Air Canada 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

MESSAGE FROM THE PRESIDENT AND

CHIEF EXECUTIVE OFFICER

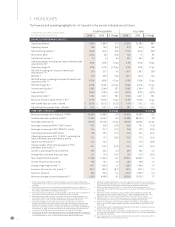

2014 was a breakout year for Air Canada, where the

Corporation showed what we are truly capable of.

Record sales. Record EBITDAR. Record Adjusted Net

Profit. Record number of passengers carried. Record

load factor. Best airline in North America for the fifth

year in a row.

Adjusted net income of $531 million ($1.81 per

diluted share) exceeded the previous year’s record

by $191 million ($0.61 per diluted share) or by

56.2 per cent. On a GAAP basis, annual net income

was $105 million ($0.34 per diluted share), up from

$10 million ($0.02 cents per diluted share) in the prior

period. EBITDAR was $1.67 billion, an improvement

of 16.6 per cent over 2013 excluding the impact of

benefit plan amendments.

These results were achieved thanks to everyone in

the organization working together to both effectively

increase revenues and take bold action to reduce

costs. We achieved an operating margin of 6.1 per

cent in 2014, up 1.8 percentage points from the

previous year, excluding the impact of benefit

plan amendments.

I am extremely pleased to see Air Canada execute

on our margin enhancement strategies and build

a sustainably profitable enterprise. Return on

invested capital at year end was 12.1 per cent, versus

10.5 per cent a year earlier. This puts us squarely

within our stated target of a sustainable ROIC of

10-to-13 per cent by 2015.

Operating revenue grew for the sixth consecutive

year to reach a record $13.3 billion, up $890 million

from 2013. All market segments showed an increase,

with passenger revenue climbing 7.1 per cent over

2013. As anticipated and planned, passenger yield on

a stage length adjusted basis decreased 1.3 per cent,

attributable to our strategy of profitably increasing

long-haul international flying, particularly in the

leisure market using incremental lower cost capacity.

Overall, we achieved a 2.6 per cent reduction in

adjusted unit costs despite an unfavourable currency

impact owing to the much weaker Canadian dollar as

compared to the previous year.

Air Canada flew more customers than ever in 2014,

with a passenger load factor of 83.4 per cent. We

ended the year with nearly $2.7 billion in liquidity,