eBay 2001 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2001 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

$2.3 million in cash to certain shareholders and incurred acquisition-related costs of approximately

$2.9 million. The shares issued in the acquisition were valued on May 18, 2001, the Ñrst date on which the

number of eBay's shares and the amount of other consideration became Ñxed, using the average closing

price of eBay shares for the Ñve days prior to and including the closing date of May 18, 2001. The

aggregate purchase price of approximately $125.6 million has been allocated to the net tangible and

identiÑable intangible assets acquired and liabilities assumed on the basis of their estimated fair values on

the acquisition date.

Tangible assets were valued at their respective carrying amounts as we believe that these amounts

approximate their current fair values. The valuation of the identiÑable intangible assets acquired was based

on management's estimates using a valuation report prepared by an independent third-party valuation

consultant and consists of customer base, assembled workforce, developed technology and trade names.

IdentiÑable intangible assets are amortized using estimated useful lives ranging from two to Ñve years. We

also identiÑed certain assets as held for sale and valued these assets based on the expected sale proceeds

adjusted for losses expected to be incurred during the holding period.

We have established plans to exit certain activities of iBazar and to involuntarily terminate certain

iBazar employees. In accordance with this exit plan included in our purchase accounting, approximately

$2.0 million has been accrued for the estimated costs associated with severance, contract terminations and

Ñnancial advisory and legal fees and has been included in net tangible assets. As of December 31, 2001,

$1.4 million has been charged against this liability.

The excess of the purchase price over the fair value of the identiÑable net assets acquired of

$119.6 million has been recorded as goodwill and is being amortized over a Ñve-year useful life. See

""Note 1 Ì The Company and Summary of SigniÑcant Accounting Policies, Recent Accounting

Pronouncements.''

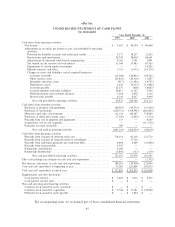

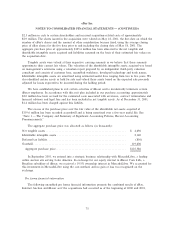

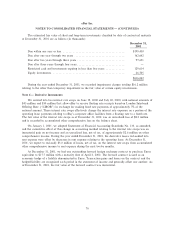

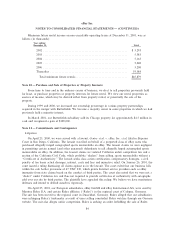

The aggregate purchase price was allocated as follows (in thousands):

Net tangible assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 4,696

IdentiÑable intangible assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,140

Deferred tax liabilityÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (856)

GoodwillÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 119,606

Aggregate purchase price ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $125,586

In September 2001, we entered into a strategic business relationship with MercadoLibre, a leading

online auction site serving Latin America. In exchange for our equity interest in iBazar Com Ltda, a

Brazilian subsidiary of iBazar, we received a 19.5% ownership interest in MercadoLibre. We accounted for

this investment in MercadoLibre using the cost method, and no gain or loss was recognized on the

exchange.

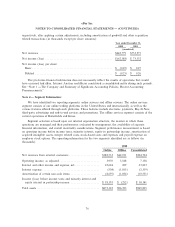

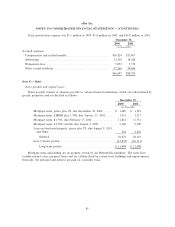

Pro forma Ñnancial information

The following unaudited pro forma Ñnancial information presents the combined results of eBay,

Internet Auction and iBazar as if the acquisitions had occurred as of the beginning of 2000 and 2001,

75