Air New Zealand 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

12

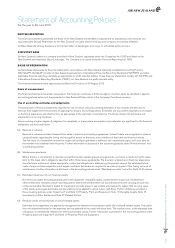

Derivative financial instruments at fair value through profit or loss

Derivative financial instruments, other than those designated as hedging instruments in a qualifying cash flow hedge (refer below), are

classified as held for trading. Subsequent to initial recognition, derivative financial instruments in this category are stated at fair value.

The gain or loss on remeasurement to fair value is recognised immediately in the Statement of Financial Performance.

Hedge accounted financial instruments

Where financial instruments qualify for hedge accounting in accordance with NZ IAS 39: Financial Instruments: Recognition and

Measurement, recognition of any resultant gain or loss depends on the nature of the hedging relationship, as detailed below.

Cash flow hedges

Changes in the fair value of hedging instruments designated as cash flow hedges are recognised within Other Comprehensive Income

and accumulated within equity to the extent that the hedges are deemed effective in accordance with NZ IAS 39: Financial Instruments:

Recognition and Measurement. To the extent that the hedges are ineffective for accounting, changes in fair value are recognised in the

Statement of Financial Performance.

If a hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated or exercised, or the designation

of the hedge relationship is revoked or changed, then hedge accounting is discontinued. The cumulative gain or loss previously

recognised in the cash flow hedge reserve remains there until the forecast transaction occurs. If the underlying hedged transaction is no

longer expected to occur, the cumulative, unrealised gain or loss recognised in the cash flow hedge reserve with respect to the hedging

instrument is recognised immediately in the Statement of Financial Performance.

Where the hedge relationship continues throughout its designated term, the amount recognised in the cash flow hedge reserve

is transferred to the Statement of Financial Performance in the same period that the hedged item is recorded in the Statement of

Financial Performance, or, when the hedged item is a non-financial asset, the amount recognised in the cash flow hedge reserve is

transferred to the carrying amount of the asset when it is recognised.

Net investment hedge

Hedges of net investments in foreign operations are accounted for similarly to cash flow hedges. Any gain or loss on the hedging

instrument relating to the effective portion of the hedge is recognised in other comprehensive income and accumulated in the foreign

currency translation reserve within equity. The gain or loss relating to the ineffective portion of the hedge is recognised immediately in

the Statement of Financial Performance.

Fair value estimation

The fair value of investments in quoted equity instruments is determined by reference to quoted market prices in an active market. This

equates to “Level 1” of the fair value hierarchy defined within “Amendments to NZ IFRS 7: Financial Instruments: Disclosures”. The fair

value of derivative financial instruments is based on published market prices for similar assets or liabilities at balance date (“Level 2” of

the fair value hierarchy). The fair value of interest-bearing liabilities for disclosure purposes is calculated based on the present value of

future principal and interest cash flows, discounted at the market rate of interest for similar liabilities at reporting date.

PROPERTY, PLANT AND EQUIPMENT

Owned assets

Items of property, plant and equipment are stated at cost or deemed cost less accumulated depreciation and accumulated impairment

losses. Cost includes expenditure that is directly attributable to the acquisition of the item and in bringing the asset to the location and

working condition for its intended use. Cost may also include transfers from equity of any gains or losses on qualifying cash flow hedges

of foreign currency purchases of property, plant and equipment.

Where significant parts of an item of property, plant and equipment have different useful lives, they are accounted for separately.

A portion of the cost of an acquired aircraft is attributed to its service potential (reflecting the maintenance condition of its engines) and

is depreciated over the shorter of the period to the next major inspection event, overhaul, or the remaining life of the asset.

Leased assets

Leases under which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. All other

leases are classified as operating leases.

Upon initial recognition, assets held under finance leases are measured at amounts equal to the lower of their fair value and the present

value of the minimum lease payments at inception of the lease. A corresponding liability is also established.

Subsequent to initial recognition, the asset is accounted for in accordance with the accounting policy applicable to that asset.

Manufacturers’ credits

The Group receives credits and other contributions from manufacturers in connection with the acquisition of certain aircraft and

engines. Depending on the reason for which the amounts are received, the credits and other contributions are either recorded as a

reduction to the cost of the related aircraft and engines, or offset against the associated operating expense. When the aircraft are held

under operating leases, the amounts are deferred and deducted from the operating lease rentals on a straight-line basis over the period

of the related lease as deferred credits.

Statement of Accounting Policies (Continued)

For the year to 30 June 2012