Adidas 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas-Salomon Annual Report 1999

Table of contents

-

Page 1

adidas-Salomon Annual Report 19 9 9 -

Page 2

..., etc. Bonfire Snowboarding apparel Erima Team equipment for soccer and other team sports M avic Cycling components: wheels, rims, gearshifts Salomon Winter sports products: skis, snowboards, bindings and boots; summer sports products: in-line skates and hiking boots Taylor M ade Golf equipment... -

Page 3

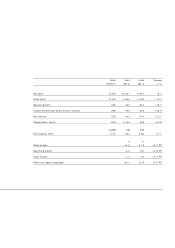

1999 1999 1998 Change EURO m DM m DM m in % Net sales Gross profit Operating profit Income before taxes and minority interests Net income Shareholders' equity 5,354 2,352 482 398 228 680 EURO 1 0 ,4 7 1 4 ,6 0 0 942 779 445 1 ,3 3 0 9,907 4,154 814 624 401 906 DM 8.84 % 41.9 8.2 4.0 20.5... -

Page 4

... to previous year (before special effect in 1998) â- Operating profit contribution from Salomon and Taylor Made increased by DM 80 million or 163% - due to innovative products and successful integration â- Net sales grew by 6% to DM 10.5 billion NET SALES INCOME EARNINGS PER SHARE (DM bn... -

Page 5

... Contents President's Letter Management Discussion and Analysis The adidas-Salomon Group adidas Salomon Taylor Made Mavic The adidas-Salomon Share Outlook Report of the Supervisory Board Supervisory Board and Executive Board Consolidated Financial Statements Auditors' Report Selected Financial Data -

Page 6

...Dear Shareholder: 1999 was a highly successful year for adidas-Salomon. Despite a tough market environment, we achieved a strong gross margin, delivered our best ever operating profit and drove income before taxes to a record level. Integration of the former Salomon group brands positively impacted... -

Page 7

... in the marketing sector, further combine activities between the brands, and increasingly utilize the internet, not only for sales and marketing, but in order to strengthen contact with the suppliers and the buyers of our products. With these measures, we intend to reduce our operating expenses as... -

Page 8

... and in-line skates and has lately taken another market by storm: snowboarding. Salomon snowboards are so popular because Salomon is constantly developing boards that ideally meet the needs of this sport. Now enjoying the status of cult products, with their new technology Salomon snowboards are more... -

Page 9

... BRANDS AND REGIONS (%) Mavic 0.8 (growth year-over-year in %) Taylor Made 5.5 Salomon adidas 10.1 83.4 adidas Salomon Taylor Made Total Europe -4 North America -1 +21 +11 +2 Asia +82 +54 +10 + 70 + 18 +11 -2 Difference to 100% due to HQ/Consolidation Management Discussion and Analysis... -

Page 10

... the largest product division within the adidas-Salomon Group. North America achieved only modest sales growth of 1.9% in 1999, after having delivered the highest growth rate the previous year. Product sales under the adidas brand name were very strong in the first half of the year but declined... -

Page 11

... 72%) delivered the highest growth rates. More detailed information on sales and performance of the individual brands is presented in the segmental reporting. Amortization of goodwill unchanged Amortization of the goodwill relating to the acquisition of the Salomon group remained unchanged at DM 57... -

Page 12

... were directly related to a special reward and incentive plan for Management which is sponsored by two individual shareholders. ROYALTY AND COMMISSION INCOME PROFIT MARGIN ON TURNOVER (DM m) 120 100 80 60 40 20 12 10 8 6 4 2 (%) â...¢ â...¢ â...¢ â...¢ 1995 1996 1997 1998 1999 1995 1996... -

Page 13

... than half of these lines have maturities from the end of 2003 or later. The total of long-term financing facilities increased by DM 600 million in 1999. In the majority of cases, adidas-Salomon takes up short-term loans, in order to take advantage of the generally lower short-term interest rates... -

Page 14

... The adidas-Salomon Group operates a methodical and systematic management reporting process that provides the Executive Board with latest information concerning financial results in relation to budgets and prior year figures. Corporate performance in the short-term period is outlined in the annual... -

Page 15

...in the individual countries in the Euro zone have already begun and, according to the current planning status, will be completed immediately after the 2001 year-end closing. Activities in Social and Environmental Affairs stepped up The program to ensure that the adidas-Salomon brand values are real... -

