been negotiated on arms’

length commercial terms, entry into the Transaction is in the best interests of Air New Zealand shareholders (other than the

Crown) and the Crown as the majority shareholder in Air New Zealand has not influenced the Board’s decision to enter into

the Agreement;

(b) when the initial term of the Transaction ends and if Air New Zealand and the Crown decide to renew the Transaction for a

further term, at the time of such renewal two directors of Air New Zealand will make the certifications described above; and

(c) the key terms of the Transaction (other than those which are commercially sensitive), the waiver, its condition and its effect are

disclosed in the half year and annual reports for the year in which the Transaction takes place.

General Information

1 In 1989, the Crown issued a Notice that arises through its holding of special rights Convertible Share, the “Kiwi Share” and the power of the Kiwi Shareholder under the

Constitution. Full details of the rights pertaining to these shares are set out in the Company’s Constitution. The Kiwi Share does not confer any right on its holder to vote at a

shareholders’ meeting unless the Kiwi Share has been converted into an Ordinary Share by its holder. The Kiwi Share is not listed on any stock exchange.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

71