Adidas 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Management Discussion and Analysis

Total assets increased,

new financing

instruments used,

equity ratio significantly

improved

Total assets of the adidas-Salomon Group in 1999 in-

creased by DM 746 million or 12%. On the assets side,

trade accounts receivable showed an overproportional

increase of 29%, which was related to growth in busi-

ness volume, partly of adidas Japan, but also resulted

in part from higher currency exchange rates. If the

exchange rates of the Deutsche Mark had remained

unchanged in 1999, trade accounts receivable would

have shown an increase of only 17%.

Year-end inventories in 1999 were 7% up compared to

the prior year. This increase is slightly higher than the

growth in order backlog but is in line with the Group’s

objective to maintain a close correlation between inven-

tories and order backlogs. Changes in currency ratios

also impacted inventories. If the exchange rates of

the Deutsche Mark had remained unchanged in 1999,

inventories would have been reduced by around 2%.

Current assets rose by 14% in total.

Fixed assets increased by 16%, impacted by the ex-

pansion of the new “ World of Sports” headquarters in

Herzogenaurach and by investments in state-of-the-art

IT technology. These investments partly served to handle

the “ Year 2000 issue” but were also needed in order to

harmonize and accelerate the implementation of sys-

tems and achieve savings in logistics expenses.

As a result of the reformulation of the equity covenant

in the medium-term credit agreements, borrowings

under these agreements are now reported under long-

term borrowings.

As at December 31, 1999, credit lines amounted to

a total of DM 7.0 billion. This amount includes com-

mitted medium-term credit lines and other longer-term

financing arrangements in a total of DM 2.9 billion.

These credit lines have maturities between 2001 and

2008. More than half of these lines have maturities

from the end of 2003 or later. The total of long-term

financing facilities increased by DM 600 million in

1999. In the majority of cases, adidas-Salomon takes up

short-term loans, in order to take advantage of the gen-

erally lower short-term interest rates. Interest rate caps

for the protection against interest rate risk amounted to

DM 2.9 billion at the end of 1999. Since the beginning

of 2000, adidas-Salomon has arranged additional caps

with maturities in 2005 and 2006, to replace caps

expiring in 2000 and 2001.

At the beginning of 1999, adidas-Salomon had com-

menced a Treasury Notes Program in Belgium in the

amount of Euro 150 million. Substantial investor interest

in this program subsequently led to the volume being

doubled. In January 2000, adidas-Salomon additionally

set up a Commercial Paper Program in Germany in the

amount of Euro 750 million, which was highly success-

ful from the start. The introduction of a Medium-Term

Notes Program is planned for the end of the year 2000.

All these activities serve to diversify further the financ-

ing instruments used.

The equity base was considerably strengthened in

1999. Equity rose by 47% to DM 1.3 billion as the

major share of net income was retained within the Group

and was thus used to strengthen the equity base. The

equity ratio rose by 4.6 percentage points to 19.0%.

Financial leverage, the ratio of net borrowings to equity,

decreased by 123 percentage points to 234%.

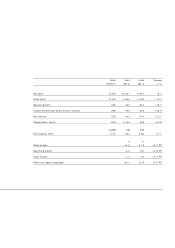

1995 1996 1997 1998 1999*

DIVIDEND

(DM per share)

2.00

1.50

1.00

0.50

* proposal

1995 1996 1997 1998 1999

EQUITY RATIO

(in % of total assets)

n

n

n

n

n

40

35

30

25

20

15