Page 16

...patented by adidas, is designed for soft ground and features eight exchangeable magnesium TRAXION ® studs and two fixed center studs. With this design, the outsole can be customized, which is truly a revolution in soccer shoes. Some of the world's top players have helped to develop and test the new... -

Page 17

13 SOCCER INTHENEWCENTURY adidas -

Page 18

... Japan. In North America, the positive sales performance of the first six months did not continue into the second half of the year, and at year-end net sales were slightly down on the prior year. The operating profit was positively impacted by currency hedging which secured favorable rates for 19... -

Page 19

... points to 44.9%, mainly resulting from the first-time inclusion of adidas Japan. For all other countries, margins could be maintained by adjusting pricing, product mix and distribution strategies to the changed market environment. ASIA/PACIFIC FOOTWEAR NET SALES 1999 Change year-overyear (in... -

Page 20

...for the first time, Footwear sales continued to grow Footwear sales in 1999 were again up on the previous year, showing an increase of 3.1%, despite a perceptible trend also in Europe toward brown shoes. According to the figures available, the adidas brand managed to increase its share of the total... -

Page 21

... product line and, of course, corresponding support through marketing activities. The gross margin in Europe improved by 0.8 percentage points to 42.1%. This was primarily due to favorable exchange rates for the US Dollar and successful, stepped-up inventory clearance activities. At the same time... -

Page 22

... first six months, sales increased by 10%, mainly due to the fact that business performance in the USA was still strong. In the first half of the year, the adidas brand outperformed most of the major competitors and the overall market. From the third quarter on, however, adidas was also impacted by... -

Page 23

... reflect the fact that growing the Apparel business has been a major focal point in further development of the adidas brand. The product management and sales force in this division were strengthened in 1999. Accordingly, the Apparel share of total net sales increased from 18% to 23%. Comparison with... -

Page 24

... a sensation in the half-pipe Salomon's leading position in winter sports is founded on the innovative spirit of the brand. Salomon's philosophy is to continuously develop new exciting and innovative products and establish them in the market. The latest example: This year's release of the Teneighty... -

Page 25

... the snowboard pros and Salomon's development team results in products that exactly meet snowboarders' needs: Salomon boards are simply more fun to ride than other boards. Salomon boards are amongst the most solid in the market. Salomon also designs and makes cutting-edge snowboarding boots and... -

Page 26

...Management Discussion and Analysis Salomon 1999 was a very successful year for the Salomon brand. Net sales increased by 25%. Growth came from all parts of the world, with Asia showing the strongest growth rates. Salomon improved sales of winter sports products by nearly 20%. Sales growth of summer... -

Page 27

... fourth quarter. Europe continues to be the most important market for Salomon, accounting for 51% of net sales. 27% of net sales are achieved in North America, 22% in Asia. Sales and profitability improvements expected for 2 0 0 0 It is currently anticipated that net sales of Salomon brand products... -

Page 28

... Made The Wood Behind Taylor M ade Taylor Made is the brand that created high-performance steel metalwoods over twenty years ago. The best professional players in the world and amateurs of all skill levels quickly recognized the superior performance of the Taylor Made metalwood. The result is... -

Page 29

... to be used as a replacement for long irons or fairway woods. It has the power of a fairway wood, the accuracy of an iron, and an unmatched level of versatility. Constructed of strong, yet light titanium along with a high-density tungsten sole, the Rescue has an extremely low center of gravity. This... -

Page 30

... high inventories had led to significant price discounts, greatly depressing gross margins. AT A GLANCE NET SALES, BY REGION 1999 Change year-overyear (in brackets: change year-over-year) Americas 74.7% (+11.3%) Europe 13.8% (+10.9%) Asia 11.5% (+10.1%) Net sales Gross margin Operating profit... -

Page 31

... ade and adidas Golf business unified The creation of a Global Business Unit " Taylor Madeadidas Golf" was completed in 1999 with the installation of a new management team and organizational structure in Carlsbad, California. Strategic planning and product design as well as development and marketing... -

Page 32

28 Mavic INNOVATION AND REVOLUTIONARY TECHNOLOGY -

Page 33

... of producing complete wheelsets. In spite of increased competition and the fact that many new high-tech wheels have arrived on the market, Mavic is still the one that other brands reference. Mavic's success can be attributed to three key factors: innovation, innovation, innovation. Cycling Today... -

