eBay 2000 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2000 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

period. The Purchase Plan will terminate after a period of ten years unless terminated earlier as permitted by

the Purchase Plan.

In July 2000, the Board of Directors of Billpoint, eBay's majority-owned subsidiary, adopted Billpoint's

2000 Stock Option and Incentive Plan (the ""Billpoint Plan'') and reserved 4,444,444 shares of Billpoint's

common stock for issuance thereunder. The Billpoint Plan authorized the award of options, restricted stock,

and other stock-based awards. Options granted under the Billpoint Plan may be either be ISOs or NSOs and

may be granted to Billpoint's employees, directors and consultants.

1998 Directors Stock Option Plan

In July 1998, the Board adopted, and in August 1998 eBay's stockholders approved, the 1998 Directors

Stock Option Plan (""Directors Plan'') and reserved a total of 1,200,000 shares of eBay's common stock for

issuance thereunder. Members of the Board who are not employees of eBay, or any parent, subsidiary or

aÇliate of eBay, are eligible to participate in the Directors Plan. The option grants under the Directors Plan

are automatic and nondiscretionary, and the exercise price of the options must be 100% of the fair market

value of the common stock on the date of grant. Each eligible director who Ñrst becomes a member of the

Board on or after September 24, 1998 will initially be granted an option to purchase 180,000 shares (an

""Initial Grant'') on the date such director Ñrst becomes a director. Immediately following each Annual

Meeting of eBay, each eligible director will automatically be granted an additional option to purchase 30,000

shares if such director has served continuously as a member of the Board since the date of such director's

Initial Grant or, if such director was ineligible to receive an Initial Grant, since the EÅective Date. In 1999,

the Board amended the Directors Plan to provide that no such grants would be made to eligible directors at

the 1999 Annual Meeting. The term of such options is ten years, provided that they will terminate seven

months following the date the director ceases to be a director or a consultant of eBay (twelve months if the

termination is due to death or disability). All options granted under the Directors Plan will vest as to 25% of

the shares on the Ñrst anniversary of the date of grant and as to 2.08% of the shares each month thereafter,

provided the optionee continues as a member of the Board or as a consultant to eBay.

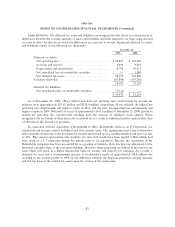

Unearned stock-based compensation

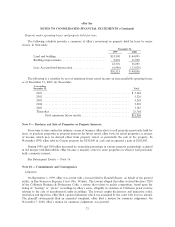

In connection with certain stock option and stock warrant grants during the years ended December 31,

1998, 1999 and 2000, eBay recognized unearned compensation totaling $5.8 million, $10.7 million, and

$187,000, respectively. The unearned compensation for 1998 and 1999 is being amortized over the four-year

vesting periods of the options and the one year vesting period of the warrant as applicable. The unearned

compensation for 2000 is related to the Half.com acquisition and was amortized fully in 2000. Amortization

expense recognized during the years ended December 31, 1998, 1999 and 2000 totaled approximately

$3.1 million, $4.8 million and $7.1 million, respectively.

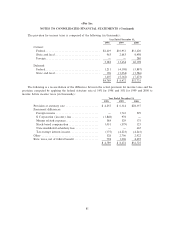

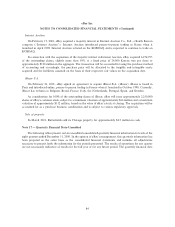

Note 15 Ì Income Taxes:

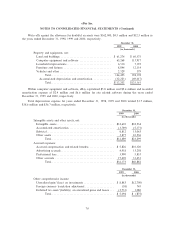

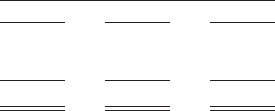

The components of income (loss) including minority interest and equity interest in partnership income

before income taxes, for the years ended December 31, 1998, 1999 and 2000 are as follows (in thousands):

Year Ended December 31,

1998 1999 2000

United StatesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,062 $23,013 $80,872

Foreign ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (4,974) 147

$12,062 $18,039 $81,019

80