Adidas 1999 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1999 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

President’s Letter

PRESIDENT’S LETTER

Dear Shareholder:

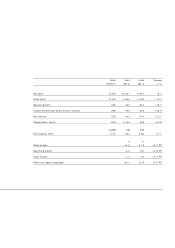

1999 was a highly successful year for adidas-Salomon.

Despite a tough market environment, we achieved a

strong gross margin, delivered our best ever operating

profit and drove income before taxes to a record level.

Integration of the former Salomon group brands posi-

tively impacted our results, the start-up of adidas Japan

has exceeded our expectations, Asia is performing well,

and Europe is showing an upward trend. Only in North

America, which represents around one third of our sales,

do we see our sales softening. Here, our business is being

negatively impacted by an adverse market situation.

Although we can be content with our 1999 results, we

need to improve them further. We have to set our sights

even higher if we want to establish ourselves as the

world’s best sporting goods company. We are in a position

to achieve above-average sales growth with innovative

products and efficient structures. This can only be

leveraged through to an even stronger bottom-line

improvement if we further strengthen cost control within

the Group. In order to further enhance shareholder value

we need to focus on what we do best: developing and

marketing top-quality sporting goods.

Our aim is to shape our company into a high-performance

organization with a focus on innovative sports products.

To this end, at the beginning of 2000, we decided to

implement a growth and efficiency program which

supports our objective to achieve a 15% annual growth

in earnings between 2001 and 2003.

For the adidas brand, for example, focusing on our own

strengths means streamlining the product range, cutting

the number of products by 20%, pushing products

with strong margins, eliminating the weaker ones. This

reduces complexity in all areas of the organization, from

design to product development, from sourcing to ware-

housing. And it sets free energies that will allow us to

concentrate more strongly on winning products.

These will be products featuring new technologies and

exciting new designs. For instance, prior to the European

Soccer Championship we will be introducing a new

Predator®soccer boot with exchangeable studs. For the

Olympic Games in Sydney we will be presenting a sprint

shoe incorporating state-of-the-art carbon technology

that has been developed by Salomon for adidas. In the

design sector, we are moving to new designs, working

together with external design studios and developing

footwear concepts that will generate new impetus in

categories with strong sales potential.

Focusing on our core business also means further

enhancing the innovative strength of the Salomon

and Taylor Made brands. In the hardware sector, it is

vital that we remain at the leading edge, convincing

customers that with our new ideas they can improve

their performance and thus further increase their enjoy-

ment of sport.

Our clear focus on the essentials is also reflected in our

brand policy. After intensive discussions, and extensive

tests and market research, we decided not to pursue

any further the idea of a new brand for the leisurewear

market. Our market research showed quite clearly that

this market potential can be leveraged with significantly

less effort and risk by further differentiating our existing

brands. That is where our strength lies!