Page 34

... operating result. The introduction of new Wheels led to an improved second half of the year in terms of sales and orders. Sales in USA and Europe declined Net sales of the Mavic brand decreased by 16% to DM 86 million. This was a result of continued erosion of the mountain-bike market, high... -

Page 35

31 -

Page 36

... to shareholder value. The program includes demanding exercise criteria so that management will only be able to profit from the options if the stock price has increased by more than the long-term average of the stock market. For details see Note 29. Volatile adidas-Salomon share price development... -

Page 37

... internet greatly increased in 1999. Investors and all other interested parties can find current share prices, current annual and quarterly reports, presentations and press releases as well as other detailed financial information at . Via the internet, conference... -

Page 38

34 Management Discussion and Analysis Outlook Sporting goods markets expected to grow in Asia and Europe, but sluggish in North America adidas-Salomon anticipates that development of the world's sporting goods markets in 2000 will be mixed. The highest growth rates are expected for Asia. Following... -

Page 39

...products, â- expand significantly the sales and marketing activities of the Taylor Made and Salomon brands, in order to create the conditions for increasing success in the marketplace. The related expenditures in an anticipated volume of approximately DM 75 million will impact the operating profit... -

Page 40

...America in Portland, Oregon, bringing together the activities which are currently spread over several leased locations, â- IT hardware and software to improve the efficiency of the information flow, and â- restructuring of the production facilities of the Salomon and Mavic brands. adidas-Salomon... -

Page 41

37 -

Page 42

... Board meeting on March 8, 1999, the Supervisory Board discussed the business situation of the Company in the past and current financial year. Additionally, prior to and during this meeting, one of the main points of discussion related to the stock option plan for the management of adidas-Salomon AG... -

Page 43

... results for the first quarter of 1999. Furthermore, the Supervisory Board members discussed the project " Merger of Salomon Gesellschaft m.b.H. into adidasSalomon AG" , with a focus on cost savings and improvement of the market share of the Salomon brand in Germany. As the Company and its domestic... -

Page 44

... May 20, 1999 Lungern, Switzerland until May 20, 1999 Dr. Thomas Russell, Glenn Bennett, Portland, USA Dean Hawkins, Richmond, UK until January 31, 2000 Ulrich Becker, Puschendorf, Germany * ) since May 20, 1999 Gerold Brandt, Gräfelfing, Germany David Bromilow, Bangkok, Thailand Peter Göbel... -

Page 45

41 adidas-Salomon AG AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEM ENTS (INTERNATIONAL ACCOUNTING STANDARDS) -

Page 46

42 Consolidated Financial Statements adidas-Salomon AG AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in DM 0 0 0 ) December 31, (Note) Cash and cash equivalents Accounts receivable Inventories Other current assets Total current assets 19 9 9 19 9 8 (26) (4) (5) (6) 135,164 2,020,131 2,044,... -

Page 47

... DM 0 0 0 ) Year ended December 31, (Note) Net sales Cost of sales Gross profit 19 9 9 19 9 8 (25) 10,471,414 5,871,173 4 ,6 0 0 ,2 4 1 9,907,118 5,753,198 4 ,1 5 3 ,9 2 0 Selling, general and administrative expenses Depreciation and amortization (excl. goodwill) Operating profit 3,534,682... -

Page 48

... ) Increase in long-term borrowings, net Dividends of adidas-Salomon AG Dividends to minority shareholders Capital contributions by minority shareholders (Decrease)/increase in short-term borrowings, net Net cash (used in)/provided by financing activities Effect of exchange rates on cash 2,418,770... -

Page 49

... STATEM ENTS OF CHANGES IN EQUITY (in DM 0 0 0 ) Currency Share capital Balance at January 1, ...Dividend payment Currency translation Cumulative effect of the adoption of IAS 19 (revised 1998) Share...part of these consolidated financial statements. Consolidated Financial Statements adidas-Salomon... -

Page 50

... on behalf of adidas. SALOMON branded products include ski equipment (skis, boots and bindings) which are designed and manufactured in France and Italy. In recent years the business was expanded into summer activities such as hiking boots and in-line skates. TAYLOR MADE develops and assembles or... -

