eBay 2000 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2000 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Fair value of Ñnancial instruments

eBay's Ñnancial instruments, including cash, cash equivalents, accounts receivable, and accounts payable

are carried at cost, which approximates their fair value because of the short-term maturity of these

instruments. Cash and cash equivalents are short-term, highly liquid investments with original maturities of

three months or less when purchased. Short and long-term investments, which include marketable equity

securities, municipal, government and corporate bonds are classiÑed as available-for-sale and reported at fair

value using the speciÑc identiÑcation method. Realized gains and losses are included in earnings. Unrealized

gains and losses are excluded from earnings and reported as other comprehensive income, net of estimated tax

provisions or beneÑts.

Concentrations of credit risk

Financial instruments that potentially subject eBay to a concentration of credit risk consist of cash, cash

equivalents, investments and accounts receivable. Cash, cash equivalents and investments are deposited with

high credit, quality Ñnancial institutions. eBay's accounts receivable are derived from revenue earned from

customers located in the U.S. and internationally. The revenues earned from the U.S. site are denominated in

U.S. dollars and revenue earned from eBay's international sites are denominated in the country's functional

currency. Accounts receivable balances are typically settled through customer credit cards and, as a result, the

majority of accounts receivable are collected upon processing of credit card transactions. eBay maintains an

allowance for doubtful accounts receivable based upon the expected collectibility of accounts receivable.

Generally, due to the relative small amount of individual outstanding accounts receivable balances, eBay does

not require collateral on these balances. eBay also entered into two interest rate swaps with two separate

Ñnancial institutions in order to reduce its interest rate exposure on its lease payments. If either of these

Ñnancial institutions should fail to deliver under these contracts, eBay may be subject to variable interest rate

payments. During the years ended December 31, 1998, 1999 and 2000 no customers accounted for more than

10% of net revenues or net accounts receivable.

Foreign currency

All of eBay's foreign subsidiaries use the local currency of their respective countries as their functional

currency. Assets and liabilities are translated at exchange rates prevailing at the balance sheet dates.

Revenues, costs and expenses are translated into United States dollars at average exchange rates for the

period. Gains and losses resulting from translation are accumulated as a component of other comprehensive

income.

Realized gains and losses from foreign currency transactions are recognized as a component of net

income as incurred.

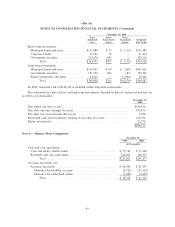

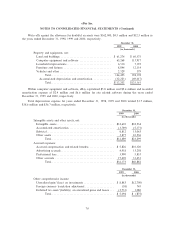

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation and

amortization are computed using the straight-line method over the estimated useful lives of the assets,

generally 5 years or less for equipment and furniture, and up to 40 years for buildings and building

improvements.

Impairment of long-lived assets

eBay evaluates the recoverability of long-lived assets in accordance with Statement of Financial

Accounting Standards (""SFAS'') No. 121, ""Accounting for the Impairment of Long-Lived Assets and for

Long-Lived Assets to be Disposed of.'' SFAS No. 121 requires recognition of impairment of long-lived assets

60