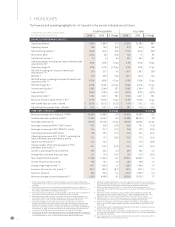

Air Canada 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

2014 Management’s Discussion and Analysis 11

2014 Management’s Discussion and Analysis

customer benefits vis-à-vis its competitors in the

leisure markets.

Air Canada rouge operates under the principle of

maintaining a long-term cost structure consistent

with that of its competitors in the leisure market.

Air Canada has effectively lowered its CASM on

leisure routes through increased seat density, lower

wage rates, more efficient work rules, and reduced

overhead costs. Air Canada rouge launched its

operations in 2013 with four aircraft and by the end

of 2014 its fleet grew to 28 aircraft (20 Airbus A319

and eight Boeing 767 aircraft). Six Boeing 767-300

aircraft (four of which will be transferred from the

mainline fleet and two of which will be leased from

third parties) and two Airbus A321 aircraft (which

will be leased from third parties) will be added to

the Air Canada rouge fleet during 2015 for a planned

fleet of 36 aircraft by the end of 2015. Air Canada

continues to seek additional opportunities to

accelerate the growth of the Air Canada rouge fleet

in order to further expand margins.

The 2014 collective agreement concluded with the

Air Canada Pilots Association (“ACPA”), the union

representing Air Canada’s pilots, further facilitates

rouge’s evolution with improved fleet flexibility

and terms. While the maximum number of aircraft

Air Canada rouge may operate remains at 50,

Air Canada rouge’s fleet may now have up to

25 wide-body aircraft (previously 20) and 25 Airbus

narrow-body aircraft (previously 30).

CONTINUED INTRODUCTION OF

FUEL-EFFICIENT BOEING 787 AIRCRAFT

Air Canada is generating fuel and maintenance cost

savings with the arrival of its first seven Boeing 787-8

Dreamliners (six aircraft in 2014 and an additional

aircraft in January 2015). Air Canada plans to take

delivery of an additional 30 Boeing 787 aircraft by the

end of 2019, comprised of eight Boeing 787-8 aircraft

and 22 larger capacity Boeing 787-9 aircraft. The

Boeing 787 Dreamliner is driving new opportunities

for profitable growth at Air Canada. In addition to

replacing Boeing 767s on existing mainline routes,

these aircraft are also serving new international

destinations made viable by its lower operating

costs, mid-size capacity and longer range. The

approximately 30% greater cargo capacity on the

Boeing 787 aircraft when compared to the

Boeing 767 aircraft also improves Air Canada’s

revenue potential.

RECONFIGURATION OF BOEING 777

AND AIRBUS A330-300 AIRCRAFT

In order to improve the economics of its standard

configuration Boeing 777 long-haul fleet and

to provide customers with a product consistent

with its new Boeing 787 Dreamliners, the airline

plans to convert 12 Boeing 777-300ER and six

Boeing 777-200LR aircraft into a more cost effective

and competitive configuration, adding a Premium

Economy cabin and refurbishing the International

Business Class cabin to the new Boeing 787 state-

of-the-art standard. The capital expenditure related

to this program is approximately $300 million with

a projected payback period of less than three years.

Air Canada also plans to reconfigure its fleet of

eight Airbus A330-300 aircraft to lower unit costs,

allow the airline to compete more effectively, offer

customers the option of its new Premium Economy

cabin and to deliver a harmonized product offering

across its flagship international fleet. Conversion

of these Boeing 777 and Airbus A330 aircraft is

scheduled from late 2015 to the second half of 2016.

NARROW-BODY FLEET

RENEWAL PROGRAM

In March 2014, Air Canada entered into agreements

with The Boeing Company (“Boeing”) for firm

orders, options and certain rights to purchase up to

109 Boeing 737 MAX narrow-body aircraft, to replace

the existing mainline fleet of Airbus narrow-body

aircraft. Deliveries are scheduled to begin in 2017 with

two aircraft, with the remaining deliveries scheduled

from 2018 to 2021. Air Canada estimates that the

projected fuel burn and maintenance cost savings on

a per seat basis of greater than 20% will generate an

estimated CASM reduction of approximately 10% as

compared to the airline’s existing narrow-body fleet.

Refer to section 8 “Fleet” of this MD&A for additional

information.

REGIONAL AIRLINE DIVERSIFICATION

Over the last several years, Air Canada has also

focused on lowering its regional costs. The 2014

agreement concluded with ACPA provides increased

flexibility in the airline’s relationships with regional

airlines and Air Canada may also replace Bombardier

CRJ-100/200 and Bombardier Dash 8-100/300 aircraft

with Bombardier Dash 8-Q400 aircraft under certain

conditions. Furthermore, the airline has diversified

its regional operations across multiple regional

partners. For example, in 2013, Air Canada transferred