Page 51

...material respects except that IAS 19 (revised 1998) " Employee Benefits" has been applied as at January 1, 1999. The present value of the defined benefit obligation of the pension plans sponsored by adidas-Salomon AG has been calculated using a discount rate of 5.5%, compared to 6.25% as at December... -

Page 52

... to the financial position. The shares in these companies are accounted for at the lower of cost or net realizable value. A schedule of the shareholdings of adidas-Salomon AG is shown in attachment II to these notes. Consolidation of equity is made in compliance with the book value method by... -

Page 53

... measured at closing exchange rates at the balance sheet date. The resulting currency gains and losses are recorded directly in income. Notes to Consolidated Financial Statements Cash and cash equivalents: Cash and cash equivalents represent cash and short-term, highly liquid investments with... -

Page 54

...on product research and development for the years ended December 31, 1999 and 1998, respectively. The value of acquired in-process research and development, i.e. products and processes which have not reached technological and commercial feasibility at the date of the acquisition of the Salomon group... -

Page 55

... of revenues: Revenues are recognized when title passes based on the terms of the sale. Sales are recorded net of returns, discounts, allowances and sales taxes. Advertising and promotional expenditures: Production costs for media campaigns are shown under prepaid expenses until the advertising... -

Page 56

... full responsibility for European inventory management and global sourcing activities through its subsidiary adidas Salomon International Sourcing Ltd. (formerly adidas Asia/Pacific Ltd.), Hong Kong. In 1999 this company assumed responsibility for the inventory of the adidas brand in the United... -

Page 57

... mainly to shipments from suppliers in the Far East to subsidiaries in Europe and the Americas. 6 . Other current assets Other current assets consist of the following: December 31, (in DM 0 0 0 ) 19 9 9 19 9 8 Prepaid expenses - current portion Taxes receivable Premiums for derivative financial... -

Page 58

... shares in unconsolidated affiliated companies of DM 6.9 million and DM 3.1 million as at December 31, 1999 and 1998, respectively. Further financial assets include investments which are related to a deferred compensation plan (see note 14). Cash deposits with maturities exceeding 12 months relate... -

Page 59

... lines for the issuance of letters of credit in an amount of approximately DM 1.3 billion (1998: DM 1.2 billion). Short-term borrowings, even if they were backed by committed medium-term credit lines of adidas-Salomon AG, had been reported as short-term borrowings in 1998. Since 1999, all short-term... -

Page 60

... for distribution, such as discounts, rebates and sales commissions, and promotion. Restructuring provisions relate mainly to a restructuring plan in connection with the acquisition of the Salomon group, which focuses on the integration of the Salomon group into the adidas structure. The plan... -

Page 61

...benefit plans are made at the end of each reporting period. Similar obligations include mainly long-term liabilities under a deferred compensation plan. The funds withheld are invested by the Company on behalf of the employees in certain securities, which are presented under other non current assets... -

Page 62

...Defined benefit plans: Notes to Consolidated Financial Statements The retirement plans of adidas-Salomon AG cover substantially all employees. They are financed internally through provisions, except one plan of adidas-Salomon AG, which is financed, subject to funding limitations in the German tax... -

Page 63

...the defined benefit plans of adidas-Salomon AG comprises: Year ended (in DM 0 0 0 ) December 31 , 19 9 9 Current service cost Interest cost Past service cost Release of provision Pension expense 7,855 4,870 8,086 (1,001) 1 9 ,8 1 0 Past service cost relates to plan amendments in 1999. 15 . Other... -

Page 64

60 Notes to Consolidated Financial Statements 17. Shareholders' equity By resolution of the Shareholders' Meeting held on May 20, 1999, the shareholders of adidas-Salomon AG approved the conversion of the stock capital into no-parvalue shares and into EURO. Additionally, in order to achieve even ... -

Page 65

... corresponding change of the Articles of Association was entered into the Commercial Register on August 27, 1999. Distributable profits and dividends: Distributable profits to shareholders are determined by reference to the retained earnings of adidas-Salomon AG calculated under German Commercial... -

Page 66

... amounts with terms of more than 5 years of DM 10 million and DM 12 million as at December 31, 1999 and 1998, respectively. Service arrangements: The Company out-sourced certain logistic and information technology functions, for which it has entered into long-term contracts. Financial commitments... -

