Access America 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

Notes

to the consolidated financial statements

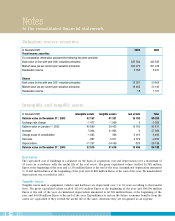

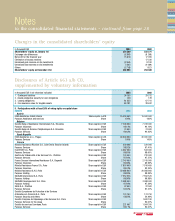

Intangible and tangible assets

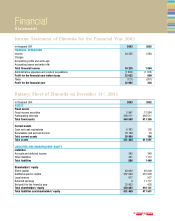

in thousand EUR intangible assets tangible assets real estate Total

Balance value on December 31st, 2002 42 167 41 331 15 702 99 200

Exchange rate change -1 477 -1 906 0 -3 383

Balance value on January 1st, 2003 40 690 39 425 15 702 95 817

Increase 5 904 21 965 0 27 869

Change scope of consolidation -1 845 368 -2 015 -3 492

Decrease -967 -5 911 -2 372 -9 250

Depreciations -11 207 -14 169 -820 -26 196

Balance value on December 31st, 2003 32 575 41 678 10 495 84 748

Real Estate

The capitalised cost of buildings is calculated on the basis of acquisition cost and depreciation over a maximum of

50 years in accordance with the useful life of the real estate. The gross capitalised values totalled 26.785 million

Euros at the beginning of the year and 21.376 million Euros at the end of the year. Accumulated depreciation amounted

to 11.083 million Euros at the beginning of the year and 10.881 million Euros at the end of the year. No unscheduled

depreciation was recorded in 2003.

Tangible Assets

Tangible assets such as equipment, vehicles and hardware are depreciated over 3 to 10 years according to their useful

lives. The gross capitalised values totalled 102.033 million Euros at the beginning of the year and 106.596 million

Euros at the end of the year. Accumulated depreciation amounted to 60.702 million Euros at the beginning of the

year and 64.918 million Euros at the end of the year. Expenditures to restore the future economic benefits from the

assets are capitalised if they extend the useful life of the asset, otherwise they are recognised as an expense.

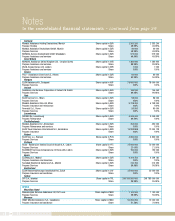

Valuation reserve securities

in thousand EUR 2003 2002

Fixed-income securities

For comparative information purposes the following has been provided:

Book value (in line with year 2001 valuation principles) 387 504 342 585

Market value (as per current year valuation principles) 393 270 351 016

Revaluation reserve 5 766 8 431

Shares

Book value (in line with year 2001 valuation principles) 18 387 50 803

Market value (as per current year valuation principles) 18 405 52 180

Revaluation reserve 18 1 377