eBay 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

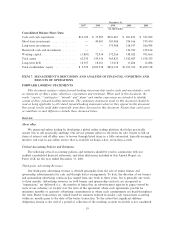

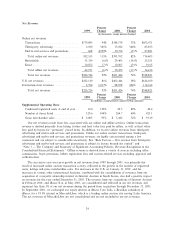

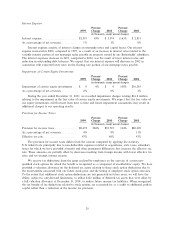

Interest Expense

Percent Percent

1999 Change 2000 Change 2001

(in thousands, except percent changes)

Interest expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,319 45% $ 3,374 (16)% $ 2,851

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏ 1% 1% 0%

Interest expense consists of interest charges on mortgage notes and capital leases. Our interest

expense increased in 2000, compared to 1999, as a result of an increase in interest rates related to the

variable interest portion of our mortgage notes payable on property owned by our ButterÑelds' subsidiary.

The interest expenses decrease in 2001, compared to 2000, was the result of lower interest rates and

reduction in outstanding debt balances. We expect that our interest expense will decrease in 2002 in

connection with expected lower rates on the Öoating rate portion of our mortgage notes payable.

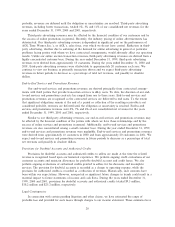

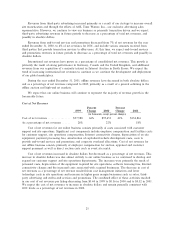

Impairment of Certain Equity Investments

Percent Percent

1999 Change 2000 Change 2001

(in thousands, except percent changes)

Impairment of certain equity investments ÏÏ $ 0 0% $ 0 100% $16,245

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏ 0% 0% 2%

During the year ended December 31, 2001, we recorded impairment charges totaling $16.2 million

relating to the impairment in the fair value of certain equity investments. We expect that the fair value of

our equity investments will Öuctuate from time to time and future impairment assessments may result in

additional charges to our operating results.

Provision for Income Taxes

Percent Percent

1999 Change 2000 Change 2001

(in thousands, except percent changes)

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $8,472 286% $32,725 144% $80,009

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏ 4% 8% 11%

EÅective tax rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 47% 40% 47%

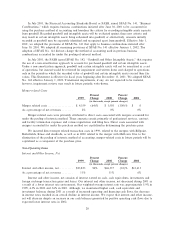

The provision for income taxes diÅers from the amount computed by applying the statutory

U.S. federal rate principally due to non-deductible expenses related to acquisitions, state taxes, subsidiary

losses for which we have provided a beneÑt and other permanent diÅerences that increase the eÅective tax

rate. These amounts are partially oÅset by decreases resulting from foreign income with lower eÅective tax

rates and tax-exempt interest income.

We receive tax deductions from the gains realized by employees on the exercise of certain non-

qualiÑed stock options for which the beneÑt is recognized as a component of stockholders' equity. We have

provided a valuation allowance on the deferred tax assets relating to these stock option deductions due to

the uncertainties associated with our future stock price and the timing of employee stock option exercises.

To the extent that additional stock option deductions are not generated in future years, we will have the

ability, subject to carryforward limitations, to utilize $122 million of deferred tax assets that were oÅset by

a full valuation allowance at December 31, 2001, to reduce future income tax liabilities. When recognized,

the tax beneÑt of tax deductions related to stock options are accounted for as a credit to additional paid-in

capital rather than a reduction of the income tax provision.

29