Access America 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

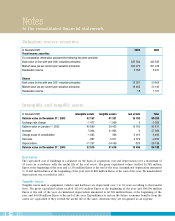

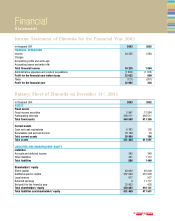

Income Taxes

Income tax expense includes current income taxes and deferred income taxes. Certain items of income and expense

are not reported in tax returns and financial statements in the same year. The tax effect of these timing differences

is booked as deferred taxes.

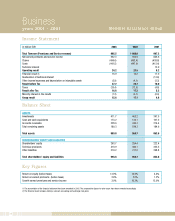

Technical interest

Due to the short term character of the business the calculation of technical interest was discontinued in 2002.

This has an impact on the ratios of previous years.

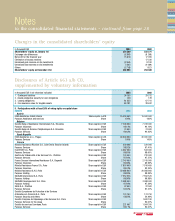

Explanation of the accounting and valuation policies differing from Swiss law

The most important differences are summarised below.

Shareholders’ equity

Shareholders’ equity increases overall because investments available for sale are shown in the balance sheet at

market value with the unrealised gains / losses being included under other reserves.

Claim equalisation reserves

Claim equalisation reserves and major risk reserves are not allowed under Mondial Assistance Group accounting

policy because they do not represent a present obligation toward third parties.

Claims reserves

Claims reserves tend to be somewhat lower under Mondial Assistance Group accounting policy because they are not

calculated in accordance with the prudence concept but at the best estimate of the ultimate cost.

Acquisition costs

Under Mondial Assistance Group accounting policy acquisition costs are capitalised and amortised over the term of

the policy.

Goodwill

Goodwill is amortised through income over its estimated useful life under Mondial Assistance Group accounting

policy, but not exceeding 10 years.