Air New Zealand 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

44

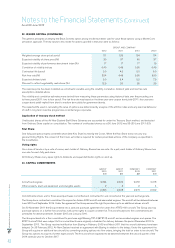

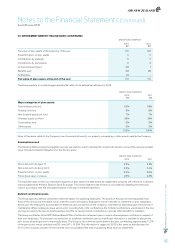

25. CONTINGENT LIABILITIES (CONTINUED)

The Group has a partnership agreement with Pratt and Whitney in relation to the CEC in which it holds a 49 percent interest (Note 13).

By the nature of the agreement, joint and several liability exists between the two parties. Total liabilities of the CEC are $39 million (30

June 2011: $77 million).

The Company enters into financial guarantee contracts to guarantee the indebtedness of other companies within the Group. Air New

Zealand treats the guarantee contract as a contingent liability until such time as it becomes probable that the Company will be required

to make a payment under the guarantee.

The Company guarantees aircraft end of lease obligations of Air New Zealand Aircraft Holdings Limited and New Zealand International

Airlines Limited.

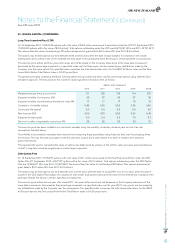

26. RETIREMENT BENEFIT OBLIGATIONS

Defined benefit plans

The Group operates two defined benefit plans for qualifying employees in New Zealand and overseas. The New Zealand plan is now

closed to new members. The plans provide a benefit on retirement or resignation based upon the employee’s length of membership

and final average salary. Each year an actuarial calculation is undertaken using the Projected Unit Credit Method to calculate the

present value of the defined benefit obligation and the related current service cost. The most recent actuarial valuations were provided

for 30 June 2012.

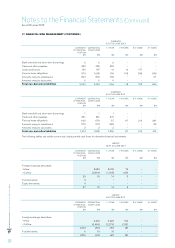

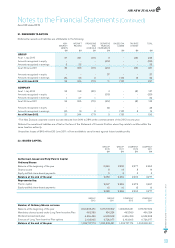

GROUP AND COMPANY

2012

$M

2 011

$M

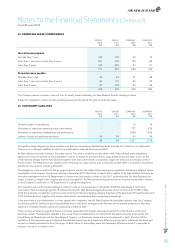

Amounts recognised in the Statement of Financial Position:

Present value of funded obligations (130) (116 )

Fair value of plan assets 113 110

(17) (6)

Unrecognised actuarial losses 27 10

Included in Statement of Financial Position 10 4

Expense recognised in the Statement of Financial Performance:

Current service cost (2) (2)

Interest cost (3) (4)

Expected return on plan assets 6 5

Total included in "Labour" 1 (1)

Actual return on plan assets 2 6

Changes in the present value of the defined benefit obligation:

Defined benefit obligation at the beginning of the year (116 ) (112 )

Current service cost (2) (2)

Interest cost (3) (4)

Contributions by plan participants (2) (2)

Actuarial (losses)/gains (14) 1

Benefits paid 6 3

Settlements 1 -

Defined benefit obligation at the end of the year (130) (116 )

Notes to the Financial Statements (Continued)

As at 30 June 2012