eBay 2001 Annual Report Download - page 26

Download and view the complete annual report

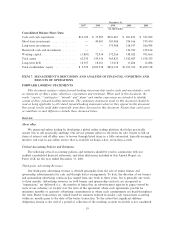

Please find page 26 of the 2001 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.events and with the onset of good weather. We have historically experienced our strongest quarter of

online growth in our Ñrst Ñscal quarter, although our users' shift to more ""practical'' items may cause our

seasonal patterns to look more like a typical retailer. Both ButterÑelds and Kruse have signiÑcant quarter-

to-quarter variations in their results of operations depending on the timing of auctions and the availability

of high quality items from large collections and estates. ButterÑelds typically has its best operating results

in the traditional spring and fall auction seasons and has historically incurred operating losses in the Ñrst

and third quarters. Kruse typically sees a seasonal peak in operations in the third calendar quarter.

Seasonal or cyclical variations in our business may become more pronounced over time and may harm our

results of operations in the future.

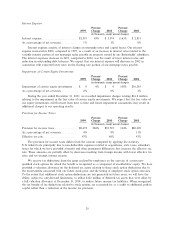

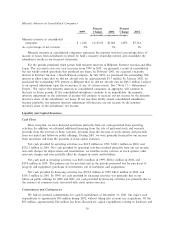

Due to the inherent diÇculty in forecasting net revenues, it is also diÇcult to forecast income

statement expense categories as a percentage of net revenues. Quarterly and annual income statement

expense categories as a percentage of net revenues may be signiÑcantly diÅerent from historical or

projected rates. However, we manage our expenses as Ñxed, variable and discretionary costs. Costs that are

largely Ñxed include employee compensation, facility and site operations. Costs that are largely variable

include provisions for doubtful accounts receivable and authorized customer credits, customer support, and

Internet connectivity. Costs that allow signiÑcant discretion as to timing and amount include marketing

and business development promotions, acquisition related costs and business expansion costs. As a general

note, we expect costs to increase in absolute dollars across all income statement categories.

22