Access America 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A finance lease gives rise to depreciation expense for the asset as well as a finance expense for each accounting

period. The depreciation policy for leased assets is consistent with that for other depreciable assets.

Investments

Investments include securities available for sale, participations, mortgages and loans.

Securities available for sale are accounted for at fair value. Positive and negative differences between market value

and cost or amortised cost are included in a separate component of shareholders’ equity, net of deferred tax. Realised

gains and losses are principally determined by applying the average cost method.

Accounts receivable

The accounts receivable are carried at nominal value less any necessary value adjustment.

Deferred acquisition costs

Deferred acquisition costs, which are incurred in connection with the acquisition or renewal of insurance policies,

are capitalised and amortised through the income statement over the term of the policies.

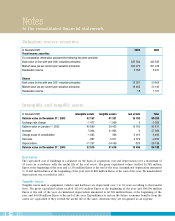

Cash and cash equivalents

This item includes balances with banks payable on demand, cash on hand and bank deposits with a maturity of three

months or less at the date of purchase.

The carrying amount of cash with banks and cash on hand corresponds to the fair value. Cash funds are stated at

their face value, with holdings of foreign notes and coins valued at year-end closing.

Deferred tax assets

The calculation of deferred tax is based on temporary differences between the carrying amounts of assets or liabilities

in the published balance sheet and their tax basis, and on differences arising from the application of uniform

valuation policies for consolidation purposes. The tax rates used for the calculation of deferred taxes are the local rates

applicable in the countries concerned. Anticipated changes are already taken into account as at balance sheet date.

Supplementary information on assets

Impairment of assets

All assets are reviewed regularly to ensure that no further value adjustments are required. Valuation write-downs

are charged to the income statement if any permanent diminution in value is identified. Write-downs are based on

the relevant estimated recoverable amounts.

Accounting for operating leases

Accounting for equipment and vehicles under operating leases, whereby the risks and benefits relating to ownership

of the assets remain with the lessor, are not recorded in the balance sheet and all related expenses are accounted

for in the income statement in the period they arise.