Page 67

...basis. In times of a falling USD, the policy authorizes Group Treasury to reset options to lower strike levels, if the strike improvements and the additional premium payments meet certain criteria. During the year 1999 the JPY strengthened significantly against the USD. The Company reset part of its... -

Page 68

...) 35.4 (0.4) 3 5 .0 1 2 .9 25.3 (1.9) 2 3 .4 (7 .8 ) The book value of the currency options represents capitalized premiums paid. Management of interest rate risks: The Company is taking advantage of lower short-term interest rates, compared to the available longer-term rates of most leading... -

Page 69

...cash, cash equivalents and borrowings approximates fair value due to the short-term maturities of these instruments. The fair value of forward exchange contracts and currency options was determined on the basis of the market conditions on the reporting dates. The fair value of the interest rate caps... -

Page 70

...by adidas-Salomon AG. The Company uses the reduced rate for corporation tax on distributed earnings for the measurement of deferred tax assets and liabilities related to its German operations. The Company recognizes a deferred tax asset for corporate income tax refund receivable upon distribution of... -

Page 71

... deferred tax assets of companies which are operating in the start-up phase or certain emerging markets, since the realization of the related tax benefits is not probable. Further adidas Salomon North America Inc. (formerly adidas North America Inc.) has tax loss carryforwards, which can be utilized... -

Page 72

... losses, and an increase in deductible temporary differences across the companies of the group. The reconciliation of the effective tax rate of the adidas-Salomon Group to the German corporate tax rate of 40% (1998: 45%) is as follows: Year ended December 31, 19 9 9 in DM million in % in DM million... -

Page 73

.... Segmental information by brand adidas (in DM million) 19 9 9 19 9 8 SALOMON 19 9 9 19 9 8 TAYLOR MADE 19 9 9 19 9 8 Net sales third parties Gross margin 8,733 3,844 8,441 3,556 1,062 424 850 332 571 288 514 230 in % of net sales Operating profit Assets Liabilities Capital expenditure... -

Page 74

... adidas-Salomon MAVIC (in DM million) 19 9 9 19 9 8 HQ/Consolidation 19 9 9 19 9 8 Group 19 9 9 19 9 8 Net sales third parties Gross margin 86 31 102 36 19 13 (27) 1,779 3,555 - 12 - - (43) 1,524 3,709 - 12 10,471 4,600 9,907 4,154 in % of net sales Operating profit Assets Liabilities... -

Page 75

... year the composition of the segments of the adidas-Salomon Group has changed reflecting the further integration of certain central functions. Further the definition of operating profit has been unified for internal and external reporting purposes. Comparative information has been restated in order... -

Page 76

...other current assets Property and equipment Goodwill and other intangible assets Investments and other non current assets Minority interests Accounts payable and other liabilities Short-term borrowings Long-term bank borrowings Acquired in-process research and development Total acquisition cost 174... -

Page 77

... of a license and distribution agreement in Japan and the claim of a Chinese dissident. In the opinion of management, the ultimate liabilities resulting from such claims will not materially affect the consolidated financial position of the Company. Notes to Consolidated Financial Statements... -

Page 78

... 2 9 . Equity compensation benefits Special Reward and Incentive Plan (SRIP): adidas-Salomon AG implemented a one-time offer share option plan during the second quarter of 1997 for certain key employees and Executive Board members. The options can be exercised at a fixed pre-determined price. The... -

Page 79

...place of common shares the discount is paid in cash. Compensation costs for the difference between the exercise price and the fair value of the shares or the intrinsic value of share options granted will not be recognized in the financial statements. Other stock option plans: At Salomon S.A., France... -

Page 80

... average numbers of employees are as follows: December 31, 1999 Sales companies Sourcing/Production Global marketing/Research and development Central functions 8,048 3,062 811 512 12,433 1998 7,568 2,809 789 495 11,661 Remuneration of the Supervisory Board and Executive Board of adidas-Salomon AG... -

Page 81

... financial position of adidas-Salomon AG and subsidiaries as at December 31, 1999 and 1998, and the related consolidated results of its operations and its cash flows for each of the years ended December 31, 1999 and 1998 in accordance with International Accounting Standards. Frankfurt am Main... -

