Air New Zealand 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

26

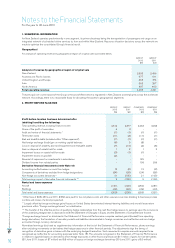

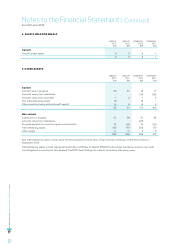

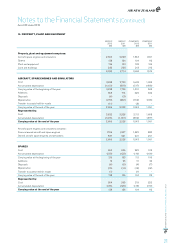

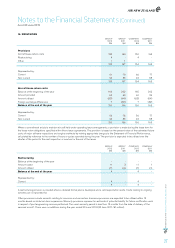

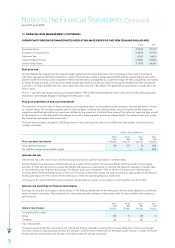

14. REVENUE IN ADVANCE

GROUP

2012

$M

GROUP

2 011

$M

COMPANY

2012

$M

COMPANY

2 011

$M

Current

Transportation sales in advance 779 767 776 758

Loyalty programme 103 106 103 107

Other 20 15 14 3

902 888 893 868

Non-current

Loyalty programme 131 122 131 122

Other 4 - 3 -

135 122 134 122

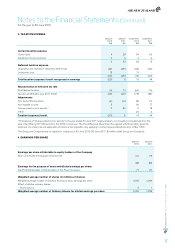

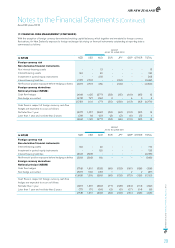

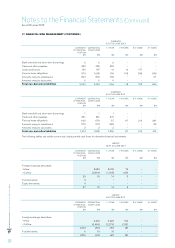

15. INTEREST-BEARING LIABILITIES

GROUP

2012

$M

GROUP

2 011

$M

COMPANY

2012

$M

COMPANY

2 011

$M

Current

Secured borrowings 14 60 - -

Finance lease liabilities 141 92 83 53

155 152 83 53

Non-current

Secured borrowings 83 94 - -

Unsecured bonds 150 - 150 -

Finance lease liabilities 1,304 1,009 889 555

1,537 1,103 1,039 555

Interest rates:

Fixed rate 762 188 559 -

Floating rate 930 1,067 563 608

At amortised cost 1,692 1,255 1,122 608

At fair value 1,605 1,276 1,053 614

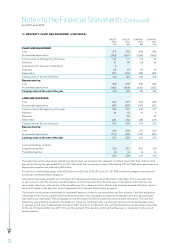

All borrowings are secured over aircraft or aircraft related assets and are subject to floating interest rates.

Finance lease liabilities are secured over aircraft and are subject to both fixed and floating interest rates. Fixed interest rates ranged from

2.4 percent to 5.1 percent in 2012 (30 June 2011: 2.5 percent to 5.1 percent). Purchase options are available on expiry or, if applicable

under the lease agreement, on early termination of the finance leases. The Company’s finance lease liabilities are with related parties.

On 28 September 2011 Air New Zealand issued $150 million of unsecured, unsubordinated fixed rate bonds. The bonds have a maturity

date of 15 November 2016 and an interest rate of 6.90% payable semi-annually.

GROUP

2012

$M

GROUP

2 011

$M

COMPANY

2012

$M

COMPANY

2 011

$M

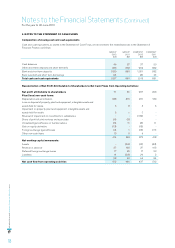

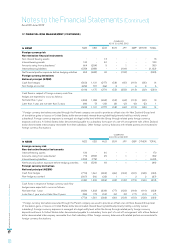

Finance lease liabilities

Repayable as follows:

Not later than 1 year 171 113 106 66

Later than 1 year and not later than 5 years 724 539 444 281

Later than 5 years 739 594 549 332

1,634 1,246 1,099 679

Less future finance costs (189) (145) (127) (71)

Present value of future rentals 1,445 1,101 972 608

Repayable as follows:

Not later than 1 year 141 92 83 53

Later than 1 year and not later than 5 years 629 471 375 243

Later than 5 years 675 538 514 312

1,445 1,101 972 608

Notes to the Financial Statements (Continued)

As at 30 June 2012