eBay 2001 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2001 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

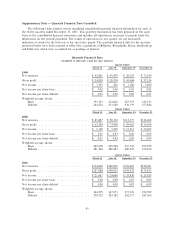

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

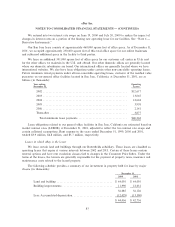

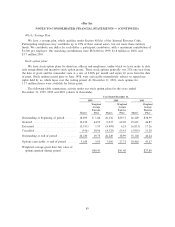

in eÅect for the year in which the diÅerences are expected to reverse. SigniÑcant deferred tax assets and

liabilities consist of the following (in thousands):

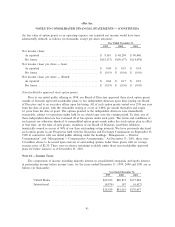

December 31,

2000 2001

Deferred tax assets:

Net operating loss ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 103,628 $ 129,211

Accruals and allowances ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,819 21,405

Depreciation and amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,313 11,381

Net unrealized lossesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,080 2,372

Net deferred tax assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 124,840 164,369

Valuation allowanceÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (101,586) (129,212)

23,254 35,157

Deferred tax liabilities:

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (3,629)

$ 23,254 $ 31,528

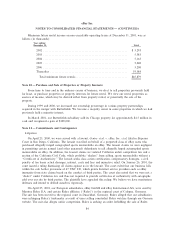

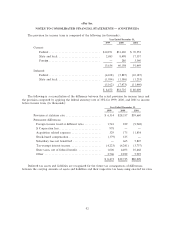

As of December 31, 2001, our federal and state net operating loss carryforwards for income tax

purposes were approximately $345.1 million and $149.8 million, respectively. If not utilized, the federal net

operating loss carryforwards will begin to expire in 2019, and the state net operating loss carryforwards will

begin to expire in 2004. Deferred tax assets on net operating losses of approximately $129.2 million at

December 31, 2001 pertain primarily to certain net operating loss carryforwards resulting from the exercise

of employee stock options of $122.0 million and the remainder relates to losses at certain subsidiaries. We

have a full valuation allowance against these amounts at December 31, 2001 due to the impact that

uncertainties associated with our future stock price and timing of employee stock option exercises have on

the likelihood that we will realize future beneÑts from these amounts. To the extent that we generate

taxable income in future years, we will have the ability, subject to carryforward limitations, to beneÑt from

these amounts. When recognized, the tax beneÑt of tax deductions related to stock options are accounted

for as a credit to additional paid-in-capital rather than a reduction of the income tax provision.

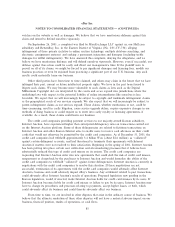

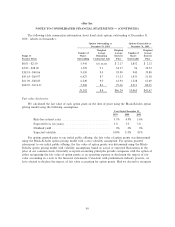

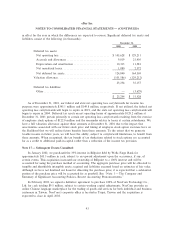

Note 17 Ì Subsequent Events-Unaudited:

In January 2002, we purchased the 35% interest in Billpoint held by Wells Fargo Bank for

approximately $43.5 million in cash, subject to an upward adjustment upon the occurrence, if any, of

certain events. This acquisition increased our ownership of Billpoint to a 100% interest and will be

accounted for using the purchase method of accounting. The aggregate purchase price will be allocated to

tangible and identiÑable intangible assets acquired and liabilities assumed based on estimates of fair value.

Although we have not Ñnalized our basis for allocating the purchase price, it is expected that a substantial

portion of the purchase price will be accounted for as goodwill. See ""Note 1 Ì The Company and

Summary of SigniÑcant Accounting Policies, Recent Accounting Pronouncements.''

In February 2002, we signed a deÑnitive agreement to purchase 100% of NeoCom Technology Co.,

Ltd. for cash totaling $9.5 million, subject to certain working capital adjustments. NeoCom provides an

online Chinese language marketplace for the trading of goods and services for both individual and business

customers in Taiwan. NeoCom's corporate oÇce is located in Taipei, Taiwan and the acquisition is

expected to close in April 2002.

93