eBay 2000 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2000 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

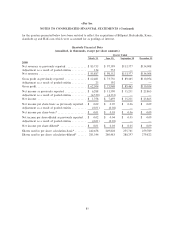

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

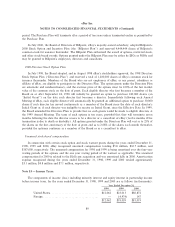

The pro forma provision for income taxes is composed of the following (in thousands):

Year Ended December 31,

1998 1999 2000

Current:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $4,303 $10,267 $31,420

State and localÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,243 2,505 8,498

Foreign ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 280

5,546 12,772 40,198

Deferred:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,138 (4,327) (5,887)

State and localÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 176 (1,091) (1,586)

1,314 (5,418) (7,473)

$6,860 $ 7,354 $32,725

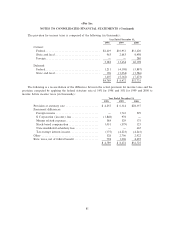

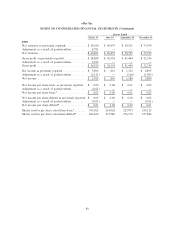

The following is a reconciliation of the diÅerence between the proforma provision for income taxes and

the provision computed by applying the federal statutory rate of 34% 1998 and 35% for 1999 and 2000 to

income before income taxes (in thousands):

Year Ended December 31,

1998 1999 2000

Provision at statutory rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $4,255 $ 6,314 $28,357

Permanent diÅerences:

Foreign income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 1,741 229

Merger related expensesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 384 329 175

Nonconsolidated subsidiary loss ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 665

Stock based compensation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,051 (379) 125

Tax exempt interest incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (175) (4,223) (4,241)

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 316 2,706 2,922

State taxes, net of federal beneÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,029 866 4,493

$6,860 $ 7,354 $32,725

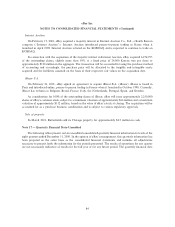

Note 16 Ì Subsequent Events-Unaudited:

Litigation

On January 26, 2001, the Court issued a ruling dismissing all claims against eBay in the Gentry et.al

lawsuit. The Court ruled that eBay's business falls within the safe harbor provisions of 47 USC 230, which

grants internet service providers such as eBay with immunity from state claims based on the conduct of third

parties. The Court also noted that eBay was not a ""dealer'' under California law and thus not required to

provide certiÑcates of authenticity with autographs sold over its site by third parties. All counts of the

plaintiÅs' suit were dismissed with prejudice as to eBay. PlaintiÅs appealed this ruling. eBay believes it has

meritorious defenses and intends to defend itself vigorously.

In February 2001, the parties settled the Bidder's Edge lawsuit. All claims by both parties were dismissed,

and Bidder's Edge paid eBay an undisclosed amount.

GO.com

In January 2001, Disney announced that it was dissolving GO.com; consequently, eBay is currently in the

process of renegotiating new contract terms with Disney.

83