Access America 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign currency translation

The Group’s reporting currency is the Euro (€). Foreign currency is translated by the method

of functional currency. The functional currency for Group companies is always the national

currency, i.e. the prevailing currency in the environment where the enterprise carries on its

ordinary activities. In accordance with the method of functional currency, assets and liabilities

are translated at the closing rate on the balance sheet date and expenses and income

are

translated at the annual average rate in all financial statements of subsidiaries not

reporting in Euro.

Any translation differences, including those arising in the process of

equity consolidation, are taken to shareholders’ equity without affecting earnings.

Accounting and valuation policies

Information on assets

Intangible assets

Intangible assets include Goodwill and other intangible assets such as exclusivity fees and

software purchased from others or developed in-house.

Goodwill represents the difference between the purchase price of subsidiaries and the

proportionate share of their net assets valued at the current value of all assets and liabilities

at the time of acquisition. Goodwill is recognised as an asset in the balance sheet.

Intangible assets are measured initially at cost and are recognised if it is probable that the

future economic benefits that are attributable to the asset will flow to the Group, and the

cost of the asset can be measured reliably. After initial recognition, intangible assets are

measured at cost less accumulated amortisation and any accumulated impairment losses.

Goodwill and other intangible assets are amortised using the straight-line method over

their estimated period of benefit, being 10 years for Goodwill and the estimated useful life

for Software, with a maximum of 5 years. Mondial Assistance Group periodically evaluates

the recoverability of Goodwill and takes into account events or circumstances that warrant

revised estimates of useful lives or that indicate the existence of an impairment.

Tangible assets

Tangible assets include property and other tangible assets such as equipment.

Property employed for its own use and equipment are stated at cost and depreciated using

the straight-line method over the shorter of the estimated life of the asset or the lease term.

Land is depreciated over 100 years, land and building combined over 50 years and other

tangible assets included under the heading “Other assets” over a period of their estimated

useful life at the date of purchase.

The Group recognises finance leases as assets and liabilities in the balance sheet at

amounts equal at the inception of the lease to the fair value of the leased property. Initial

direct costs incurred are included as part of the asset. Lease payments are apportioned

between the finance charge and the reduction of the outstanding liability. The finance charge

is allocated to periods during the lease term so as to produce a constant periodic rate of

interest on the remaining balance of the liability for each period.

24

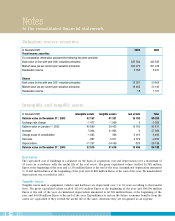

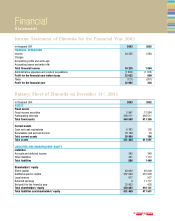

Exchange rates of principal

currencies (against 1 Euro) 2003 2002

Balance sheet Income statement Balance sheet Income statement

year-end rate average rate year-end rate average rate

Australia (AUD) 1.6788 1.7402 1.8497 1.7389

Japan (JPY) 134.8500 131.0988 124.1900 118.1644

Brazil (BRL) 3.6439 3.5184 3.7112 2.8304

United Kingdom (GBP) 0.7070 0.6924 0.6502 0.6292

Switzerland (CHF) 1.5590 1.5211 1.4525 1.4670

USA (USD) 1.2610 1.1321 1.0415 0.9459