Adidas 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Management Discussion and Analysis

The contribution of the Footwear division to total net

sales of the Group increased by 1.1 percentage points

to 41.5%. This means Footwear is now again the largest

product division within the adidas-Salomon Group.

Decline in Apparel sales

Apparel sales, in contrast, were impacted by changing

consumer preferences. Total Apparel sales reached DM

4.3 billion, which represents a decrease of 0.5% com-

pared to 1998. Apparel contributed 40.9% of total net

sales of the Group in 1999, down 2.6 percentage points

on the previous year.

Increase in Hardware sales

As the products of the Salomon and Taylor Made brands

are primarily included in the Hardware division, which

has changed slightly compared to the prior year, and as

both brands also recorded strong sales growth, this divi-

sion showed a correspondingly strong increase, growing

by 15.1% to DM 1.8 billion.

Strongest sales growth in Asia

In terms of regional performance, Asia delivered the high-

est growth rates. The increase of 70.3% to DM 1.3 billion

was driven primarily, although not exclusively, by the

first-time inclusion of the sales of adidas Japan. Even

excluding adidas Japan, net sales in Region Asia grew

by 15.6%. This development is an indication that most

of the countries throughout Asia have largely recovered

from the effects of the economic and currency crises.

adidas-Salomon was also able to achieve significant

growth in sales in Latin America. Net sales in this region

totaled DM 246 million, which is an increase of 12.5%.

North America achieved only modest sales growth of

1.9% in 1999, after having delivered the highest growth

rate the previous year. Product sales under the adidas

brand name were very strong in the first half of the year

but declined in the second half to record an overall de-

crease of 1% for the year. In a difficult overall market

for

athletic footwear and particularly for sports apparel,

the adidas brand managed to maintain its overall market

share.

Sales performance of the Taylor Made and Salomon

brands in North America was strong. Taylor Made re-

corded an 11% increase in sales, proving that, in golf in

particular, innovative products sell well even in a flat

market. Salomon increased sales by 21%, becoming the

Group’s fastest growing brand in the American market.

Growth in Asia, North America and Latin America was

sufficient to more than offset a slight decline in sales in

Europe. Despite an upward trend over the course of the

year, sales under the adidas brand name in Europe ex-

perienced a year-over-year decline of just under 4%.

Strong growth in France and the Benelux countries was

not able to offset decreases in the U.K., Germany and

Spain. The picture in the first half of the year was very

different from the second half. In contrast to North

America though, Region Europe showed a clear upward

trend, and in the fourth quarter even recorded signifi-

cant sales growth.

The Salomon and Taylor Made brands performed very

solidly in Europe. Taylor Made profited from a positive

overall market development, increasing sales by 11%.

Salomon achieved excellent growth rates with both sum-

mer and winter products, recording an 18% increase in

sales for the full year.

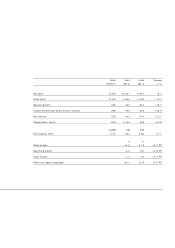

Difference to 100% due to HQ/Consolidation

Share of Change

net sales year-over-

in % year in %

Footwear 41.5 +8.5

Apparel 40.9 –0.5

Hardware 17.4 +15.3

NET SALES BY DIVISION

Americas Europe Asia

36.3% 50.9% 12.2%

NET SALES BY REGION

Difference to 100% due to HQ/Consolidation