Air Canada 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

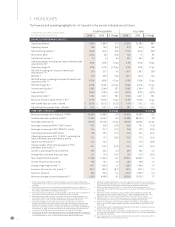

12 2014 Annual Report

all of its 15 Embraer 175 aircraft from the mainline

fleet to Sky Regional which operates these aircraft

on behalf of Air Canada at a much lower-cost. In

addition, since 2014, Air Georgian, also a lower-cost

regional provider, operates a number of regional

routes on Air Canada’s behalf using Bombardier

CRJ-100 and Beechcraft 1900. In 2015, Air Canada

plans to continue to seek opportunities to further

reduce regional costs and optimize its regional fleet

deployment.

On February 2, 2015, Air Canada announced that it

had concluded an amended and extended capacity

purchase agreement with Jazz, a wholly owned

subsidiary of Chorus Aviation Inc. The agreement

provides both parties with greater stability and

significant cost reductions through a better alignment

of their interests. The agreement also provides

for long-term stability by eliminating the risks,

uncertainties and set-up costs of a potential transition

to alternative regional providers in 2021. Post-2020,

Air Canada expects Jazz will provide competitive costs

and continued high service levels.

The highlights of the new capacity purchase

agreement include:

• Extension of the term by five years to

December 31, 2025

• Establishment of a pilot mobility agreement that

provides Jazz pilots with access to pilot vacancies

at Air Canada, thus allowing a significant reduction

in Jazz operating costs

• Simplification and modernization of the Jazz fleet

which will provide improved service and greater

efficiency through the addition of 23 Bombardier

Dash 8-Q400 aircraft

• Reduction in Air Canada and Jazz costs derived

from a combination of improved fleet economics,

greater network flexibility and reduced operating

and labour costs. This supports Air Canada’s cost

reduction initiatives

• Modification of Jazz’s CPA fee structure, moving

from a “cost plus” mark-up to a more industry

standard fixed fee compensation structure. This

provides a more competitive structure and better

aligns the cost reduction goals of both Air Canada

and Jazz. This change also eliminates non-value

added costs and the necessity of the 2015

benchmarking exercise

OTHER REVENUE OPTIMIZATION AND

COST REDUCTION INITIATIVES

Air Canada continues to foster a culture of continuous

cost transformation and revenue improvement across

the organization. To this end, Air Canada’s Business

Transformation team actively pursues its mission

to identify and help implement initiatives through

productivity enhancements, process reforms and

other measures. Initiatives may include revising

business and operational processes, including supply

chain and maintenance operations, improving

employee productivity and asset utilization,

consolidating call centres and promoting workplace

policies to drive revenue and reduce costs. The airline

is also implementing a continuous improvement

program at airports which will also optimize supplier

arrangements and reduce aircraft turnaround times.

Lowering distribution costs, including through the

renegotiation of global distribution system (“GDS”)

and other agreements, is another key initiative aimed

at increasing margins.

In the area of yield management, Air Canada is

implementing a new passenger revenue management

system to optimize its revenue performance on the

basis of a passenger’s full trip itinerary rather than on

individual flight legs. Given the number of connecting

passengers Air Canada serves, this new system will

allow the airline to better optimize passenger flows

across the network. Air Canada estimates that this

initiative, which will be implemented in the second

quarter of 2015, will drive incremental annual revenues

in excess of $100 million.

Air Canada is also increasing its ancillary revenues

through onboard retail and other à la carte services,

such as those related to ticket changes, baggage,

seat selection, upgrades, preferred seating, as well as

onboard offerings, including food, duty free shopping,

in-flight entertainment and onboard Wi-Fi.

The airline is also generating revenues from its

tripartite credit card agreements and loyalty

partnerships. New and renewed financial card

partnerships in conjunction with Aeroplan help bolster

overall ancillary revenues and enhance cardholders’

travel experience by providing complimentary travel

benefits, such as first checked baggage, priority check-

in and certain access to Maple Leaf Lounges. These

Aeroplan co-brand financial card partner agreements

included the introduction of TD co-branded cards as

well as the renewal of the American Express and CIBC

card partnerships.

To better monetize its ancillary offerings and

increase related revenues, in August 2014, Air Canada

introduced a new merchandising tool to help

customize, differentiate and combine its offerings. This

new tool also provides the airline with the ability to

more quickly introduce new products.

In 2014, Air Canada’s ancillary revenue per passenger

increased 10% when compared to 2013.