Adidas 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Management Discussion and Analysis

The companies contributing to the result in 1999 other-

wise remained the same as in 1998. Excluding the

contribution from Japan from the previous year’s figures,

royalty and commission income remained virtually

unchanged.

Significant improvement

of financial result

Compared to the previous year (minus DM 224 million),

the financial result at minus DM 164 million improved

significantly in 1999, due to the non-recurrence of spe-

cial effects. In 1998, substantial expenses had been

incurred in connection with the instruments used for

currency hedging activities which secured a favorable

rate for US Dollar requirements in 1999. Additionally,

the Russian crisis had necessitated one-time provisions

and allowances in 1998. These burdens did not recur

in 1999.

During 1999, net borrowings were reduced slightly.

But

a strong US Dollar led to an increase in the DM value

of US Dollar denominated loans and a corresponding

increase in the interest burden for dollar-denominated

financing. Despite this development, in aggregate, these

factors led to a significant improvement of the financial

result.

Extraordinary income neutral on results

In 1999, as in the prior year, extraordinary income was

recorded. This amounted to DM 9 million (1998: DM 24

million) although it had no impact on income before

taxes as offsetting expenses of the same amount were

included in the selling, general and administrative ex-

penses. The expenses and extraordinary income were

directly related to a special reward and incentive plan

for Management which is sponsored by two individual

shareholders.

Income before taxes at record level

The significant improvement of the operating profit and

financial result drove income before taxes to a new all-

time high. DM 779 million represents an increase of

DM 155 million or 25% year-over-year and, additionally,

an improvement compared to the record result of 1997.

This is the best result the Group has ever achieved.

Earnings per share improved,

higher dividend proposed

Net income totaled DM 445 million, representing an

increase of DM 45 million or 11%. The significant im-

provement of income before taxes is not fully reflected

in net income due to an overproportional increase in tax

expenses and in minority interests. The tax rate rose by

5.4 percentage points to 38.4%. The main reasons for

this increase: The tax burden in 1998 was reduced as a

result of various one-off effects, which did not lead to

similar reductions in the 1999 fiscal year. Additionally,

changes in German tax legislation introduced in March

1999 resulted in an unavoidable increase in the tax rate

compared to the greatly reduced level of 1998.

Earnings per share in 1999 reached DM 9.82, rep-

resenting a year-over-year improvement (before special

effect in 1998) of DM 0.98 or 11%.

The Executive Board proposes a dividend of DM 1.80

per share. This represents a total payout of approximately

DM 82 million. The tax situation permits a full tax

credit

for German domestic shareholders with unlimited

tax lia

bility. With this proposal, the Executive Board

remains within the previously identified payout ratio of

between

15% and 20% of consolidated net income. The

dividend

paid for 1998 was DM 1.65.

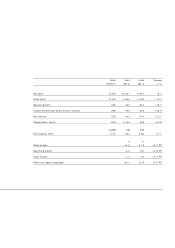

1995 1996 1997 1998* 1999

PROFIT MARGIN ON TURNOVER

(%)

n

n

n

n

n

nbefore taxes

nnet

* before special effect

12

10

8

6

4

2

nnn

nn

1995 1996 1997 1998 1999

ROYALTY AND COMMISSION INCOME

(DM m)

120

100

80

60

40

20