Page 82

... I to the Notes adidas-Salomon AG AND SUBSIDIARIES STATEM ENT OF M OVEM ENTS OF FIXED ASSETS (in DM 0 0 0 ) Software, patents, trademarks and Goodwill Acquisition cost December 31, 19 9 7 2 7 7 ,9 9 0 3 9 ,1 3 7 875 3 1 8 ,0 0 2 concessions Advance payments Total intangible assets Currency effect... -

Page 83

... furniture and fittings Advance payments/ Construction in progress Total tangible assets Shares in affiliated group companies Participations Other financial assets Total financial assets 2 4 1 ,3 1 2 6 7 ,5 9 8 2 8 5 ,5 7 5 7 ,7 6 0 6 0 2 ,2 4 5 9 4 3 ,2 5 0 123 459 9 4 3 ,8 3 2 (2,934) 17... -

Page 84

... II to the Notes SHAREHOLDINGS OF adidas-Salomon AG, HERZOGENAURACH As at December 31, 19 9 9 Company and Domicile Germany Currency Equity 0 0 0 currency units Share in capital held by in % 1 GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG Herzogenaurach (Germany) 2 GEV Grundstücks... -

Page 85

...Ltd. 2) 11) Dublin (Ireland) 34 adidas Espana S.A. Zaragoza (Spain) 35 adidas Italia S.r.l. Monza (Italy) 36 Salomon Italia S.p.A. Bergamo (Italy) 37 Salomon San Giorgio S.p.A. Treviso (Italy) 38 adidas Portugal Lda. Lisbon (Portugal) 2) 11) 8) 11) 1) 11) GBP GBP GBP IEP IEP IEP ESP ITL ITL ITL PTE... -

Page 86

... at December 31, 19 9 9 Company and Domicile Currency Equity 0 0 0 currency units Share in capital held by in % 39 adidas Norge A/S Gjovik (Norway) 40 Salomon Norge A/S Oslo (Norway) 41 adidas Sverige AB Hägersten (Sweden) 42 Salomon Sport AB Svenljunga (Sweden) 43 adidas Suomi Oy 9) NOK NOK SEK... -

Page 87

...Salomon North America Inc. 3) Portland, Oregon (USA) 61 adidas Salomon USA, Inc. Carlsbad, California (USA) 62 adidas America Inc. 3) Spartanburg, South Carolina (USA) 63 adidas Distribution Center Inc. 3) 11) Lansing, Michigan (USA) 64 Sports Inc. 3) 11) Portland, Oregon (USA) 65 adidas Promotional... -

Page 88

...As at December 31, 19 9 9 Company and Domicile Asia/Pacific Currency Equity 0 0 0 currency units Share in capital held by in % 76 adidas-Salomon International Sourcing Ltd. 4) (former adidas Asia/Pacific Ltd.) Hong Kong (China) 77 adidas Hong Kong Ltd. Hong Kong (China) 78 adidas (Suzhou) Co. Ltd... -

Page 89

...369 directly directly directly 106 Sub-group adidas UK Sub-group Ireland Sub-group USA Sub-group adidas-Salomon International Sourcing Sub-group India Sub-group Mexico Sub-group Venezuela Sub-group Salomon-Taylor Made UK Ten companies have not been included in the consolidated financial statements... -

Page 90

... SELECTED FINANCIAL DATA (INTERNATIONAL ACCOUNTING STANDARDS) EURO 1999 P&L data (in DM million) 19 9 9 19 9 8 2 ) 19 9 7 1 ) 19 9 6 1 ) 19 9 5 Net sales Footwear3) Apparel 3) Hardware adidas Salomon Taylor Made Mavic Europe North America Asia/Pacific Latin America Gross profit Operating profit... -

Page 91

... Taylor Made and Mavic products. In 1998 before special effect of DEM 723 million for acquired in-process research and development - expensed. Definitions: Gross margin is defined as gross profit divided by net sales Operating margin is defined as operating profit divided by net sales Profit margin... -

Page 92

88 -

Page 93

... Herzogenaurach Germany Internet Address: www.adidas.de Investor Relations: Tel.: Fax: e-mail: +49 (9132) 84-2471 /-2920 +49 (9132) 84-3127 [email protected] adidas-Salomon is a member of DIRK (German Investor Relations Association) Concept and Design: adidas-Salomon Realization... -

Page 94