Access America 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

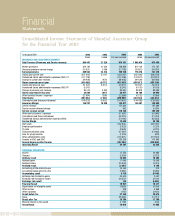

Investments and financial results

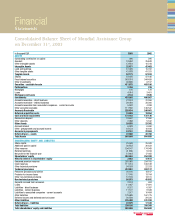

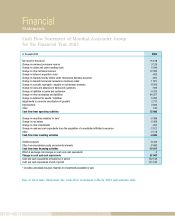

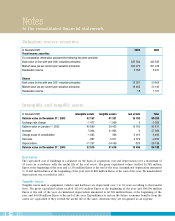

On December 31st, 2003, the Group’s financial investments amounted to 418.6 million Euros, compared to

407.0 million Euros at the end of the previous year. A portion of the cash and cash equivalents held at year-end

(173.3 million Euros ; preceding year: 122.1 million Euros) can be considered as part of the investment portfolio.

Given the situation in the bond market, the Group decided to temporarily increase short-term investments, which

are classified as cash equivalents.

The part of shares in the portfolio has been reduced significantly in order to further improve the matching of the

asset structure with the characteristics of liabilities born out of insurance contracts.

Ordinary investment results decreased to 14.0 million Euros (down from 18.3 million Euros in 2002) as market interest

rates fell to an exceptionally low level. Realised gains and losses on investment assets amounted to -1.5 million Euros

but were more than offset by the reversal of impairments recognised at year-end 2002 (accounting result: +6.2 million

Euros in 2003, compared to -9.1 million Euros in 2002). In addition, the Group reduced its share in a subsidiary

which in turn generated an additional realised loss of 1.9 million Euros. The realised total was therefore

-3.4 million Euros, compared with those posted in 2002 at +6.8 million Euros. 2002 results included an exceptional

gain from the sale of an office building in Switzerland, amounting to +5.6 million Euros. We consider that the reported

16.9 million Euros in total financial results reflect a return to a normal level. In 2002 this figure was 10.2 million

Euros, and in 2001, 17.0 million Euros.

Results before and after tax

With a slight growth in earned turnover (1.7%), an improved claims ratio and only a marginal increase in

acquisition and administration expenses, 2003 posted a nearly constant net operating result of 23.9 million Euros

compared to 23.5 million Euros the previous year.

Due to much improved Financial Results, profit before taxes was 37.2 million Euros in 2003 versus 29.7 million Euros

the previous year.

Taking into consideration the exceptionally high taxes on profits (20.4 million Euros in 2003, compared to

12.4 million Euros in 2002), which included a significant portion of non-recurrent tax expenses, profit after taxes

was 15.6 million Euros, compared to 17.1 million Euros the previous year.

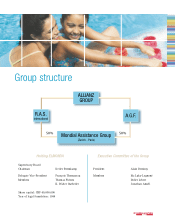

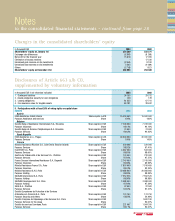

Changes in Group structure

In 2003, Mondial Assistance Group legally established its Chinese subsidiary in Beijing, and prepared to launch operations.

The Group reduced its participation in the Moroccan subsidiary from 80% to 41%.

Elvia Travel Insurance in Zurich obtained an insurance license to operate in Poland and has established a branch

office in Warsaw, which will begin underwriting travel and assistance policies in 2004. Elvia Sp.z.o.o, its Services

subsidiary, has represented Mondial Assistance Group in Poland since 1999.

The portfolio of the Dutch branch of Société Belge d’Assistance Internationale S.A. (SBAI) has been transferred to

the Dutch branch of Elvia Travel Insurance.